After a historic year of 2025, when gold and silver prices continuously hit new peaks, the biggest question for investors at this time is how long that upward momentum will last, or is the precious metal market entering a completely different stage in essence?

According to Mr. Robert Gottlieb - former leader of precious metals at JPMorgan and HSBC, a veteran expert in the industry - what is happening is not a short-term speculative fever. He believes that gold and silver are being "revalued" in the global portfolio, based on long-term structural factors.

Gold price and geopolitical turning point

According to Mr. Gottlieb, the defining moment of gold prices appeared in 2022, when the US and its allies used the USD as a tool to punish Russia after the Ukraine conflict. This move has caused many central banks in emerging economies to strongly buy gold, in order to reduce dependence on the greenback.

A noteworthy point is that the price is not a decisive factor for this buying group. “The central bank buys gold not because of the high or low price, but because of the policy - what is happening inside and outside their country,” he said.

Structured scarcity

If gold has had its "moment" from a few years ago, then with silver, a turning point has only appeared in 2025, even since the summer. According to Mr. Gottlieb, the market is gradually realizing how scarce the amount of silver available globally is.

In the past 5 years, strong industrial demand - from renewable energy to electronics - has seriously eroded the amount of silver inventory on the ground. When investment demand increases, the silver supply chain falls into a tense state, not enough metals "in the right place, in the right form" to meet the market.

2026: Not explosive, but healthier

Although optimistic about both gold and silver, Gottlieb warned investors not to expect 2026 to repeat the 60-70% increase like 2025. "That will not happen, but it does not mean the price-rising market has ended," he said.

In the base scenario, the forecast that gold prices will increase by another 10-15% from the current high level is still a significant profit, especially for organizations that are restructuring their portfolios in the direction of increasing the proportion of tangible assets.

Silver, on the contrary, is still a more volatile metal: Adjustments will be deeper and more painful, but long-term potential remains unchanged.

For Gottlieb, strong sell-offs of silver - often due to algorithmic transactions or futures contracts - are not reverse signs, but necessary "re-establishments", as long as the physical market is still scarce.

Revaluation, not a bubble

The core message for 2026 is that gold and silver are no longer seen as a defensive tool. After 2025, more and more organizations are doubting the traditional 60/40 portfolio model and accepting allocations of up to 20% for tangible assets.

structural changes have occurred in 2025," Gottlieb concluded. "By 2026, the market will no longer have to'explore' gold and silver - they have believed in them.

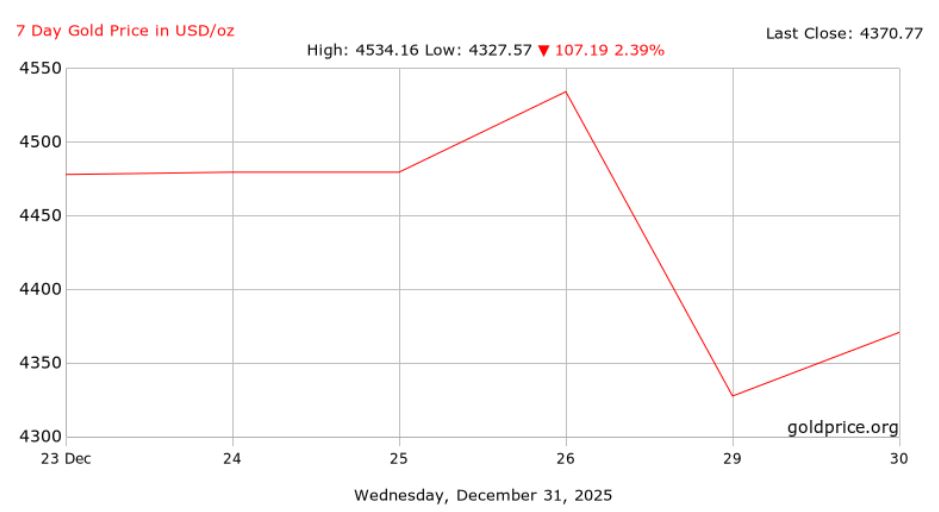

World gold prices at 4 pm on December 31st, Vietnam time, traded at 4,316.69 USD/ounce, down 54.08 USD.

Domestic SJC gold bar prices are traded at 150.8 - 152.8 million VND/tael (buying - selling). 9999 Bao Tin Minh Chau gold ring prices are traded at 152 - 155 million VND/tael (buying - selling).