Virtual assistant to support taxpayers

Hanoi Tax Department said that the unit is currently managing a huge amount of data with over 236 thousand enterprises, 235 thousand business households and over 10 million individual tax codes (MST).

In the context of identifying digital transformation as one of the key tasks that the Tax Department needs to implement soon, the Hanoi Tax Department identifies propaganda and support for taxpayers as the top priority measure that the tax authority implements to enhance taxpayers' voluntary compliance with the law.

Therefore, in parallel with building a database on tax management information, building a database to support taxpayers and researching and applying artificial intelligence (AI) to support taxpayers is one of the top key tasks set by the Hanoi Tax Department to reform tax administration and improve the quality of taxpayer services.

With that goal in mind, since the beginning of 2024, the Hanoi Tax Department has collected data sources from the system of legal documents on tax policies and related legal policies, tax administrative procedures and frequently asked questions compiled through dialogue conferences between the Tax Authority and taxpayers. To date, the Hanoi Tax Department has developed over 12,000 contents.

With the close guidance and direction of the General Department of Taxation, the Hanoi People's Committee and the great efforts and determination of civil servants, the Hanoi Tax Department has completed the artificial intelligence product "Virtual assistant to support taxpayers". After the research and development process, the Hanoi Tax Department is honored to be selected by the General Department of Taxation as the pilot unit to organize the Launching Ceremony of the virtual assistant product to support taxpayers.

Questions for AI virtual assistant

The virtual assistant supporting taxpayers is one of the first artificial intelligence application subsystems launched as part of the overall project of applying artificial intelligence to tax management that the Hanoi Tax Department is researching and building.

From synthesizing and classifying the entire database of legal regulations, policies, and tax administrative procedures (with 100 specialized laws), editing more than 10,000 bilingual questions... and being refined, combined with artificial intelligence technology, the Virtual Assistant supporting taxpayers will answer taxpayers' questions automatically, quickly, accurately with detailed, easy-to-understand content, integrating current administrative procedure forms, intuitive, easy-to-understand instructional clips.

Taxpayers can easily use and interact with the Virtual Assistant 24/7, anytime, anywhere through technology devices such as smartphones, tablets, and computers with internet connection right on the Tax Industry Electronic Information Portal, Etaxmobile electronic tax application and on the Ihanoi Digital Capital citizen application.

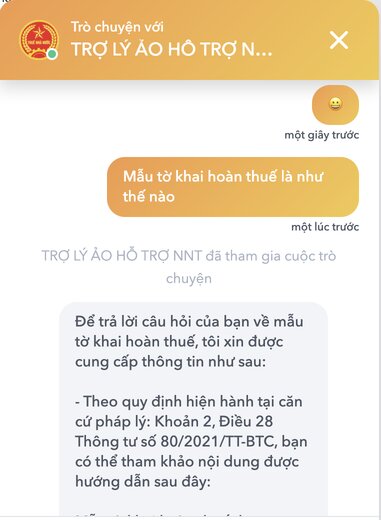

For example, when a taxpayer asks a virtual assistant a question via a message with the Hanoi Tax Department on the Tax Industry Electronic Information Portal, as follows: "What is a tax refund declaration form?"

The virtual assistant on the Hanoi Tax Department's Electronic Information Portal responded as follows:

To answer your question about the tax refund declaration form, I would like to provide the following information: - According to current regulations on the legal basis: Clause 2, Article 28 of Circular No. 80/2021/TT-BTC, you can refer to the following instructions: The tax refund declaration form is specifically prescribed as follows: 1. The list of invoices and documents of purchased goods and services is made according to form No. 01-1/HT issued with Appendix I of Circular No. 80/2021/TT-BTC. 2. According to this form, taxpayers need to fully declare the information of invoices, documents, and tax payment receipts. 3. However, there is an important point to note: For tax periods in which enterprises have implemented electronic invoices, when submitting a tax refund request to the tax authority, enterprises do not need to send a list of form 01-1/HT. This helps reduce time and effort for businesses in the process of declaring tax refunds, especially for businesses with a large number of invoices with many items. The answer is for reference only. During the implementation process, if you still have any problems, please refer to the guidance documents posted on the tax authority's website or contact the tax authority directly in charge for support. Sincerely thank you!