Investigation of criminal liability if tax evasion

According to regulations, from June 1, 2025, businesses in a number of sectors such as food, retail, and services with high revenue will have to use cryptocurrency computers directly connected to the tax industry's data system. All sales invoices must be recorded and sent to the tax authority in real time.

Not only stopping at the device, transactions transferred through personal bank accounts can also be tracked if unusual signs are detected. According to the Tax sector, reviewing cash flow aims to determine actual revenue, ensure the correct contract tax rate or re-determin tax obligations if there are signs of incorrect or under-declaration declarations.

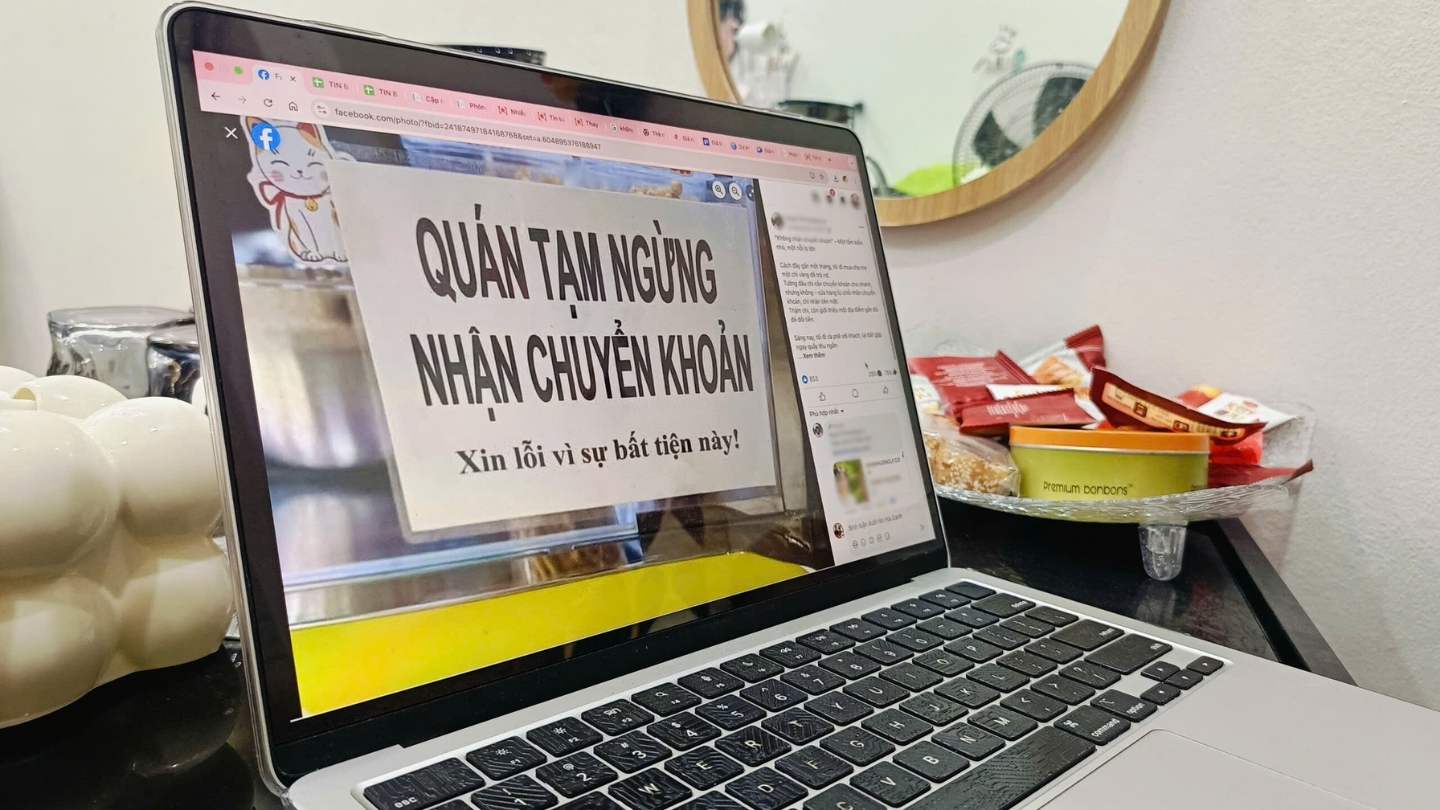

From the concerns of households and individuals doing business about this regulation, many posts have appeared on social networking platforms about not accepting transfers when purchasing goods or asking customers to transfer money with other content to avoid tax collection.

An account named Tran Kieu Anh (name changed) specializing in receiving orders and leasing clothes has notified customers immediately after the changes in the new tax policy.

"Due to changes in tax laws, when transferring money, customers are not allowed to record the content as transfer (money). If payment is by bank transfer, please pay an additional 1.5% due to arising tax payment costs" - the owner of this account wrote.

Sharing with Lao Dong about this issue, Lawyer Tran Thi Thanh Lam - Chinh Phap Law Office said that the reaction of business households by hanging signs of "not accepting transfers" shows signs of avoiding revenue supervision from tax authorities.

"This is a sign that a part of households and individuals doing business are still not fully aware of tax responsibility, not only from a legal perspective but also a standard of professional ethics and civilization in finance.

In principle, a business household choosing the method of cash payment instead of a bank transfer is not considered a violation of the law because current law does not require a business household to choose the form of cash payment or bank transfer, nor does it prohibit cash payment.

In case the business household does not accept transfers, only receives cash but still fully fulfills tax obligations; Issues invoices according to regulations; Declares honest and accurate income to determine tax obligations, ... then this behavior is in compliance with legal regulations.

