Club of 100,000 billion VND

For the first time in Vietnam, up to 5 localities have entered the "100,000 billion VND Club", meaning that budget revenue in the year reached over 100,000 billion VND, of which Ho Chi Minh City continues to affirm itself as the economic locomotive.

Data from the Ho Chi Minh City Department of Finance shows that total state budget revenue in Ho Chi Minh City accumulated by the end of December 31, 2025 reached 800,043 billion VND, exceeding 19% compared to the centrally assigned estimate and 15% higher than the estimate assigned by the City People's Council.

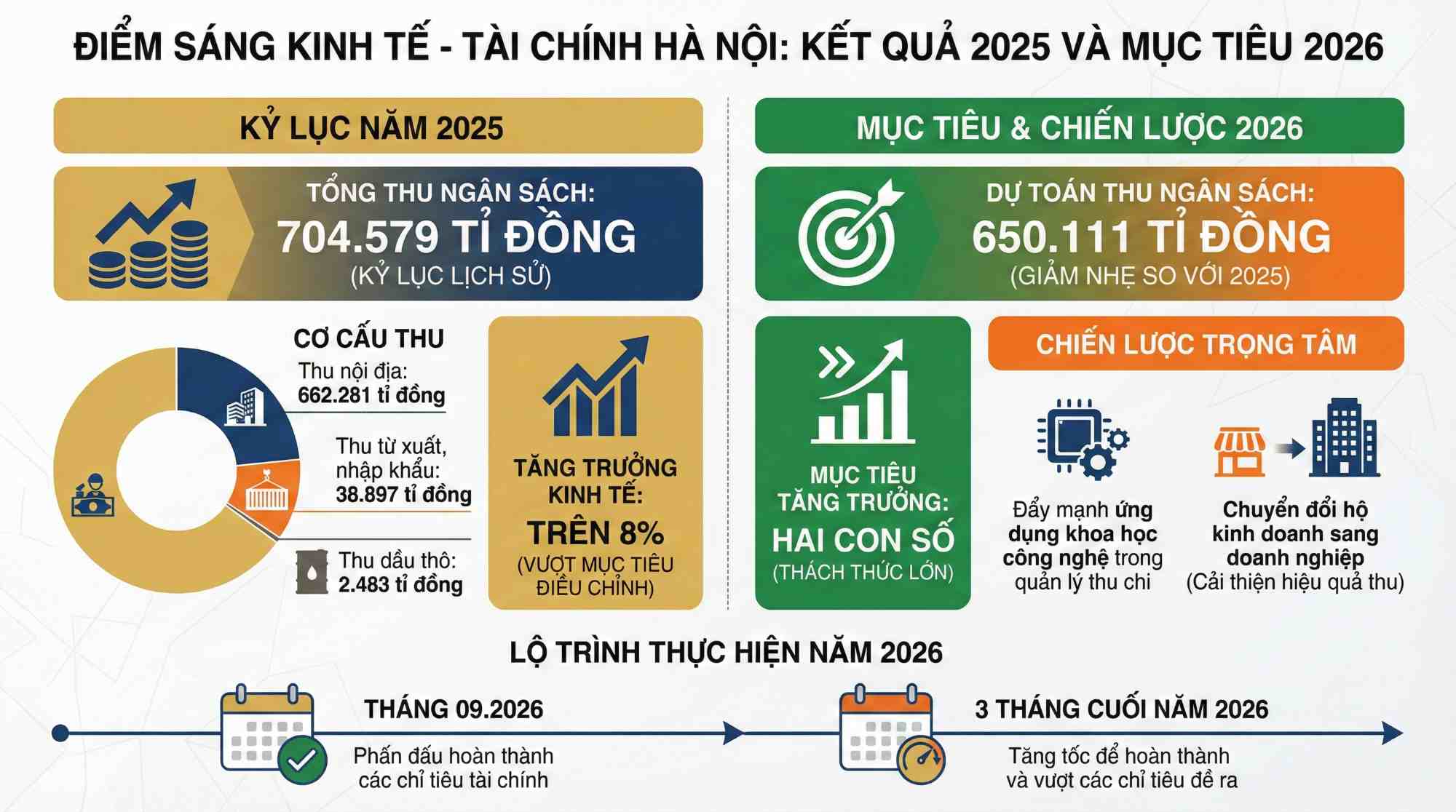

Meanwhile, Hanoi, a locality not heavily affected by the merger, also had an impressive figure with the first time exceeding the 700,000 billion VND mark. If in 2024, Hanoi's total budget revenue reached 511,928 billion VND, in 2025 it increased by 34%. An incredible increase. In which domestic revenue accounted for 94%, reaching over 622,000 billion VND.

