UBS Bank forecasts gold prices could rise to $5,900/ounce by the end of this year, amid expectations of the US Federal Reserve (Fed) easing monetary policy and central banks continuing to boost buying.

According to UBS analysts, the continued decrease in real interest rates in the US will support investment demand in gold exchange-traded funds (ETFs), as the opportunity cost of holding non-performing assets such as gold is narrowed. Along with that, persistent buying power from central banks is still an important pillar for the upward momentum of precious metals.

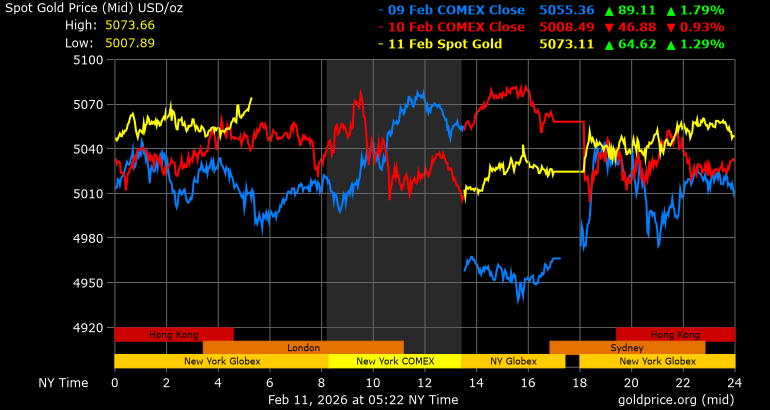

UBS said gold has been under pressure for most of last week and is still about 7% lower than its historical peak, despite a recovery. Market volatility in the past time has been very high, with the deepest declines since 2013 and the strongest increase since 2008.

The direct catalyst for these tremors was President Donald Trump's nomination of Mr. Kevin Warsh to the position of Fed Chairman at the end of January.

According to UBS, this move eases concerns about the possibility that the Fed will choose a leader with an overly "honeyfish" stance, which could accelerate the weakening of the USD. Previously, gold benefited from psychological concerns about the decline in the greenback value.

However, UBS believes that recent doubts about gold's role as a haven against geopolitical risks and market volatility are exaggerated. "We believe that gold's upward momentum will soon return," the analysis group said.

Since the beginning of the year, gold prices have still increased by about 16%, becoming one of the assets clearly benefiting from geopolitical tensions.

UBS believes that these instability factors have not shown signs of cooling down, while the Fed's policy is likely not enough to end the gold rally cycle as happened in the past.

Although Mr. Kevin Warsh supports narrowing the Fed's balance sheet, he once had a view supporting lower interest rates. According to UBS, the trend of further real interest rate reductions will continue to boost capital inflows into gold ETFs, while strengthening price outlooks.

UBS is currently raising its year-end gold price forecast to around $5,900/ounce. This positive view is also part of the bank's general commodity prioritization strategy, as it believes that industrial metals and precious metals still have room to increase due to supply-demand imbalances, geopolitical risks and long-term trends.

For investors who already hold a large proportion of gold and make significant profits, UBS recommends expanding the portfolio to other items such as copper, aluminum and agricultural products to diversify profit sources and stabilize the portfolio.

World gold price at 5:12 PM on February 11 traded at 5,065.8 USD/ounce, up 57.31 USD, equivalent to an increase of 1.14%.

Regarding domestic gold prices in the Vietnamese market, SJC gold bar prices and Bao Tin Minh Chau 9999 gold ring prices are both traded at 178-181 million VND/tael (buying - selling).