However, if the act of refusing to receive a transfer of a business household or individual is for the purpose of evading the obligation to declare revenue or incorrectly declare actual revenue to evade tax, this act is a violation of the law and can be subject to administrative sanctions or criminal prosecution depending on the nature, extent, consequences of the act, etc." - Lawyer Lam emphasized.

Cash or bank transfer payments are controlled

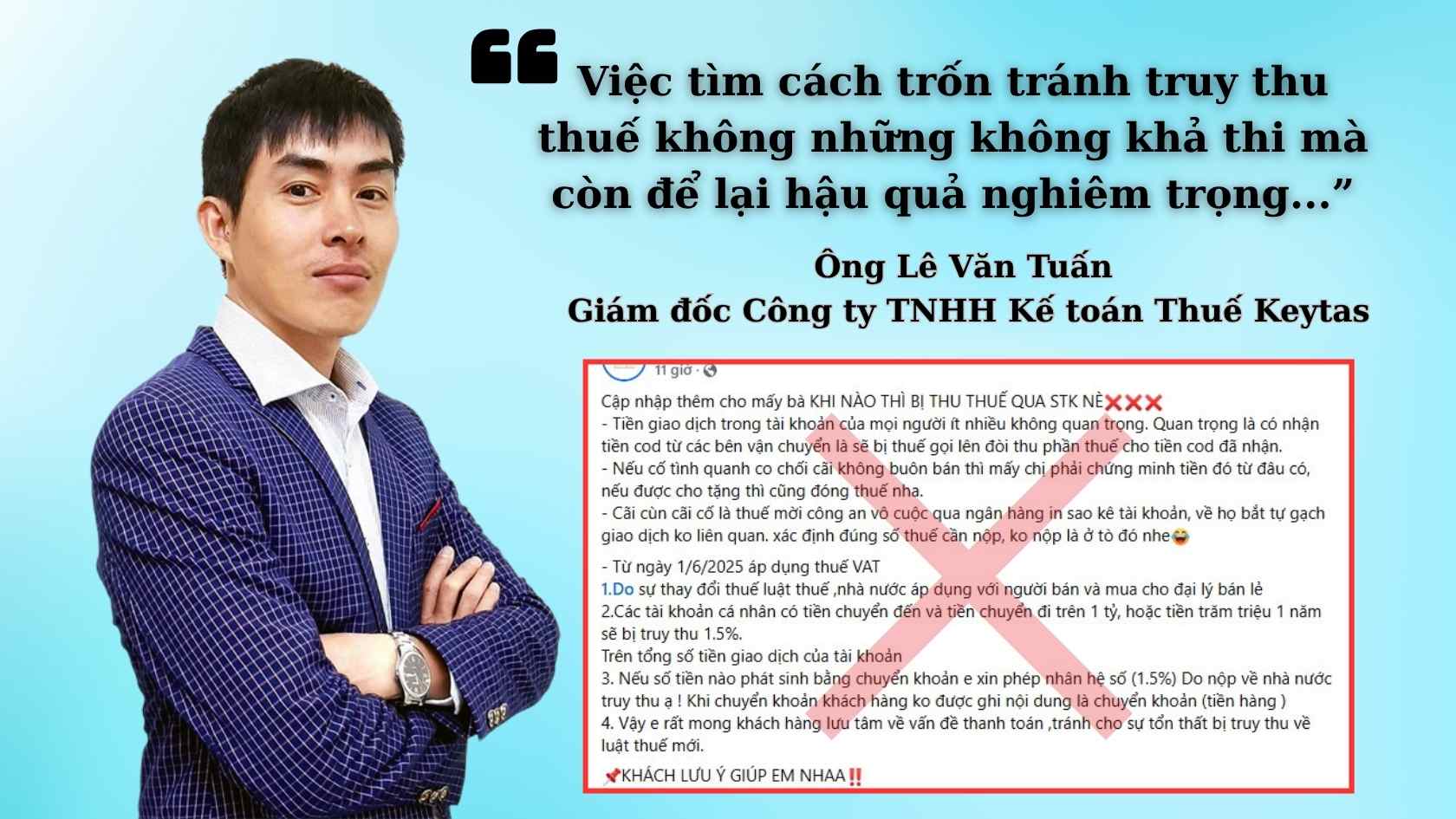

Sharing about this issue, Mr. Le Van Tuan - Director of Keytas Tax Accounting Company Limited - acknowledged that in reality, many individuals and business households transfer money to personal accounts, but many cases have misunderstood the nature, leading to potential risks, tax collection, and more serious crimes in the future.

Regarding the issue of cash payment or transfer, Mr. Tuan commented: "Most individuals and business households believe that only when revenue arises from transferring money to personal accounts, must they fulfill their tax obligations. In the case of cash collection, it is possible to evade taxes or declare lower revenue than the actual amount that no one knows. This is an extremely dangerous misunderstanding because tax obligations occur on total revenue".

Mr. Le Van Tuan also said that the electronic identification method has been applied, and the data of the tax authority is being updated. From July 1, the regulation on using personal identification numbers instead of tax numbers will also apply to individuals, business households and enterprises.

For that reason, the taxpayer's information will be identified on VneID, linked to a bank account and the eTax Mobile application. This data may be confidential to individuals, but for authorities, they have sufficient information and evidence to consider tax obligations of taxpayers, so finding ways to evade tax collection is not only unfeasible but also leaves serious consequences.

"Tax fraud in one way or another is useless because the tax sector has used Big Data, artificial intelligence (AI), completely monitoring each online trader accurately, including how to transport goods, how much revenue, where the goods come from... Therefore, regardless of payment for transactions by bank transfer or cash, the content of electronic invoices recorded in general, not true to the reality of goods, the space for tax fraud..." - Mr. Tuan informed.