Update SJC gold price

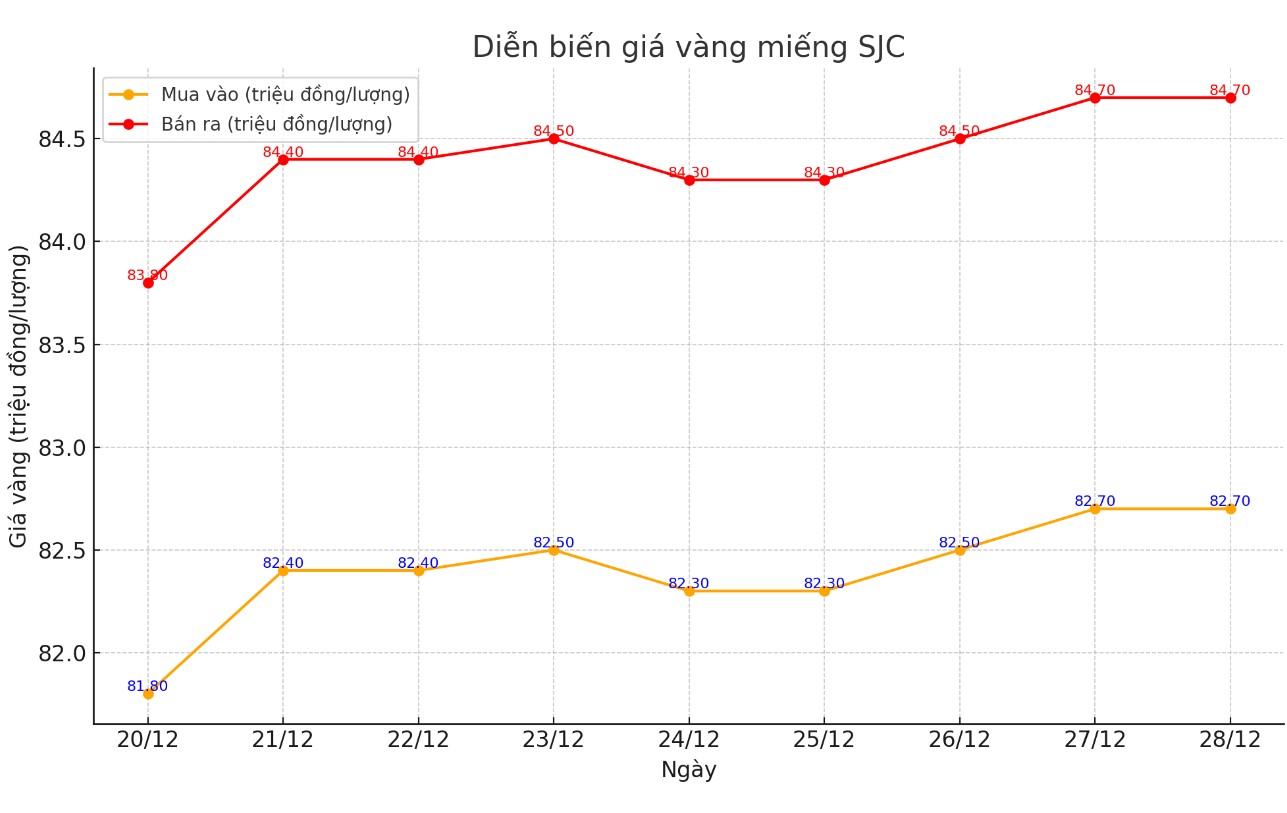

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 82.7-84.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.7-84.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.7-84.7 million VND/tael (buy - sell), up 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around VND2 million/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

