Many experts warn that the unprecedented correction is starting, with the scenario of gold prices could reach $3,500/ounce before the end of November.

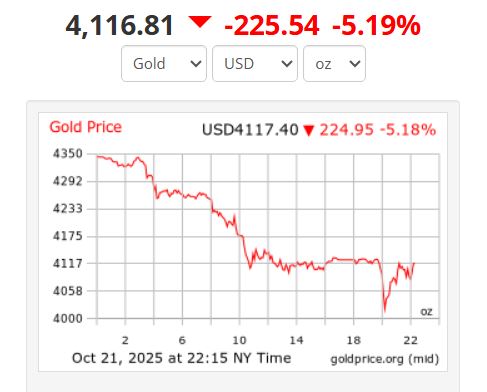

On October 21, world gold prices experienced their worst trading session since 2013 when gold futures fell by 6%, down to around $4,105/ounce. The sharp decline caused the precious metal market to sway, ending the hot increase streak over the past 2 months.

According to analysts, the simultaneous decline in gold, silver and mining company stocks on October 21 is a clear signal that "the peak has formed" and the deep correction cycle may be starting.

The Gold Cycle indicator is at 450 points, equivalent to a state of excessive long-term buying. A new report by technical analysts warns that if the market replicates the 2006 model - when gold prices increased by 36% in 2 months and then lost almost all of their results after just over 1 month - gold could fall to the $3,500/ounce range by the end of November.

Gold prices have now hit a 2-day moving average (MA 200) - the threshold considered the market's "balance". The worst scenario couldwing prices to the technical gap around $3,450 - $3,500/ounce, equivalent to a 15% decrease compared to the present.

Investors believe that this decline is the result of three factors at the same time: US-China trade tensions show signs of cooling down, the USD increases again, and technical indicators signal a bubble in the gold market.

Gold has tried to break above $4,400 many times since last week but failed, said expert David Morrison (Trade Nation). The $4,000/ounce zone will be the first test, if it breaks through this threshold, the decline could spread.

However, many investors still maintain optimistic views. this is just a temporary stop on the road up, said Tom Essay, founder of Sevens Report Research. According to him, gold still benefits from high inflation, low real interest rates, geopolitical instability and financial stagnation in Washington - all of which create a "perfect mix for gold".

Since mid-August, gold has increased by 28%, thanks to net buying from central banks and risk-off ETFs. This capital flow shows that investors still consider gold as their number one safe-haven asset in the context of weakening legal currencies.

Strategist Michele Schneider (Market Gauge.com) commented that the only thing that can end gold's strong up cycle is when the world is out of debt and peaceful again - something that has not happened yet.

Despite the shocking decline, major banks still maintain a long-term gold buying stance.

Bank of America forecasts gold prices to reach $6,000/ounce by mid-2026.

Goldman Sachs raised its forecast from $4,300 to $4,900 an ounce by the end of 2026.

JPMorgan even sets a target of $6,000/ounce by 2029.

Between two opposing viewpoints - one side warns of a technical collapse, the other side believes in a long-term increase cycle - the global gold market is facing a major turn.

As of 9:14 a.m. on October 22, Vietnam time, the world gold price was trading around $4,116.81/ounce.

Regarding domestic gold prices, SJC gold bar prices are trading around 147 - 148.5 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is trading around 152.5 - 155.5 million VND/tael (buy - sell).