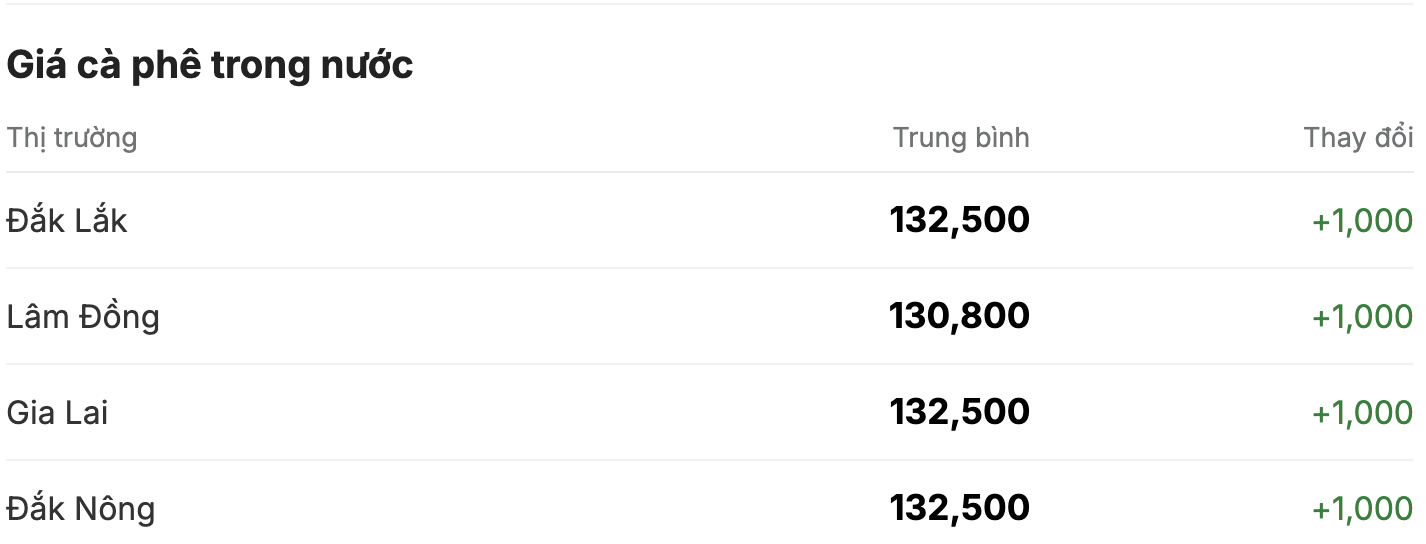

Domestic coffee prices

Domestic coffee prices today increased by VND 1,000/kg compared to yesterday, continuing to set a high price level. In key localities, the recorded prices are as follows:

Dak Lak, Gia Lai, Dak Nong: 132,500 VND/kg (+1,000 VND/kg).

Lam Dong: 130,800 VND/kg (+1,000 VND/kg).

After the downward adjustment on February 17, domestic coffee prices have quickly recovered in the past two days. Compared to the lowest level last week (129,800 VND/kg), coffee prices have now increased by about 2,700 - 3,000 VND/kg, consolidating the upward trend after adjusted declines.

World coffee prices

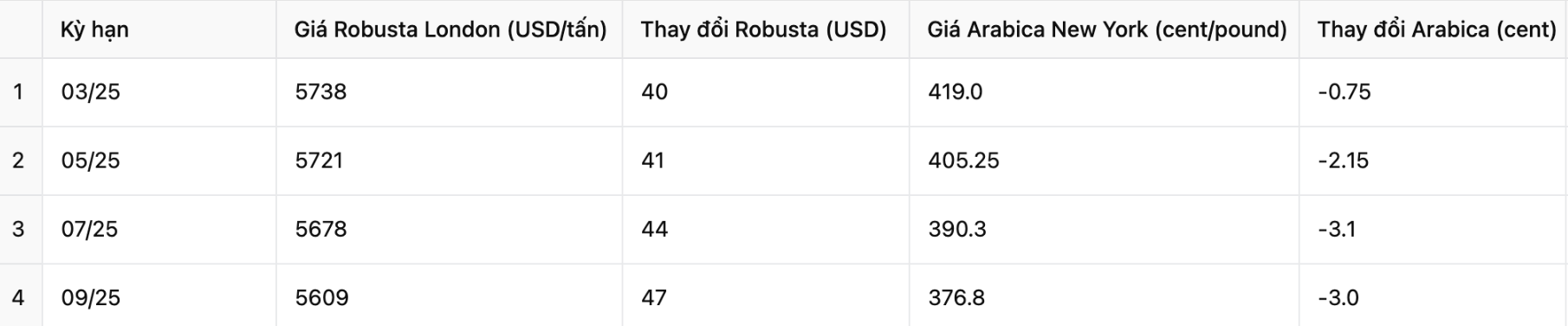

Recorded at 11:44, on the London Stock Exchange, Robusta coffee prices rebounded after a series of sharp declines. The contract for March 2025 term increased by 40 USD, closing at 5,738 USD/ton. Longer terms increased by 41 - 47 USD/ton, showing signs of recovery after previous profit-taking pressures.

Meanwhile, on the New York Stock Exchange, Arabica coffee prices continued to adjust down slightly. The March 2025 term decreased by 0.75 cents to 419 cents/pound, while the longer term lost 2.15 - 3 cents/pound. This is Arabica's second consecutive decline, reflecting pressure from expectations of increased supply in the coming time.

Coffee market assessment and forecast

Since the beginning of February, world coffee prices have experienced a strong fluctuation, when Robusta reached 5,817 USD/ton on February 13 before adjusting to 5,698 USD/ton on February 18, and now recovering to 5,738 USD/ton.

Arabica also peaked at 438.9 cents/pound on February 14, then fell below 420 cents/pound in recent sessions. Despite the decrease, the current price is still significantly higher than the same period last year.

Experts say that in the short term, coffee prices are still under pressure to adjust but it is difficult to decrease deeply because supply has not improved significantly.

According to a Reuters survey, the coffee market could enter a cooling phase by the end of 2025. The main factors affecting this trend include:

Regarding increased supply from Brazil and Vietnam, it is forecasted that Brazil's 2025/2026 crop will decrease slightly but still reach about 64.6 million bags, enough to stabilize the market. Vietnam can reach 29 million bags, an increase of 3.57% compared to the 2024/2025 crop, helping to supplement the supply of Robusta.

Regarding ICE inventories, Arabica inventories on the ICE have decreased sharply in recent times, but if the supply from Brazil is stable, the shortage can be solved, reducing upward pressure on prices.

Next, speculative capital flows may cool down. Currently, coffee prices are being pushed up partly due to financial speculation. If US interest rates continue to rise and investment funds adjust their portfolios, coffee prices could face downward pressure.

However, experts also warn that any unexpected weather factor ( drought, frost in Brazil or the Central Highlands) could cause coffee prices to rebound.

In general, domestic and world coffee prices are in a period of strong fluctuations. Although prices are still high, there are signs of adjustment as supply gradually improves. In the coming time, the market may continue to fluctuate but it will be difficult to return to the low price range as in the previous period.