Orientation for reforming Vietnam's tax policy system in the coming period

Tax policy reform is identified as one of the important pillars in Vietnam's public administration reform process. The 10-year Socio-Economic Development Strategy 2021-2030, the 5-year Socio-Economic Development Orientation 2021-2025 and Resolution No. 23/2021/QH15 dated July 28, 2021 of the National Assembly on the National Financial Plan and Public Debt Repayment for the 5-year period 2021-2025 have set out important goals and orientations as the basis for reforming Vietnam's tax policy system in the coming years.

In particular, the 10-year Socio-Economic Development Strategy 2021-2030 has set out the directions, tasks, and solutions for reforming the tax policy system in the coming period as follows:

“Amend and supplement laws on taxes and fees according to market principles, in line with international practices, associated with restructuring revenue sources, expanding the tax base, improving the effectiveness and efficiency of tax management and applying reasonable tax rates, towards a synchronous tax system with a sustainable structure, ensuring reasonable mobilization of resources for the state budget, while contributing to establishing a competitive environment suitable for the integration and development process of the economy”.

Clause 2, Article 4 of Resolution No. 23/2021/QH15 dated July 28, 2021 of the National Assembly on the 5-year national financial plan for borrowing and repaying public debt for the period 2021-2025 sets out the tasks and solutions for reforming the tax policy system as follows:

“Implement feasible solutions to achieve a higher mobilization rate into the state budget, exploit revenue potential, expand and prevent tax base erosion, promote the fight against revenue loss, strive to reduce the tax arrears rate to below 5% of total state budget revenue.... Limit the integration of social policies into tax laws. Review and perfect tax incentive regulations to avoid revenue loss, ensure transparency, fairness, feasibility, and conformity with development trends and international practices...”.

To specify these goals and orientations, the Ministry of Finance has developed and submitted to the Prime Minister Decision No. 508/QD-TTg dated April 23, 2022 approving the Tax System Reform Strategy to 2030. Regarding the general goals, the Tax System Reform Strategy to 2030 has identified:

“Continue to perfect the tax policy system associated with restructuring the state budget revenue towards covering all revenue sources, expanding the revenue base, especially new revenue sources, in line with international practices; ensure the proportion of domestic revenue, the proportion between indirect and direct taxes at a reasonable level, effectively exploit taxes, fees and charges collected from assets, resources, and environmental protection; minimize the integration of social policies in tax laws and exemption and reduction policies, ensure tax neutrality, towards a synchronous tax system with a sustainable structure, ensuring the reasonable mobilization of resources for the state budget; at the same time, contribute to creating a favorable and fair investment and business environment, encouraging investment, promoting competition, and regulating income reasonably, in line with the integration and development process of the economy”.

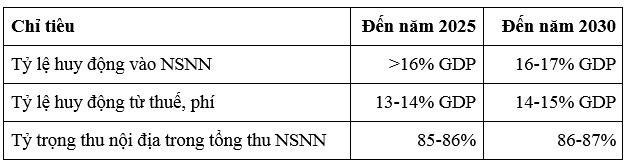

Based on these specific objectives, the Strategy also sets out specific tasks and targets on the scale and structure of state budget revenue for the 5-year period 2021-2025 and 2026-2030, ensuring that the rate of mobilization into the state budget from taxes and fees is maintained at a stable and reasonable level. At the same time, as an important pillar, inseparable from tax policy reform and innovation, related to tax management reform, the Strategy for tax system reform to 2030 also clearly states:

“Building a modern, streamlined, effective and efficient Vietnamese Tax sector; unified, transparent, in-depth and professional tax, fee and charge management according to risk management methods; promoting the application of information technology, simplifying administrative procedures, reducing compliance costs for people and businesses….”

Table 1: State budget mobilization targets for the period 2011-2030 - Source: Decision 508/QD-TTg dated April 23, 2022.

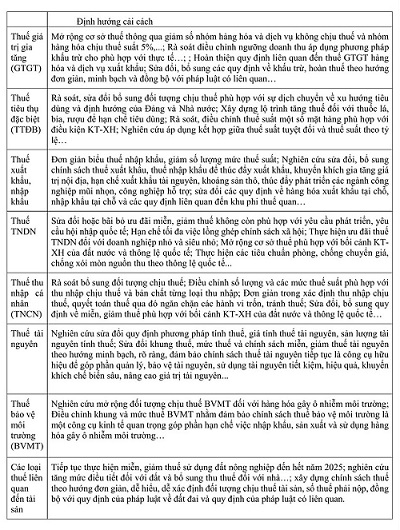

Table 2: Orientation for reforming some taxes in Vietnam - Source: Decision 508/QD-TTg dated April 23, 2022.

The successes in tax reform in Vietnam in the recent period are an important premise for implementing the reform goals and orientations identified in the Tax System Reform Strategy to 2030. The goals, tasks and reform orientations in this Strategy are quite large, demonstrating high determination in continuing to reform and innovate Vietnam's tax policy system, especially in completing and synchronizing Vietnam's tax policy system in accordance with the standards of a good tax system according to international practices, meeting the requirements of mobilizing resources for the State budget. However, the socio-economic context in the coming years is also posing many challenges for Vietnam in implementing these goals and tasks.

