" Queue up" to close, cancel accounts

In response to the information that many banks collected account fees that did not have enough balance, Ms. Nguyen Minh Dung (Thanh Xuan, Hanoi) directly went to the nearest transaction offices and branches to check and close unnecessary accounts.

"I only use 3 bank accounts, but sometimes I open them to help friends and receive promotions when shopping," said Ms. Dung.

Directly checking a branch of Eximbank, Ms. Dung discovered that she had a bank account with a balance of only over VND17,000.

Ms. Dung added: "I want to close my account again, but the bank staff said I have to wait a long time because there are many people making transactions. As the bank employee shared, with an account balance of less than VND 500,000/month, I will automatically have VND 11,000/month deducted. If the account does not transact, the deduction can be negative but not badly recorded, deducting credit points".

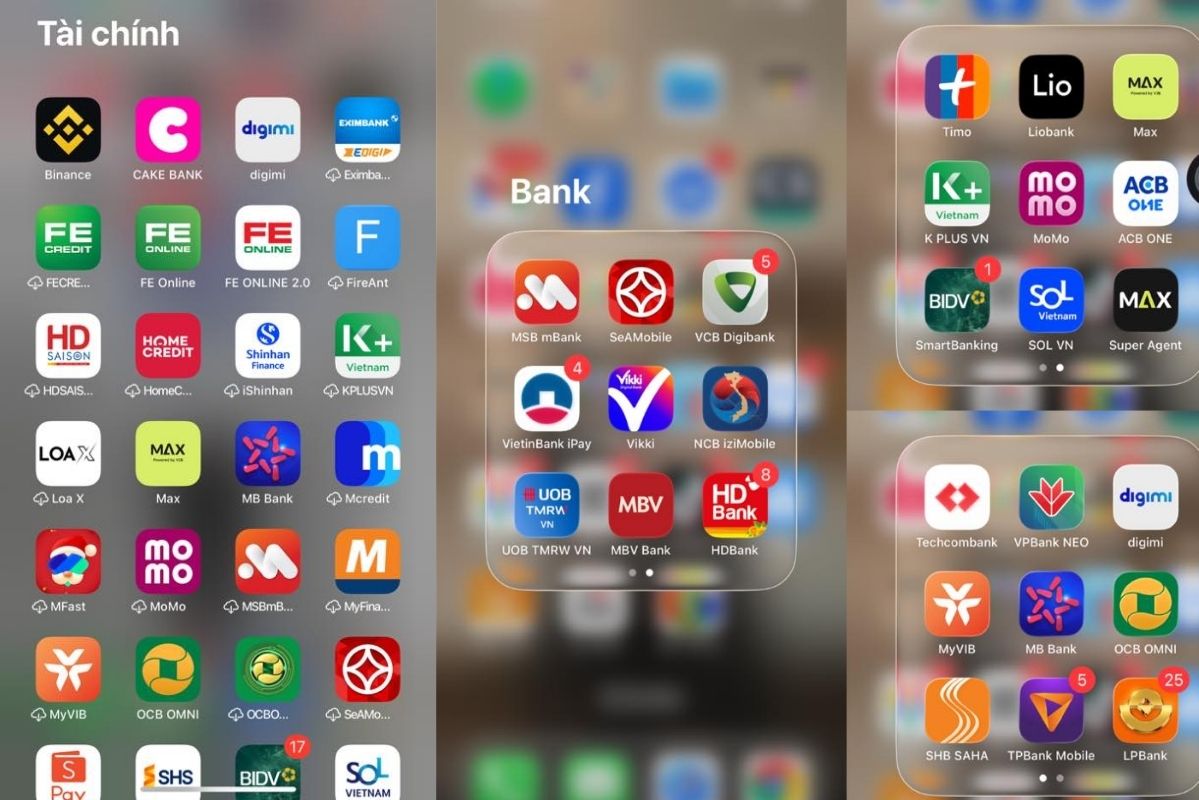

In the same case as Ms. Dung, Mr. Bui Le Hoang (Tay Ho ward, Hanoi) sadly shared: "For personal reasons, I opened many bank accounts. Now that there are new fee collection regulations, I am afraid of getting into bad debt. All the accounts I created were less than 6 months old, no cards were issued, only accounts were created without transactions".

The collection of bank management fees has made many people avoid and switch to platforms that integrate many features. Mr. Vu Dinh Diep frankly said: "When bank employees have to pay for sales, they race to invite customers to open cards, even open them for free, open them to receive more money, cheap beautiful license plates, but now they charge if customers do not use the card. In the near future, people may queue up to destroy bank accounts, returning to the days without accounts".

Risks and consequences of "open-to-let" accounts

Commenting on the above issue, Associate Professor, Dr. Dang Ngoc Duc - Director of the Institute of Financial Technology, Dai Nam University - said that the way commercial banks assign targets to employees according to the above tasks is very common in Vietnam, despite leaving many consequences.

"It can even create conditions for hackers to attack, take over account use rights or conduct fraudulent transactions, not excluding credit card accounts" - Associate Professor, Dr. Dang Ngoc Duc said.

However, people have the right to request the commercial bank to close the account if they do not have a need to use it. The Director of the Institute of Financial Technology, Dai Nam University suggested: "User should leave the minimum number of accounts, should not let the account "sleeper" because it costs management fees and is at risk".

Associate Professor, Dr. Dang Ngoc Duc added that the State Bank and the Banking Association have no instructions or policies to collect account management fees from customers. This activity was proactively carried out by commercial banks (CMs) in order to promote account holders to increase their balance by more than VND500,000/month.

From this policy, commercial banks will mobilize more without having to pay interest or very low interest. In the context of commercial banks racing to increase mobilization, this is a short-term solution.

Associate Professor, Dr. Dang Ngoc Duc cited specific evidence: " Suppose a bank has 5 million users, each customer increases the account balance by 100,000 VND, the revenue increases by 5,000 billion VND, this is not a small number. Meanwhile, there is no interest or very low interest rates".

However, when having to pay account management fees, customers will have few transactions. In case the user has more than 1 account at one or more shopping centers, the account will be closed.

To thoroughly resolve the situation of many accounts "ding down" or posing a potential risk of fraud, Associate Professor, Dr. Dang Ngoc Duc emphasized that it is necessary to take action from both sides.

First, strictly prohibit forcing bank staff to open accounts for customers, including payment cards and credit cards.

Second, propagate and educate people to carefully consider their needs before deciding to open a card. "User should not open a card when they do not need to use it, even if there is a promotional policy or "for the benefit of" their children..." - Mr. Duc pointed out the reality.