On April 2, 2025, President Donald Trump declared a state of emergency for the US economy and announced a tax rate of at least 10% for all countries, with counterpart tariffs even higher for 60 countries/ territories or commercial blocks with high trade deficits with the US. He called it "Liberation Day".

On the evening of July 31, President Donald Trump announced adjustments to some of those tariffs before the deadline of August 1.

In addition to the tariff rate announced by the White House, the new trade policy also applies a 40% tax rate on transited goods. These are goods transported from a country with a high tax rate to a country with a low tax rate and then transported back to the United States.

The US has now imposed fines and penalties on goods that Customs and Border Guard officials consider transit goods. A senior government official said a 40% additional tax rate would be applied.

In the coming weeks, the government is expected to establish a rule of origin, stipulating that goods and content will also be subject to that 40% tax rate.

This is the reason why the new tariffs will not take effect from August 1 as expected. Lawyers for the US Customs and Border Protection have requested a delay to give the system more time to prepare for new tax rates.

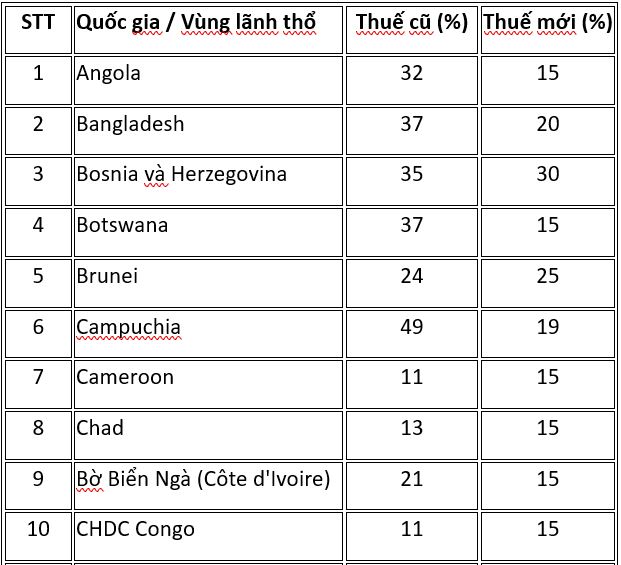

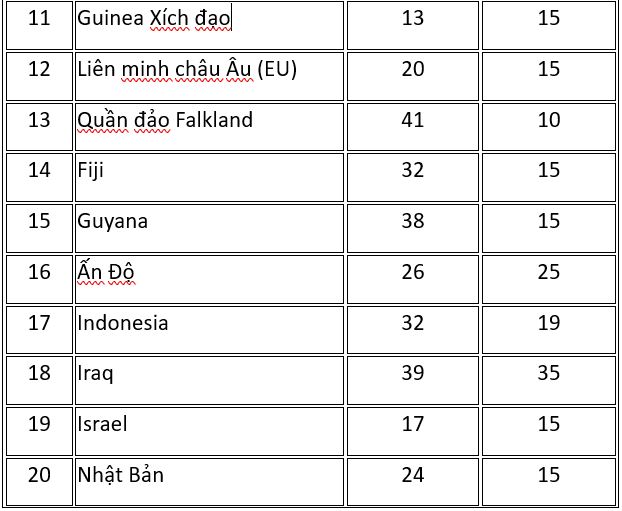

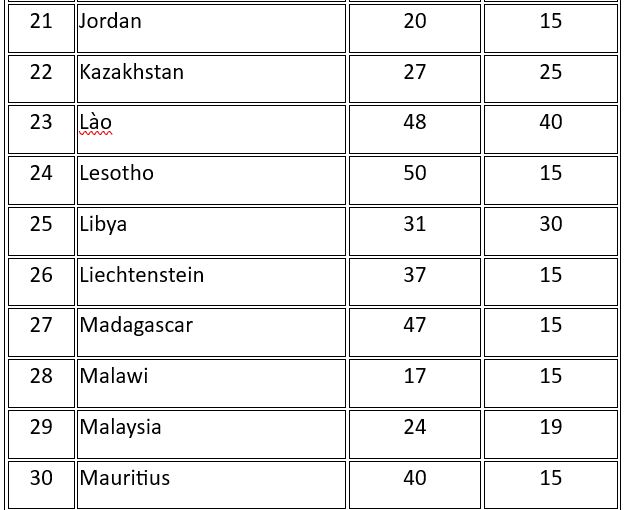

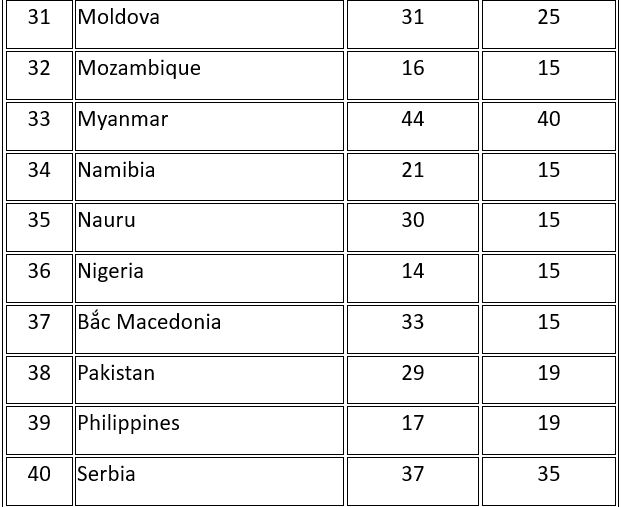

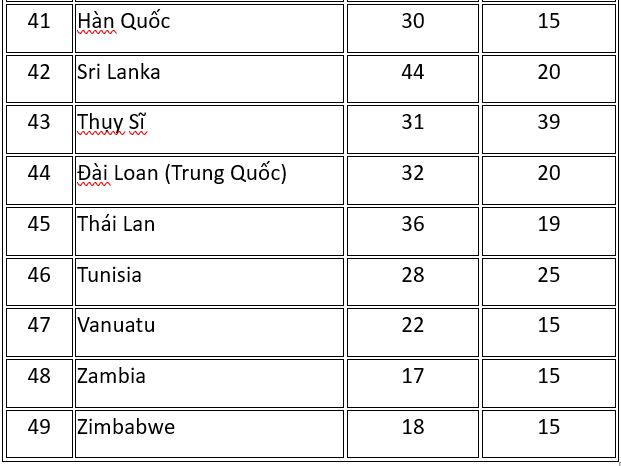

Comparison table of old tax rates (April 2, 2025) and new tax rates (July 31, 2025) according to the US adjustment announcement