Price of round gold ring 9999

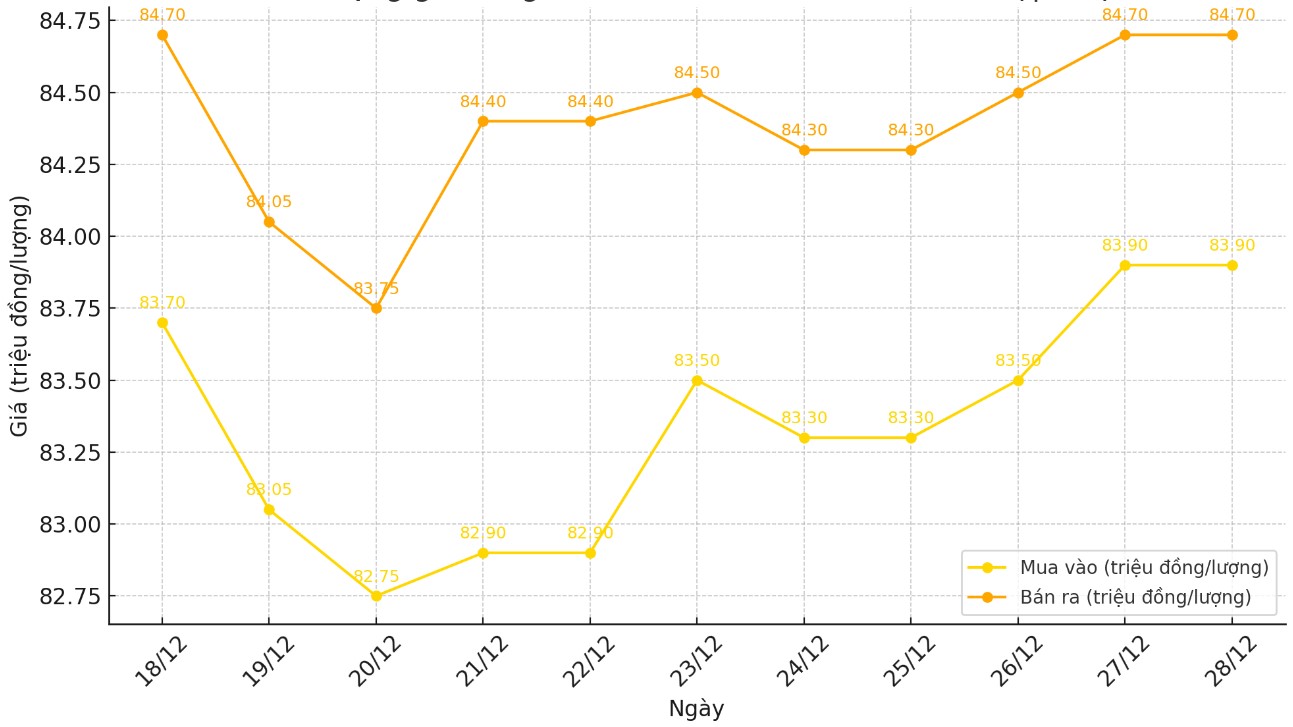

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.9-84.7 million VND/tael (buy - sell); an increase of 400,000 VND/tael for buying and an increase of 200,000 VND/tael for selling compared to the beginning of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.1-84.7 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and 200,000 VND/tael for selling compared to the closing price of yesterday's trading session.

World gold price

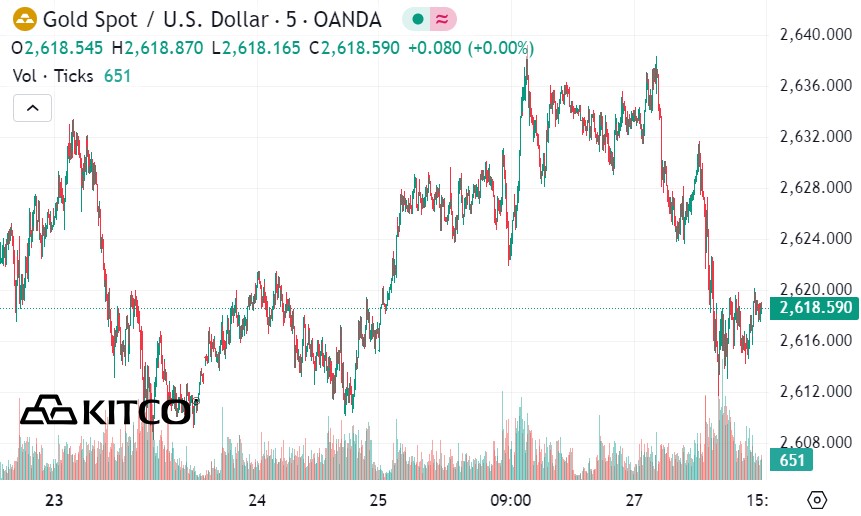

As of 2:30 a.m. on December 28 (Vietnam time), the world gold price listed on Kitco was at 2,618.5 USD/ounce, down 15.5 USD/ounce.

Gold Price Forecast

World gold prices fell despite a slight decrease in the USD index. Recorded at 2:30 a.m. on December 28, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.820 points (down 0.07%).

Gold and silver prices both fell in today's trading session. Rising US Treasury yields were the external market factor that negatively affected the two precious metals.

In overnight news, Japan's finance minister said the government would take appropriate measures to deal with the sharp fluctuations in the yen. The Bank of Japan signaled that a rate hike next month was still on the table.

Meanwhile, the South Korean won led the decline among emerging market currencies, after the country's parliament voted to impeach acting President Han Duck-soo.

Major outside markets today saw Nymex crude oil futures edge up slightly, trading around $70.25 a barrel. The yield on the 10-year US Treasury note rose, currently at 4.611%.

Technically, February gold futures bulls and bears are currently in balance in the short term.

Weak economic activity and a weaker yuan will boost gold demand in China next year, said Hamad Hussain, assistant climate and commodities economist at Capital Economics.

“We believe the Chinese real estate situation will be a major drag on economic growth and increase safe-haven demand for gold,” he said in a recent research note.

For Chinese consumers, “all roads lead to gold,” Hussain added.

While gold has long been a key asset for Chinese investors and consumers, many analysts believe the risk of a demand slowdown is growing as the government looks to support the economy with significant quantitative easing. However, Hussain said China’s stimulus measures have so far been much weaker than expected, which could provide fresh impetus to the gold market.

See more news related to gold prices HERE...