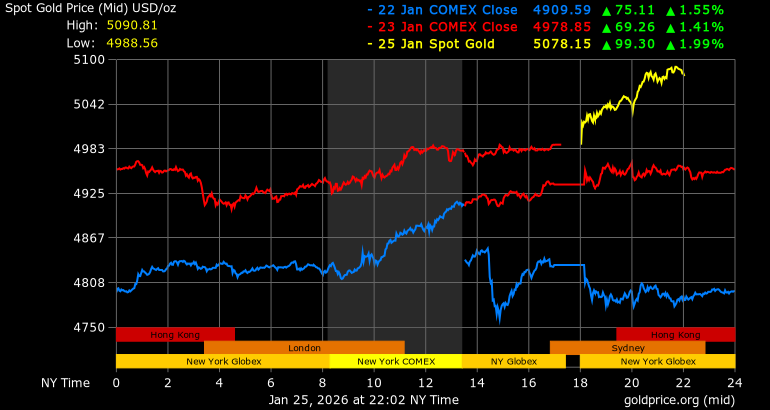

World spot gold price at 9:50 am on January 26 Vietnam time traded at 5,086.1 USD/ounce, up to 107.25 USD, equivalent to an increase of 2.15%. While the US gold futures for February delivery traded around 5,036 USD/ounce.

The rise of gold takes place in the context of many emerging geopolitical hotspots, from Greenland, Venezuela to the Middle East, increasing concerns about global risks and strengthening the role of gold as a preventive tool against instability.

The recent strong increase in gold and silver stems from economic and geopolitical issues related to Greenland," HSBC said in a report released last week.

Along with gold, silver prices also surged strongly in the first session of the week. Spot silver prices rose 8.12%, to 109.23 USD/ounce, supported by both shelter demand and industrial demand.

Analysts at Union Bancaire Privee (UBP) said that stable demand from both institutional and individual investors has pushed gold prices up sharply in recent times.

UBP forecasts that gold prices will continue to have a positive growth year, with the target price at the end of the year reaching about 5,200 USD/ounce, thanks to sustainable buying power from central banks and individual investors.

Goldman Sachs believes that gold demand has expanded beyond traditional channels. According to this bank, the amount of gold held by ETF funds in the West has increased by about 500 tons since the beginning of 2025.

In addition, new macro policy risk hedging tools, including wealthy families increasing physical gold purchases, are becoming an increasingly important source of demand.

This investment bank recently raised its gold price forecast for December 2026 to 5,400 USD/ounce, from the previous 4,900 USD, saying that macroeconomic risk hedging and global policy have become sustainable, thereby establishing a new price level for gold.

Gold buying activity by central banks also continues to be maintained at a high level. Goldman Sachs estimates that central banks currently buy an average of about 60 tons of gold per month, much higher than the average of 17 tons/month before 2022, while emerging economies continue to shift foreign exchange reserves to gold.

Goldman Sachs believes that global macroeconomic policy risk hedging measures, including concerns about financial sustainability, are likely to last until 2026, different from hedging factors related to the US election that quickly declined after the vote at the end of 2024.

We believe that global macroeconomic policy risk hedging measures remain stable, because perceived risks, such as financial sustainability, are unlikely to be completely resolved in the short term," Goldman Sachs stated.

Regarding domestic gold prices, SJC gold bar prices at 9:32 am on January 26 traded at 174.5 - 176.5 million VND/tael (buying - selling).

The price of 9999 Bao Tin Minh Chau gold rings is trading at 173.5 - 176.5 million VND/tael (buying - selling).