Global economic growth still faces many risks, macroeconomic instability tends to increase, potentially affecting Vietnam's economic growth and the roadmap for implementing solutions for socio-economic development in general, and reforming the tax policy system in particular.

In this context, solutions for reforming the tax policy system in the coming time will focus on handling short-term issues to support people and businesses in the context of the regional and world economies still facing many difficulties, challenges and long-term requirements identified in the Strategy.

The process of reforming Vietnam's tax policy system in the coming period will focus on the following key tasks:

- Effectively and synchronously implement measures to reform the tax policy system according to the orientations identified in the Tax System Reform Strategy to 2030.

In the immediate future, in 2025, focus on the following key tasks: i) effectively implement the Law on VAT (amended) approved by the 15th National Assembly, 8th session (effective from July 1, 2025); ii) coordinate with relevant agencies of the National Assembly and ministries and branches to study, absorb and explain the opinions of National Assembly deputies on two tax law projects, the Law on Special Consumption Tax (amended) and the Law on Corporate Income Tax (amended) approved by the 15th National Assembly at the 8th session to report to the Government to submit to the National Assembly during the process of finalizing and approving the two above-mentioned Law projects at the May 2025 session; iii) coordinate with relevant ministries and branches to develop a new Law on Personal Income Tax to replace the current Law on Personal Income Tax according to the roadmap approved by the Government. At the same time, build a roadmap to amend and supplement other tax laws in the tax policy system for the period after 2025 such as the Law on Environmental Protection Tax, the Law on Natural Resources Tax, the Law on Export Tax, Import Tax; the Law on Property Tax, etc.

Reform of each tax will be placed within the overall reform of the entire tax system and associated with the following basic requirements:

i) Timely and fully concretize the policies and orientations of the Party and the National Assembly on tax policy reform, especially the 10-year Socio-Economic Development Strategy 2021-2030, the 5-year Socio-Economic Development Tasks and Directions 2021-2025 and Resolution No. 23/2021/QH15 dated July 28, 2021 of the National Assembly;

ii) Closely follow the goals and orientations in reforming each tax as determined in the Tax System Reform Strategy to 2030 approved by the Prime Minister, meeting the requirements for restructuring state budget revenue in a sustainable manner and the requirements for mobilizing resources for the state budget to implement the 10-year Socio-Economic Development Strategy 2021-2030;

iii) Inheriting and promoting the regulations that have brought positive impacts of current tax policies; at the same time, amending and supplementing regulations that are problematic and no longer suitable to promptly resolve problems arising in practice, promptly remove difficulties for production and business, ensure the unity and synchronization of the legal system; and iv) Ensuring the goal of international economic integration, in line with the development trend and tax reform trend in the world, promoting administrative procedure reform.

- Continue to effectively promote the lever role of tax policy in promoting domestic investment and consumption, effectively supporting the implementation of green growth and sustainable development goals on the basis of reviewing and rationalizing tax incentive policies.

Ensure that tax incentive policies are implemented selectively, focusing on projects that can create positive externalities and spillover effects on the economy, in line with the market and international labor division trends, and encourage investment in green production and green consumption industries; At the same time, ensure that tax incentive policies are implemented in conjunction with specific and clear criteria and conditions.

- Continue to promote international tax cooperation activities, proactively participate in regional and global tax forums; complete the tax framework to effectively participate in international tax initiatives such as the Base Erosion and Profit Shifting (BEPS) Forum and the Two Pillar Solution. In the immediate future, focus on developing and submitting to the Government for promulgation a Decree guiding the application of additional corporate income tax in accordance with the regulations on preventing global base erosion under Resolution No. 107/2023/QH15 dated November 29, 2023 of the National Assembly to apply from fiscal year 2024. At the same time, proactively research and evaluate issues related to Pillar 1 of the Two Pillar Solution to be prepared and proactively participate.

- Ensure the synchronization between the reform of the tax policy system and the requirement to continue to improve the efficiency of tax collection management through promoting the reform of processes and procedures on tax registration, tax declaration, tax payment, inspection, examination and related business processes on the basis of enhancing the application of IT and promoting risk management, ensuring the synchronization between tax policy reform and tax management reform. Strengthen the coordination between state agencies and relevant organizations to build a synchronous, integrated tax and taxpayer database system capable of effectively supporting tax management as well as policy making.

- Continue to effectively implement support solutions on taxes, fees, charges, and land rents issued by competent authorities, and proactively coordinate with relevant agencies to closely monitor actual developments to research and submit to competent authorities appropriate support solutions in 2025 (continue to reduce VAT and environmental protection tax on gasoline, oil, and grease). Specifically:

+ Regarding VAT: On November 30, 2024, the National Assembly passed a Resolution on the 8th session of the 15th National Assembly, continuing to implement the policy of reducing 2% VAT rates for a number of groups of goods and services currently applying a VAT rate of 10% in the first 6 months of 2025 (from January 1, 2025 to June 30, 2025).

+ Regarding environmental protection tax: On December 10, 2024, the Government issued Document No. 843/TTr-CP to the National Assembly Standing Committee with a draft Resolution on environmental protection tax rates for gasoline, oil, and grease applicable for 2025 (continuing to reduce taxes as applied in 2024).