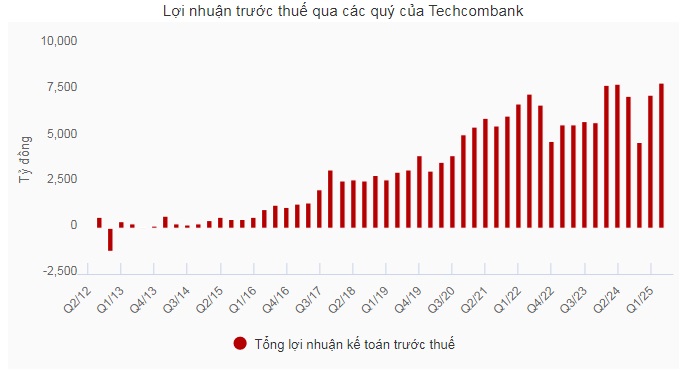

According to the announcement, Techcombank's 9-month pre-tax profit reached VND23.4 trillion and the third quarter reached VND8.3 trillion, up 14.4% over the same period, the bank's highest quarterly profit ever.

Highest quarterly profit in history

In the third quarter of 2025, Techcombank recorded pre-tax profit of nearly VND 8.3 trillion, up 14.4% over the same period, marking the highest quarterly profit ever. Accumulated in the first 9 months, the Bank achieved VND23.4 trillion in pre-tax profit, up 2.4% over the same period last year.

Total operating income (TOI) reached VND38.6 trillion, up 3.1% over the same period, of which the third quarter alone increased by 21.2% thanks to strong growth in both interest income, service fees and foreign exchange trading.

According to Techcombank's General Director, Mr. Jens Lottner, this positive result is driven by strong credit demand, along with the strategy of "taking customers as the focus" and the growth momentum of the Vietnamese economy.

The event of the first public offering of shares (IPO) by technology Securities Corporation (HOSE: TCX) with the number of registrations exceeding the offering price is a historic milestone for Techcombank and the Vietnamese capital market. This demonstrates investors' strong confidence in the Bank's financial ecosystem and its ability to open up new growth opportunities, while promoting the development of the capital market.

Techcombank's ecosystem continues to be strengthened with the official launch of Techcom Life in September, paving the way for the launch of new life insurance products, meeting customers' protection needs.

The success of the transformation strategy and leading financial ecosystem in Vietnam has been recognized by The Asian Banker magazine, honoring Techcombank as the best governor bank in Vietnam for the period 2022 - 2025, General Director Jens Lottner emphasized.

Credit increases sharply with asset quality in the leading group

Techcombank's total assets as of September 30, 2025 reached VND 1.13 trillion. For the Bank alone, credit growth was stable at 16.8% compared to the beginning of the year. On the basis of consolidation, strong credit demand comes from both individual and corporate customers

In particular, personal credit increased by 20.2% since the beginning of the year and increased by 29.3% over the same period last year, especially deposit lending increased by 61% in line with the developments of the Vietnamese stock market and home loans increased by 14.4%. Outstanding lending recorded an outstanding growth rate of 180% compared to the beginning of the year and increased by 450% compared to the same period last year, when the Bank aimed for products with higher yields.

Corporate credit increased by 16.2%, compared to the beginning of the year and 17.2% over the same period last year, reaching VND 463 trillion, the main driving force came from the strategy of diversifying credit portfolio in many areas such as Utilities and Telecommunications, FMCG, Retail, and Logistics.

With strong credit growth momentum, net interest income in the first 9 months of the year reached VND 27.4 trillion (up 1.7% over the same period). Ntimely interest rate (NIM) quarterly was stable at 3.8% thanks to improved capital costs.

In addition to core credit revenue, the Bank's service revenue in the first 9 months of the year reached VND8.4 trillion (up 1.3% over the same period), making the fee-based income/total operating income ratio the highest in the system, with many areas recording positive results, especially fees from investment banking services (IB) increasing by 32.8% over the same period and insurance fee collection increasing by 34.8%.

Operating expenses increased by 9.2% to VND11.6 trillion, but the cost/income ratio (CIR) was still maintained at 30.1%.

Reserve expenses decreased by 9.1% over the same period to VND3.6 trillion, reflecting a significant improvement in the asset quality of home loans and credit cards, helping the bad debt ratio (NPL) decrease from 1.32% to 1.23% by the end of the third quarter of 2025. In which, the NPL ratio before CIC decreased to 0.96%, compared to 1,05% at the end of the second quarter of 2025. Including bonds and loans, the bad debt ratio decreased to 1,18% compared to 1,23% at the end of the previous quarter. The bad debt coverage ratio (LLC) reached 119.1%,

CASA and leading capital platforms

At the end of the first 9 months of the year, Techcombank is proud to have served about 17 million customers, an increase of nearly 1.7 million new customers since the beginning of the year. Of which, 62.4% of individual customers are attracted through digital platforms, 30.1% from the branch network and 7.5% from partners in the ecosystem.

The number of transactions of individual customers via e-banking channels in the third quarter of 2025 reached 1.1 billion transactions, up 24.9% over the same period last year, corresponding to a total transaction value of VND 2.9 million billion, up 7.9% over the same period. Accumulated in the first 9 months of the year, the total number of transactions reached 2.9 billion, up 26.9% over the same period last year, bringing the total transaction value to 8.9 million billion VND, up 9.0% over the same period.

With this result, Techcombank continues to maintain its position as the No. 1 bank in terms of market share for forward-through transactions (17.3%) and forward-through transactions (15.8%) in the first 9 months of 2025.

By the end of the third quarter of 2025, total customer deposits increased by 24.1% over the same period and increased by 13.1% compared to the beginning of the year, reaching VND 638.5 trillion.

Notably, Techcombank's non-term deposit ratio (CASA) reached 42.5%, continuing to lead the whole industry, with a record balance of VND 272 trillion, up 12.1% over the previous quarter.

CASA balance of the individual customer segment including Automatic Profit balance increased by 29.5% over the same period, while CASA from corporate customers also increased by 46%. This result is driven by outstanding values for customers such as Techcombank Automatic Profit 2.0, solutions for businesses and comprehensive payment services.

Thanks to the strong capital position, the lending rate on deposit (LDR) is at 81.2% as of September 30, 2025. The ratio of short-term capital for medium and long-term lending decreased to 24.1% compared to 26.4% at the end of the previous quarter.

The Basel II Capital Investment Insurance Rating (CAR) improved to 15.8% thanks to increased capital from the IPO of the technology-based Securities Trading Joint Stock Company (TCX), reflecting Techcombank's solid capital foundation and asset quality.

Techcombank will pay the 2024 dividend in cash at a face value of 10%, equivalent to more than VND 7,000 billion, with the expected payment date of October 22, 2025.

Previously, S&P Global Ratings upgraded Techcombank's credit rating to "BB", recognizing its leading position as the largest private bank in Vietnam and highly appreciating its capital capacity and outstanding profitability.