According to analysts at Heraeus - a German industrial group specializing in precious metals and market analysis, the current market operates according to "new rules of the game", where speculation and leverage play an increasingly large role.

In the latest updated report, Heraeus experts believe that gold prices have shifted from defensive assets to highly speculative assets. The previous prolonged upward momentum is the seed for recent strong corrections.

In 10 years, world gold prices have increased 5 times, while the USD index has remained almost unchanged compared to 2015. This mismatch makes the market more fragile in the face of shocks.

The recent price drop shows clear signs of leverage positions being forced to close, loss-cutting orders being activated in series and margin requirements being continuously raised. Exchanges are still increasing margin levels for futures contracts, further amplifying the price fluctuation range.

However, global gold demand is still at a very high level. The Q4/2025 gold demand trend report shows that total demand for the first time reached the 5,000-ton mark last year.

The main driving force comes from investment demand, enough to compensate for the decline of jewelry gold and industrial demand.

Gold reserves of central banks increased by 863 tons, lower than the 2024 record level but still higher than in previous years before 2022.

Experts warn that investors need to prepare mentally for the volatile weeks and months ahead. Gold prices once rebounded strongly, recovering more than half of the previous decline, but the recovery momentum quickly weakened. However, this precious metal is still significantly higher than at the beginning of the year, in contrast to the less positive developments of many other metals.

The possibility of setting a new peak in the short term is assessed as not high. The market may need months, instead of weeks, to "discharge" all the excessive excitement that pushed prices up too quickly.

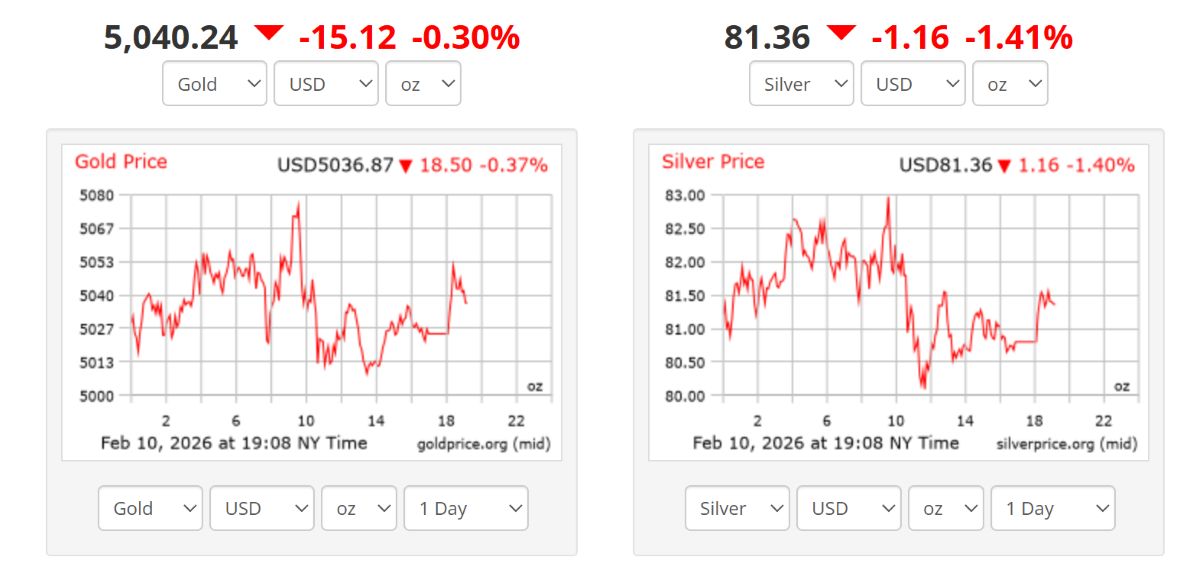

Earlier this week, gold prices returned above the 5,000 USD/ounce threshold, continuing to test the short-term resistance zone around 5,005 USD. Spot prices at one point reached about 5,036 USD/ounce, up more than 1% in the session, showing that buying power is still present but no longer as stable as before.

Meanwhile, silver is clearly in a high volatility regime. After a fierce sell-off, silver prices recovered thanks to bottom-fishing buying by small investors, dragging large capital inflows into exchange-traded funds.

However, the rapid increases were reversed when profit-taking and loss-cutting activities appeared, especially in trading sessions in Asia. Large exchanges also raised margin requirements, contributing to stronger price fluctuations.

The ratio of gold to silver has jumped to 64, reflecting that silver is falling faster than gold as the market turns around. Currently, silver prices have returned above 80 USD/ounce, following the upward trend of gold, but the risk of volatility is still high.

In this context, gold prices are no longer simply a "storm shelter", but have become a volatile playground, where risk management and investment discipline are more important than ever.

World gold price as of 7:08 am on November 11 traded at 5,040.24 USD/ounce. Silver price 81.36 USD/ounce.

Regarding domestic gold prices in the Vietnamese market, SJC gold bar prices traded around 178 - 181 million VND/tael (buying - selling). Bao Tin Minh Chau 9999 gold ring prices traded around 177.6 - 180.6 million VND/tael (buying - selling).