No longer simply "spending - accumulate points - exchange gifts", loyalty programs are entering a new phase - where personalized experiences, emotions and values associated with daily life become key factors to retain customers.

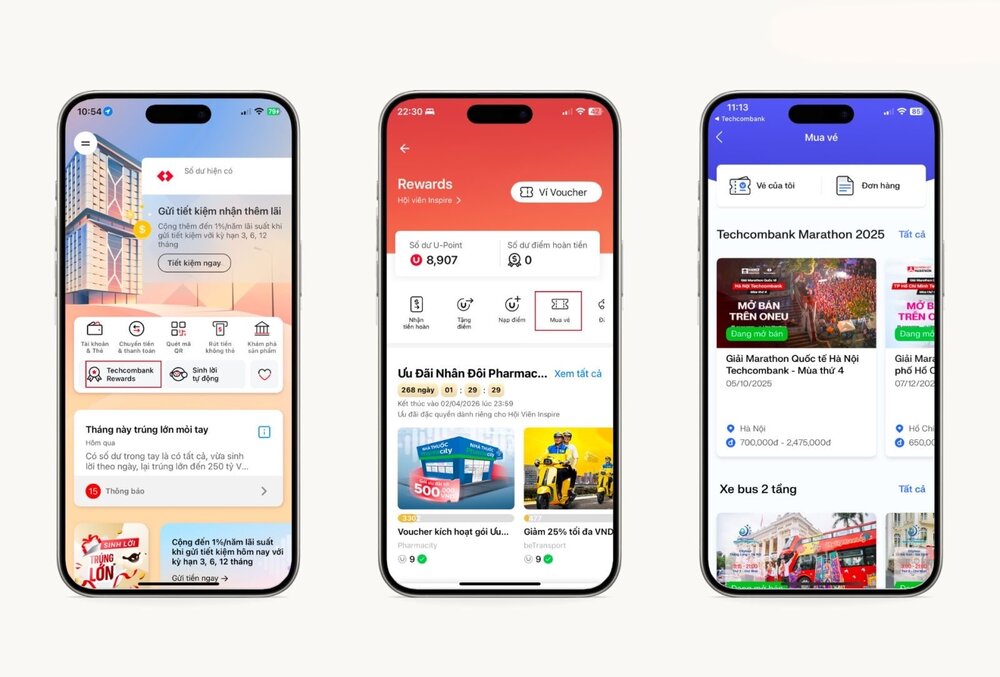

In that picture, Techcombank is considered one of the pioneering banks in redefining the loyalty program in Vietnam. With the flexible U-Point accumulation and consumption mechanism and an ecosystem of more than 5,000 partners nationwide, the Techcombank loyalty program not only brings outstanding incentives, but is also one of the pillars of the strategy for banks to enhance user experience.

Talking to us, Ms. Tran Thuy Linh - Customer Value Management Director, Techcombank - shared about how Techcombank optimizes value for familiar daily transactions, not only in terms of financial benefits but also adding connectivity and positive contributions to the community, true to the spirit of "Connecting more value, experiencing more colorful".

Madam, in the context of strongly changing customer engagement programs, what is Techcombank's core strategic orientation when developing the Customer Affection Program?

Ms. Tran Thuy Linh: "Putting customers at the center" is a consistent direction in every Techcombank strategy. With the Customer Affection Program, we do not apply a common preferential mechanism for everyone, but focus on personalizing the experience based on the level of engagement and journey of each customer.

In which, U-Point is designed as a "common value unit", recording all customer interactions with Techcombank throughout the service usage journey. Customers can accumulate points from very familiar daily transactions such as spending through payment cards, credit cards, and soon other digital payment methods such as QR code scanning.

The point accumulation and incentive mechanism is built flexibly according to membership ranking (Inspire – Priority – Private) as well as consumption habits, helping each customer receive the most appropriate value for their needs and lifestyle.

More importantly, the entire incentive system is closely connected to Techcombank's vast partner ecosystem, including units in the ecosystem such as OneMount and Masterise. We hope that the spirit of "Connecting more values, Experiencing more colorful" is not just a message, but a long-term commitment to accompany customers.

Compared to other programs on the market, what are the outstanding differences in the U-Point accumulation and elimination mechanism, Madam?

Ms. Tran Thuy Linh: Our mechanism is very simple, customers only need to have a Techcombank account to be able to start accumulating U-Points from daily spending transactions. The larger the spending value, the higher the ranking of members, the faster the scoring rate.

The biggest difference lies in flexibility when focusing. From just 1 U-Point, customers can exchange vouchers or incentives from Techcombank's vast partner ecosystem. U-Point can be used to exchange vouchers for hot deals in familiar areas of life such as food, e-commerce, supermarkets... In particular, U-Point is also used for direct payment at stores, partner business households, instead of just stopping at the form of gift exchange like many other programs.

In addition, customers can convert U-Point to flight miles, book cars, book food or other lifestyle services through the OneU application. OneU is not only a focal channel, but also a bridge between banking services and the digital lifestyle ecosystem that Techcombank and One Mount are building for customers.

The entire journey of accumulation - consumption - point tracking is carried out seamlessly on Techcombank Mobile or the OneU application.

Why does Techcombank choose the Member Rating model, and what benefits will this bring to customers, Madam?

Ms. Tran Thuy Linh: Member rating is Techcombank's way of recognizing and respecting customer engagement with substantive incentives and privileges, including the superior U-Point accumulation mechanism. This is also how we personalize the experience for users.

For example, for customers with a high membership rating, the U-Point accumulation level when spending at e-commerce platforms or partner supermarket systems can be up to 25%. This helps optimize the value for all payments, while encouraging customers to use Techcombank's product and service ecosystem more comprehensively.

What is the scale of the partner ecosystem of the Techcombank Close Customer Program currently, Madam?

Ms. Tran Thuy Linh: To date, the program has connected with more than 5,000 partners, 500 brands and over 9,000 points of use nationwide, covering many essential areas such as shopping, eating, education, health, tourism, daily consumption.

Many large and familiar brands such as Shopee, WinMart, AEON, Katinat, Grab, Golden Gate, Phuc Long, Phe La, Highlands,... have all participated in the ecosystem. Customers can easily explore this "promotional universe" right in the Techcombank Rewards section on Techombank Mobile and on the OneU application.

After more than two years of implementation, how do you assess the effectiveness of the program?

Ms. Tran Thuy Linh: Techcombank's Customer Affection Program has recorded impressive figures: nearly 13 million customers participated (as of the end of 2025), more than 1,000 billion U-Points were issued, of which more than 400 billion U-Points were used to exchange vouchers and incentives.

I believe that the high score usage rate clearly reflects the level of customer satisfaction and engagement, and at the same time affirms the effectiveness of the personalization strategy that Techcombank is pursuing.

Can you share more about Techcombank's development orientation for this program in the future?

Ms. Tran Thuy Linh: In the coming time, Techcombank will continue to expand U-Point points accumulation channels, not only from card spending but also associated with many other products and services such as mobilization products, other fee-based products... so that customers can accumulate more and deeper with Techcombank's Close Customer program. At the same time, the bank will also diversify key channels, seasonal incentives, according to actual needs and develop new experiences such as scan-to-pay, ordering and direct payment on OneU.

In particular, U-Point in the future can also be used to contribute to the "Touching Love" Fund - a charity fund pioneered by the Techcombank ecosystem. We expect U-Point to gradually become a part of daily life - where every connection with Techcombank creates positive and sustainable value for each customer and for the community.

Thank you, madam!