Low-value imported goods are no longer exempt from VAT

The Ministry of Finance has just issued Official Letter No. 1813/BTC-TCHQ dated February 17, 2025 guiding the implementation of value added tax (VAT) on imported goods of low value via express delivery service according to Decision No. 01/2025/QD-TTg.

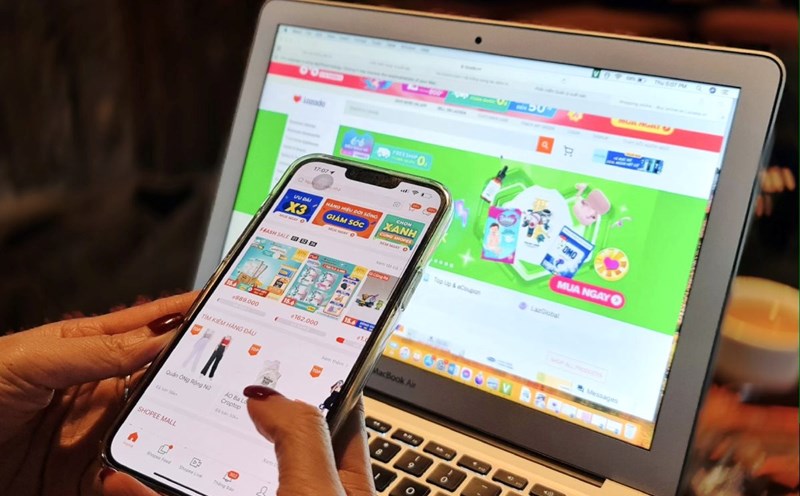

According to Decision No. 01/2025/QD-TTg of the Prime Minister, from February 18, 2025, low-value imported goods sent via express delivery service will not be exempt from VAT.

The declaration and payment of VAT on these goods is implemented in accordance with the Law on VAT and related legal documents. Meanwhile, import tax is still exempt according to the provisions of the Law on Export Tax, Import Tax No. 107/2016/QH13 and Article 29 of Decree No. 134/2016/ND-CP (amended and supplemented in Decree No. 18/2021/ND-CP).

Instructions for tax declaration and implementation of tax obligations

The Ministry of Finance has issued specific instructions on customs declaration procedures and monitoring tax obligations for express delivery businesses.

For imported goods transported by air or sea:

Express delivery enterprises shall declare customs electronically on the VNACCS System (MIC Declaration). VAT must be calculated and submitted to the customs authority according to Form No. 02-BKTKTGT (Annex I, List 2, Circular No. 56/2019/TT-BTC).

For imported goods transported by road and rail:

Enterprises must declare customs declarations according to form HQ/2015/NK (Conclusion No. 38/2015/TT-BTC). In box 18 of the declaration, the enterprise declared the name of the goods representing the shipment with the file number attached to the Detailed List of goods (according to Official Dispatch No. 6110/TCHQ-GSQL dated November 24, 2023).

Tax accounting and confirmation:

The customs authority shall base on the tax calculation table submitted by enterprises to update tax obligations in the Concentrated Tax Accounting System. Tax obligations will be confirmed on the form No. 02-BKTKTGT list before goods pass through the monitoring area.

Incorporate tax and customs fees

The Ministry of Finance requires businesses to quickly forward and use tax receipts according to the provisions of Appendix I of Circular No. 178/2011/TT-BTC. If the enterprise has a system that meets the use of electronic receipts, it can notify the customs authority of issuing receipts according to the provisions of Decree No. 123/2020/ND-CP and Circular No. 178/2011/TT-BTC.

The Ministry of Finance also requires provincial and municipal Customs Departments to disseminate this guidance to affiliated Customs Departments and publicly post it at customs procedure locations.