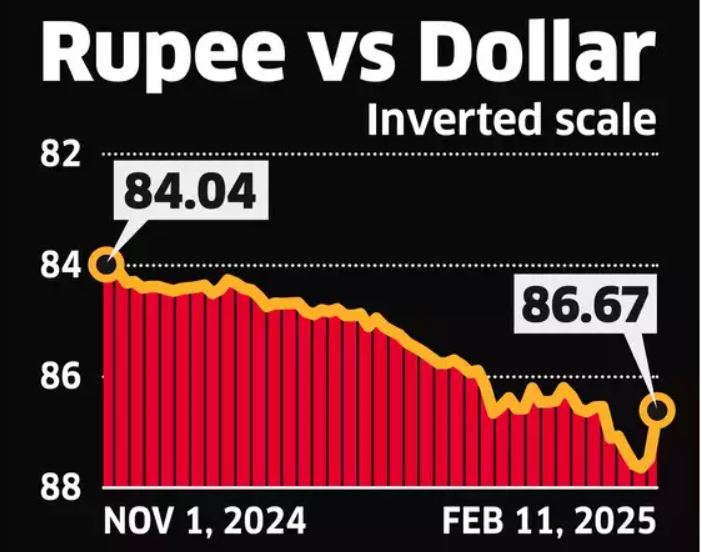

Reuters reported that the Indian rupee (INR) had a record drop to 87.60 INR/USD earlier this week, forcing the Reserve Bank of India (RBI) to intervene heavily by selling a large amount of USD estimated at up to 7 billion USD to protect the domestic currency.

Following the RBI’s drastic move, the rupee bounced sharply on February 12, hitting a high of 86.69 INR/USD before correcting to 86.89 in mid-session trading.

According to traders, the Reserve Bank of India intervened before the market opened and continued to sell dollars through state-run banks thereafter.

The massive sell-off in US dollars not only helped the rupee recover but also caused heavy losses to speculators who had bet on the INR's decline.

“This unexpected intervention has caused a real shockwave in the market, especially for those betting on a long-term USD/INR rally,” said a trader at a private bank.

Besides, RBI is also said to have conducted USD/INR swap transactions to reduce the impact of liquidity injection into the banking system.

This is not the first time India has been accused of intervening in the currency market. Last year, the country was suspected of selling dollars at least four times to control the exchange rate. This trend has continued in 2025, raising questions about the transparency of the RBI's management policy.

Meanwhile, the US dollar remained stable at 108.3 points on the DXY index, while other Asian currencies fell between 0.1% and 0.7% after US President Donald Trump imposed a 25% tariff on all imported steel and aluminum.

The rupee’s weakness has also been fueled by continued foreign investor withdrawals from Indian equities, coupled with RBI’s loose monetary policy. The rupee has lost more than 1% of its value in 2025 alone.

According to Kotak Mahindra Bank, one of India's largest private banks, although the rupee has returned to near fair value, depreciation pressure remains present given the uncertain global economic backdrop.

In another development, Indian Prime Minister Narendra Modi will hold talks with US President Donald Trump and meet senior US officials during his visit to Washington D.C. from February 13, including billionaire Elon Musk - who is serving as head of the Department of Government Efficiency in the Trump administration. This meeting is expected to discuss plans to expand Starlink and Tesla in India.