After a period of strong fluctuations at the beginning of the year, the precious metal market may face more challenges in the second quarter, as factors that once supported prices gradually change.

According to Mr. Bart Melek, CEO and Head of Global Commodity Strategy at TD Securities, the emergence of a new Federal Reserve (Fed) Chairman along with a clearer possibility of tariff policy may weaken the "push" of gold and silver.

Mr. Melek said that gold price fluctuations will continue in the near future. He cited the recent sudden plunge when gold prices lost up to 200 USD in just a few minutes - showing that the market is very sensitive to news.

According to him, there are two big unknowns. The first is that US economic data is not really clear. Recent jobs and inflation figures are both higher than expected, raising doubts about the Fed's ability to cut interest rates soon.

The second is the liquidity factor, as China enters the Lunar New Year holiday, making trading in Asia more quiet and the demand for risk hedging with gold somewhat decreasing.

Mr. Melek noted that when gold and silver hit historical peaks, deep corrections are unavoidable. "We are not sure interest rates will fall. It is also unclear whether safeguard demand from Asia will continue to be strong or not," he said.

Average gold scenario 5,000 USD/ounce in Q1

TD Securities forecasts an average gold price of about 5,000 USD/ounce in Q1 and there is no stronger breakthrough momentum immediately afterwards. According to Mr. Melek, this level is still very high compared to historical standards.

Mr. Melek believes that when Fed Chairman Jerome Powell leaves office, the Fed may have a new chairman who is more "flexible", especially in the short-term part of the interest rate curve.

However, the market is not sure that the successor will accept trading inflation to boost growth and jobs. This uncertainty makes it difficult for gold to have too strong a breakthrough in the short term.

If monetary policy does not change significantly after the new Fed Chairman takes office in May, the upward momentum from expectations of interest rate cuts may weaken.

From the perspective of retail demand, Mr. Melek predicts profit-taking activity will increase. Currently, speculators are no longer too excited, showing that the market is in a consolidation phase after a strong rally.

Tariffs - the next major variable

Another important factor is US tariff policy. If in June, Washington clarifies that some tariffs may be postponed or adjusted, metal inventories in the US - including copper and silver - may decrease sharply.

According to Mr. Melek, easing tariff-related constraints could significantly cool down the market, partly reversing the scarcity that contributed to pushing metal prices to a previous record level.

Summarizing the above factors, the prospects for the second quarter show that gold prices after Tet may remain at a high level but it is difficult to maintain a booming upward momentum, as both monetary and global trade policies enter a clearer stage - and are also less favorable for precious metals.

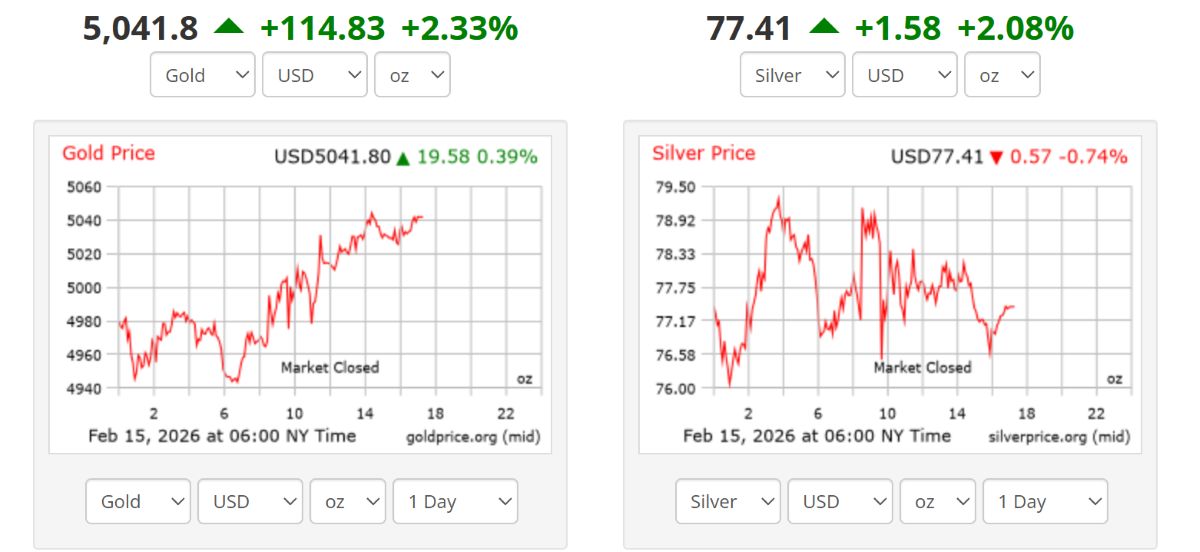

World gold price at 6 pm on February 15 Vietnam time traded at 5,041.8 USD/ounce, up 114.83 USD, equivalent to an increase of 2.33%.

Regarding domestic gold prices in the Vietnamese market, SJC gold bar prices and Bao Tin Minh Chau 9999 gold ring prices are both traded at 178 - 181 million VND/tael (buying - selling).