In addition to the two locomotives Hanoi and Ho Chi Minh City, 2025 recorded 3 more localities with total budget revenue of over 100,000 billion VND: Dong Nai, Hung Yen and Hai Phong.

Hai Phong made a mark when total state budget revenue reached 190,379 billion VND, exceeding the estimate by 34.8%; domestic revenue alone reached 103,879 billion VND for the first time, bringing Hai Phong to the top group in terms of domestic revenue scale. Dong Nai also attracted attention with total state budget revenue reaching 101.4 trillion VND, (144% of the estimate assigned by the Prime Minister and 136% of the provincial People's Council estimate). This result shows that the industry - production and business ecosystem are sustainable "collection engines" of the locality.

Notably, Hung Yen for the first time achieved 100,299 billion VND, equal to 181% of the estimate; the domestic revenue structure accounted for a very large proportion, reflecting the resurgence of the business sector and the efficiency of revenue management.

Hung Yen's resurgence is not created by the merger of Hung Yen and Thai Binh. Individually when not yet merged, in 2024 Hung Yen collected a budget of 40,114 billion VND, while Thai Binh reached about 12,418 billion VND.

The lesson from Hung Yen shows that one of the factors creating a breakthrough is the modernization of tax governance: Exploiting data from electronic invoices, increasing risk inspection, managing tax debts, collecting correctly - collecting fully.

Information from Hung Yen Provincial Tax Department said that right from the beginning of the year, the provincial tax sector has carefully reviewed each revenue source, each tax crop, each enterprise; tightened tax debt management; coordinated inter-sectoral efforts to effectively exploit revenue from land, strengthened inspection of potential risk areas and at the same time, promoted data exploitation from electronic invoices, bank accounts, electronic wallets... Thereby, both contributing to increasing budget revenue and improving transparency and efficiency of tax management.

Cannot bet on income from real estate

Assoc. Prof. Dr. Tran Dinh Thien - former Director of the Vietnam Institute of Economics - shared with Lao Dong Newspaper: "Localities that collect over 100,000 billion VND all show the capacity to organize space for industrial, service and logistics development. This is a big lesson for other provinces and cities.

When there is a processing and manufacturing industry platform, logistics - seaports, urban services, or industrial clusters associated with FDI. When production and business activities are vibrant, the foundation taxes also increase accordingly.

Typically, Hai Phong not only increased domestic revenue but was also "activated" by import and export and seaport infrastructure; the locality recorded revenue from the import and export sector estimated at 86,500 billion VND and seaport infrastructure fee collection achieved high results.

Another bright spot is revenue management shifting to "data matching", strongly shifting electronic invoices, combating revenue loss, and tightening debt arrears. Not only Hung Yen, but in major cities such as Ho Chi Minh City and Hanoi, revenue from the digital economy, cross-border services, and e-commerce is increasingly clear, showing that the budget is catching up with the movement of the economy.

In the bright picture, there are still challenges. In 2025, revenue from land continues to contribute significantly to the budget of many localities. For example, in Nghe An, total budget revenue reached over 30,000 billion VND, but revenue from real estate accounted for 30%. Reality shows that this is a cyclical source of revenue, largely dependent on the real estate market and policies. The most sustainable localities are places that do not depend on land use fees, but use this resource to invest in infrastructure, creating a foundation for long-term production and business.

Dr. Nguyen Tri Hieu - a financial - banking expert - commented: "For the budget to increase naturally and sustainably, it is necessary to shift from the "short-term revenue" mindset to "nourishing revenue sources". Localities breaking through thanks to land is a good sign of resource exploitation, but if you "bet" on land use fees without a real production - service base, the risk of revenue shortage later is present.

The lesson of budget revenue in 2025 is "collecting a lot" not only because of tax increases, but because it creates a lot of added value. Improving procedures, clean land for production, logistics infrastructure, human resources... is investing in future revenue sources.