The fastest growth in the region but facing many uncertainties

According to the updated economic situation of Vietnam in October 2025 shared by the World Bank (WB) at the Economic Insights 2025 Forum organized by the Military Commercial Joint Stock Bank (MB), Vietnam is recording the fastest growth rate in the region, however, the outlook is still uncertain, mainly due to external factors.

Mr. Sacha Dray, WB chief economist, shared that Vietnam's real GDP growth has reached 7.9% in the first 9 months of 2025. This is the highest level in the past 10 years, if not counting the post-COVID-19 recovery period.

Vietnam's main growth momentum comes from export-oriented industrial production and the service sector. This growth momentum is supported by strong exports in the short term, partly due to early push-ups of orders and tariff negotiations between Vietnam and the US. The PMI in September 2025 also showed an expansion.

In addition to trade, investment growth remains stable. Both committed and FDI disbursement have increased, along with growth in investment from the domestic and state private sectors.

Regarding the domestic economy, the WB Chief Economist commented that the report shows that private consumption is still increasing, but contributing to GDP growth is still limited. Retail sales showed a recovery, especially in the tourism sector.

fiscal policy is being expanded, mainly thanks to increased public investment. The fiscal context is assessed as positive support, with public debt at about 34% of GDP and a budget deficit remaining at 1-2% of GDP.

Although the disbursement rate of public investment capital has improved in 2025, implementation is still facing difficulties. The positive impact of public investment on growth is forecasted mainly in the medium term, as most of the projects are in the start-up phase.

Risks from monetary and credit policies

Mr. Sacha Dray also pointed out significant risks in the monetary and banking sectors. Monetary policy is focusing on stabilizing exchange rates.

As of September 2025, the Vietnamese Dong (VND) has depreciated by about 6% compared to the same period last year, mainly due to the VND-USD interest rate gap and domestic factors. This puts pressure on foreign exchange reserves, which have fallen to $78.1 billion in the third quarter of 2025.

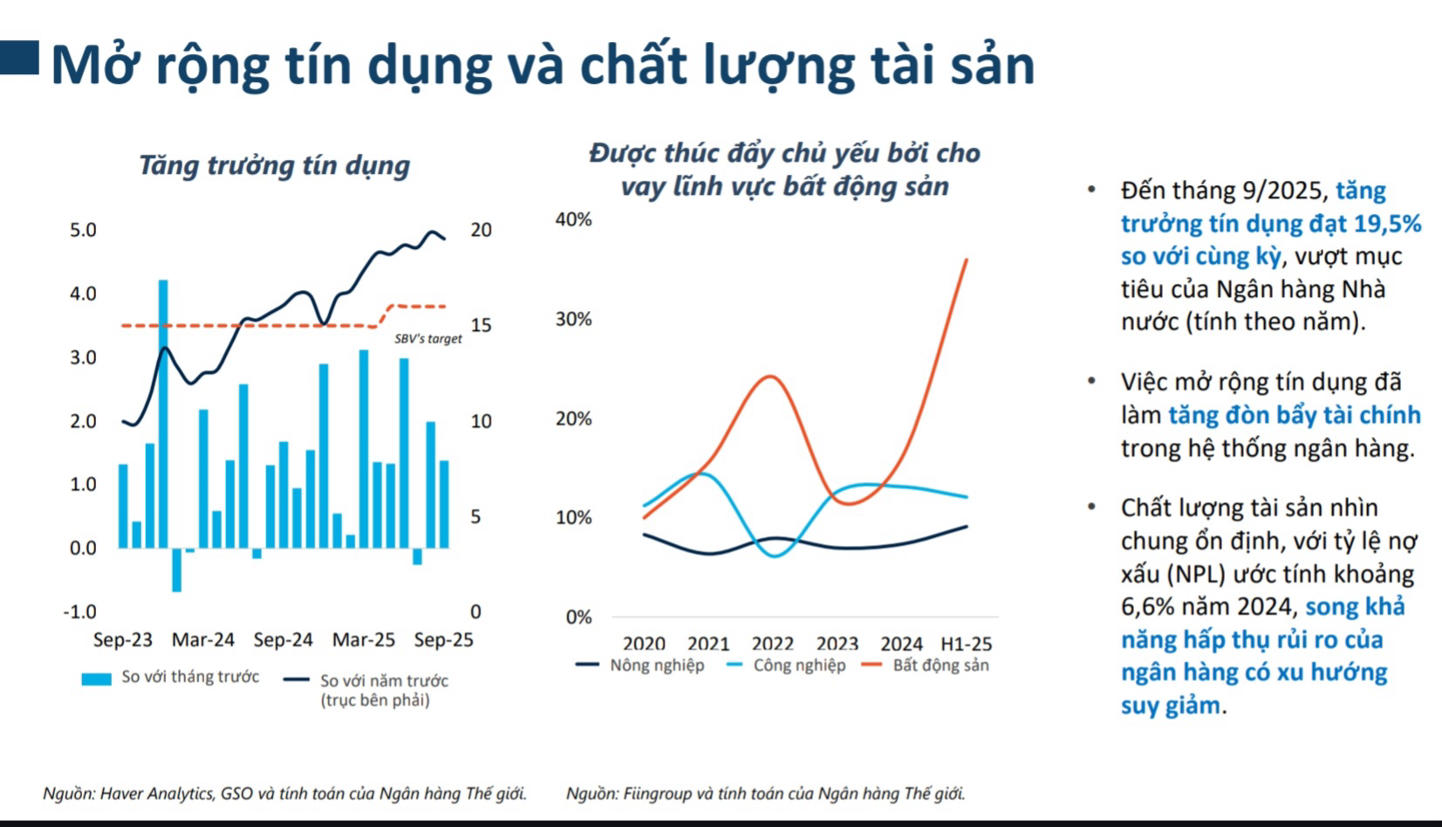

Another big risk is too rapid credit growth. By September 2025, credit growth reached 19.5% over the same period, exceeding the target of the State Bank. Notably, this increase is mainly driven by lending in the real estate sector.

Mr. Sacha Dray said that the rapid expansion of credit has increased financial leverage in the banking system. Although the overall asset quality is stable, with an estimated bad debt ratio (NPL) of about 6.6% in 2024, the risk absorption capacity of banks is declining. This is reflected in the bad debt coverage ratio decreasing to 80.4% (expected RRTD / bad debt) in the third quarter of 2025.