Violations in inspection and supervision of loan use

The Banking Inspection and Supervision Agency (State Bank) has just issued an Inspection Conclusion on HSBC Vietnam Bank Limited (period from January 1, 2021 to May 31, 2024).

The inspection agency determined that HSBC Vietnam has not fully exercised its rights and responsibilities/obligations to inspect and monitor the use of loans and debt repayment by customers. HSBC Vietnam has not fully collected records and documents proving the purpose of loan use for some customers.

A typical example is the case of V.L Import-Export Joint Stock Company: HSBC Vietnam disbursed 2 times to customers (total disbursement amount was 695,000 USD) to purchase rice for export under contracts with foreign partners. However, the documents proving the purpose of using the loan were only 1 value-added invoice and a list of purchased goods and services (there were no other documents). The accompanying documents also did not have the signature of the seller.

Or in the case of customer L.T.K - N.T.M: Based on the documents provided by HSBC Vietnam, the loan application for the customer only has a real estate deposit contract. In addition, there are no other documents showing that the customer used the loan for the correct purpose according to the credit agreement.

In addition, based on documents provided by HSBC Vietnam, there are no documents showing that HSBC Vietnam assesses factors affecting customers' ability to repay after disbursement as prescribed.

Regarding debt recovery assessment, 2/13 customers are assessed as unlikely to be recovered, including: Pacific Airlines Joint Stock Company and Asia Pharmaceutical Trading Joint Stock Company.

In addition, HSBC Vietnam was also found to have “violated regulations on the Board of Members”. “The reported data was inaccurate 02 times or more in the fiscal year” when this unit prepared and submitted the monthly accounting balance sheet of the head office, branches and the entire HSBC Vietnam system in the fiscal year (2021, 2022, 2023, 2024) of the inspection period incorrectly.

Notably, HSBC Vietnam also "did not send the State Bank a number of documents" as required by law, such as: Procedures for monitoring external environmental changes and action plans, February 2024 version, including procedures for monitoring customers' borrowing and debt repayment processes; Regulations on the authority and responsibilities of units and individuals in debt classification, off-balance sheet commitments, provisioning and use of risk provisions in operations, etc.

Requesting HSBC Vietnam to explain violations

The inspection results discovered that HSBC Vietnam had a number of violations and a number of shortcomings and errors related to governance, operation and risk management activities, credit granting activities for large customers with potential risks, customer groups (including lending to large individual customers) and bad debt handling activities and off-balance sheet debt recovery after risk handling.

The person most responsible for the violations, shortcomings and errors is Mr. Timothy Mark Redvers Evans - General Director (legal representative of HSBC Vietnam).

The Director of the Banking Inspection and Supervision Department I has issued Decision No. 88/QD-XPHC on administrative sanctions against HSBC Vietnam for 3 administrative violations, with a total fine of 85 million VND.

Based on the inspection results, the Inspection Team requested HSBC Vietnam to report and explain violations, shortcomings, and errors, and at the same time rectify and urge HSBC Vietnam to promptly propose measures to prevent, overcome, and minimize risks in banking operations.

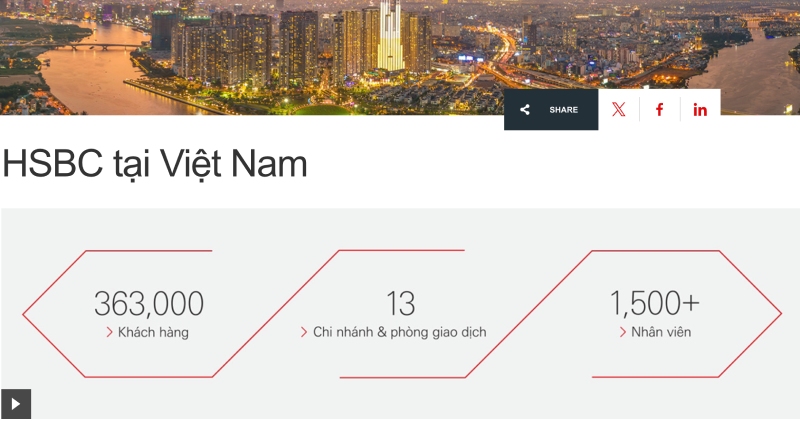

HSBC Vietnam is a 100% foreign-owned bank, established and operating under License No. 235/GP-NHNN, with a term of operation of 99 years. Current charter capital is VND 7,528 billion. Head office at 235 Dong Khoi, District 1, Ho Chi Minh City.

Bank responded "no comment"

In early December, Lao Dong Newspaper reporters contacted HSBC Vietnam Limited to learn about the feedback surrounding the Inspection Conclusion of the Banking Inspection and Supervision Agency (State Bank) on this unit.

The bank's media said: "HSBC Vietnam always cooperates with regulatory agencies and is committed to complying with state regulations. The bank would like to not comment on content related to the State Bank's inspection activities."

Some other contents in the question of Lao Dong reporter about how the bank has handled the individuals and departments involved in the violations, how they exist, were not specifically provided by this unit.