Gold prices hit a peak then plunged to a record low

On January 29, world gold prices jumped to a record level of 5,594 USD/ounce before plunging nearly 10% just 1 day later - the sharpest drop in decades. Since then, this precious metal has struggled to hold the 5,000 USD/ounce mark.

Although traditional factors such as US interest rate expectations or geopolitical tensions are still the main driving force behind safe-haven demand, some experts believe that Chinese investors - both individual and institutional - are playing a dominant role in amplifying volatility.

US speaks out about "disorderly" activities

Speaking on Fox News, US Treasury Secretary Scott Bessent said that recent gold price movements reflect a "slightly disorderly" trading situation in China. According to him, US officials had to tighten margin requirements, and the recent price increase is in the form of a "classical speculative boom".

Many market observers said that futures contracts and gold ETF funds surged, while the level of using financial leverage remained high despite raising margin requirements.

China - the main driving force of turmoil?

According to Nicky Shiels, Director of Metal Research and Strategy at MKS Pamp, China is currently the driving force dominating the precious metals market. Speculative money pouring into gold through ETFs, physical gold and futures contract positions has created a great push for prices.

Data from Capital Economics shows that gold ETF holdings in China have more than doubled since the beginning of 2025, while futures trading activities have increased sharply.

On the Shanghai Futures Exchange, the average trading volume from the beginning of the year reached nearly 540 tons/day, continuing the record level of 457 tons/day in 2025.

Faced with strong fluctuations, the Shanghai Gold Exchange has repeatedly raised margin requirements to cool down the market.

Analysts warn that the use of futures contracts and leverage to invest in gold is not a characteristic of safe-haven assets, but may be a sign of a speculative bubble forming.

From safe haven to speculation channel?

The strong wave of participation reflects both strategic and market sentiment factors. According to ANZ Research, gold currently accounts for only about 1% of China's household wealth, but this ratio may increase to 5% in the near future.

In the context of weakening real estate prices and deposit interest rates around 1%, gold is seen as an attractive alternative channel. Many believe that precious metals play an asset insurance role when traditional investment channels are less attractive.

At the national level, this trend is also associated with a strategy to reduce dependence on the USD. According to official data from the US Treasury Department, the amount of US Treasury bonds held by China decreased to $682 billion in November 2025, down 11% compared to the same period last year.

Meanwhile, the People's Bank of China has increased its gold reserves for 15 consecutive months as of January, raising total holdings to about 2,300 tons.

According to Capital Economics, besides the safe-haven demand, signs of increased leverage and strong speculative cash flow show that the risk of a gold bubble in China cannot be ruled out.

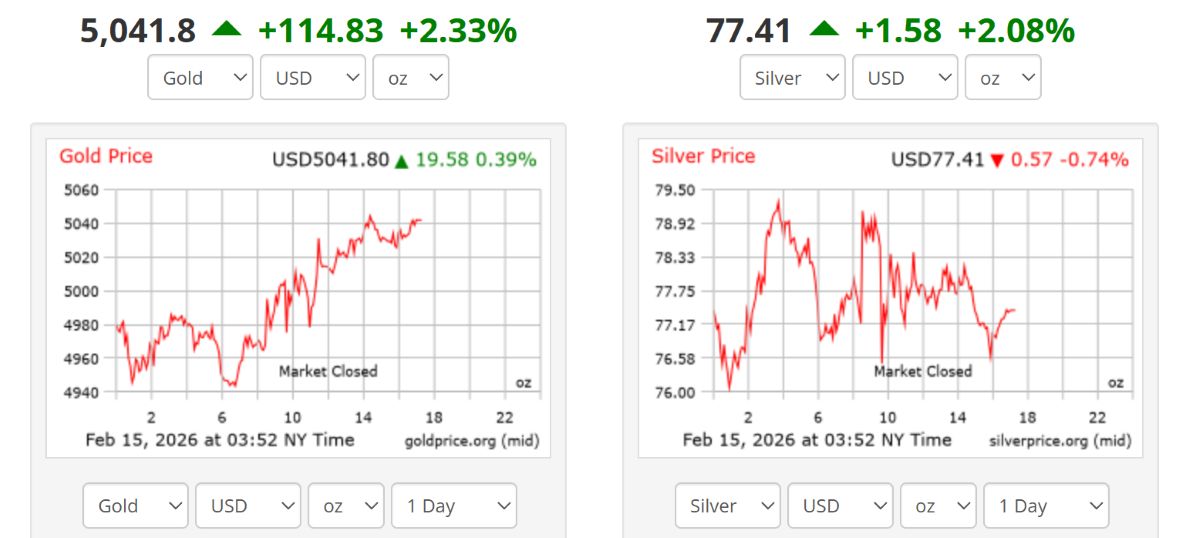

World gold price at 3:52 pm on February 15 Vietnam time traded at 5,041.8 USD/ounce, up 114.83 USD, equivalent to an increase of 2.33%.

Regarding domestic gold prices in the Vietnamese market, SJC gold bar prices and Bao Tin Minh Chau 9999 gold ring prices are both traded at 178 - 181 million VND/tael (buying - selling).