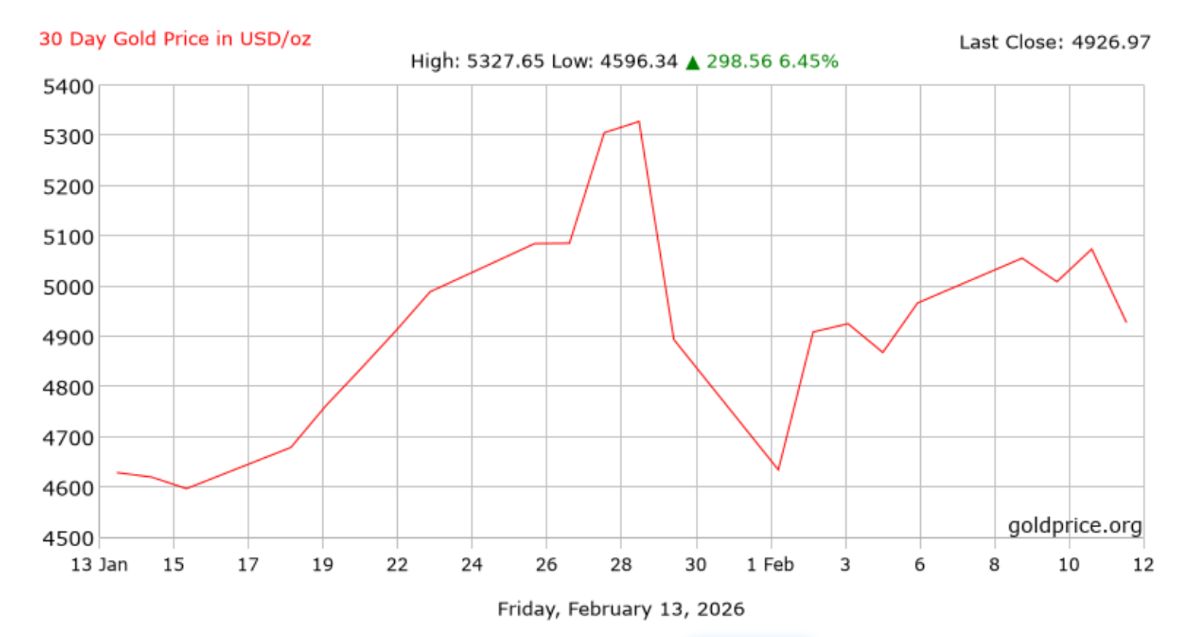

The strong upward momentum of gold prices continued to be strengthened in the first trading sessions of 2026, when this precious metal approached the historical peak and recorded a double-digit increase after just over a month. The latest developments show that 2026 may become another record-breaking year for the gold market.

World gold price at 10 PM on February 13 traded at 5,003.77 USD/ounce, up 76.80 USD, equivalent to an increase of 1.56%. In the last 7 sessions, gold prices have increased in 5 sessions, showing that the upward momentum is still very clear, although the increase range has been somewhat narrowed after the US released the January jobs report.

According to the US Department of Labor, the country's economy created 130,000 jobs in January, nearly double the forecast of 66,000-70,000 jobs. The unemployment rate fell to 4.3% from the previous level of 4.4%, reflecting that the labor market continues to maintain its stability.

More positive than expected data has almost erased the possibility of the US Federal Reserve (Fed) cutting interest rates in March. The market is no longer completely betting on an interest rate cut in June.

However, traders still expect interest rate cuts to take place in July and December, creating a supporting foundation for gold as a risk hedging asset against monetary policy incertitudes.

Fed officials recently continued to send cautious messages. San Francisco Fed Chairman Mary Daly said that the current policy is still appropriate to both support the labor market and control inflation.

Meanwhile, Dallas Fed Chairman Lorie Logan also emphasized that the central bank should not rush to adjust its position.

Previously, on January 29, 2026, gold set an all-time record, at one point exceeding the 5,500 USD/ounce mark. Compared to this mark, the current price is 9.02% lower, but still significantly higher than the closing level of the first session of January 2, which was 4,314.40 USD/ounce.

Technically, gold is in a neutral to positive state. Notably, the psychological level of 5,000 USD/ounce - once an important resistance level - has been transformed into a support zone. This is considered a major turning point, because gold only first crossed this level 3 weeks ago.

If the price maintains a solid foundation above 5,000 USD/ounce, the long-term outlook is assessed as very positive. In case of deeper correction, the next notable support zone is around 4,800 USD/ounce.

Since the beginning of 2026, gold has increased by 746 USD/ounce, equivalent to a yield of 17.25%. February alone contributed an additional 188 USD to the overall upward momentum, although it has only gone less than halfway. This upward momentum is even more prominent when placed next to the increase of about 575 USD in January, showing persistent buying power from many investor groups.

With the current foundation, 2026 is gradually taking shape as a new boom year for the gold market, as precious metals continue to maintain their attractiveness in the context of global monetary policy with many unknowns.

Regarding domestic gold prices in the Vietnamese market, SJC gold bar prices and Bao Tin Minh Chau 9999 gold bar prices are both traded at 176 - 179 million VND/tael (buying - selling).