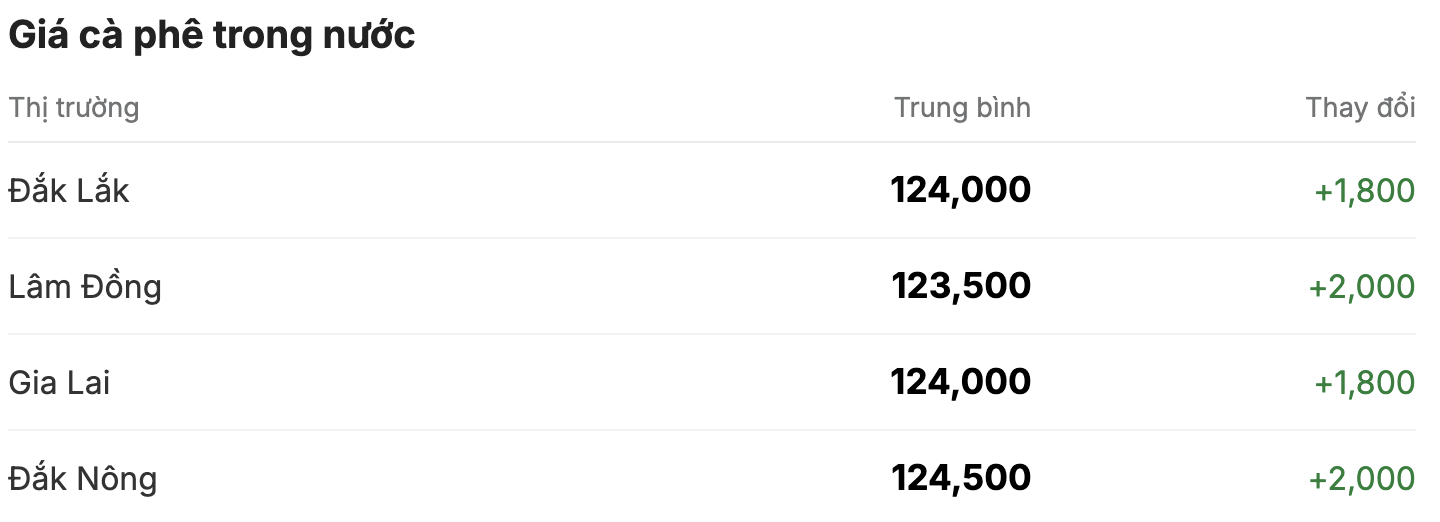

As of 11:30 a.m. today (January 23), the domestic coffee market continued to soar, increasing by an average of VND1,900/kg in the first session of the week. Currently, the purchase price fluctuates between VND123,500 - VND124,500/kg. The average coffee purchase price in the Central Highlands provinces today reached VND124,200/kg.

Lam Dong is still the province with the lowest coffee purchasing price in the Central Highlands, about 700 VND/kg higher than the average price. Compared to yesterday's price increase (January 22), coffee prices in this region continued to increase sharply by 2,000 VND/kg, currently hovering at 123,500 VND/kg.

Purchasing price is higher than Lam Dong, Gia Lai and Dak Lak provinces, all increased by 1,800 VND/kg, reaching 124,000 VND/kg.

Notably, Dak Nong is still the leading province among the provinces and cities with the highest coffee purchasing price in the country, listed at 124,500 VND/kg.

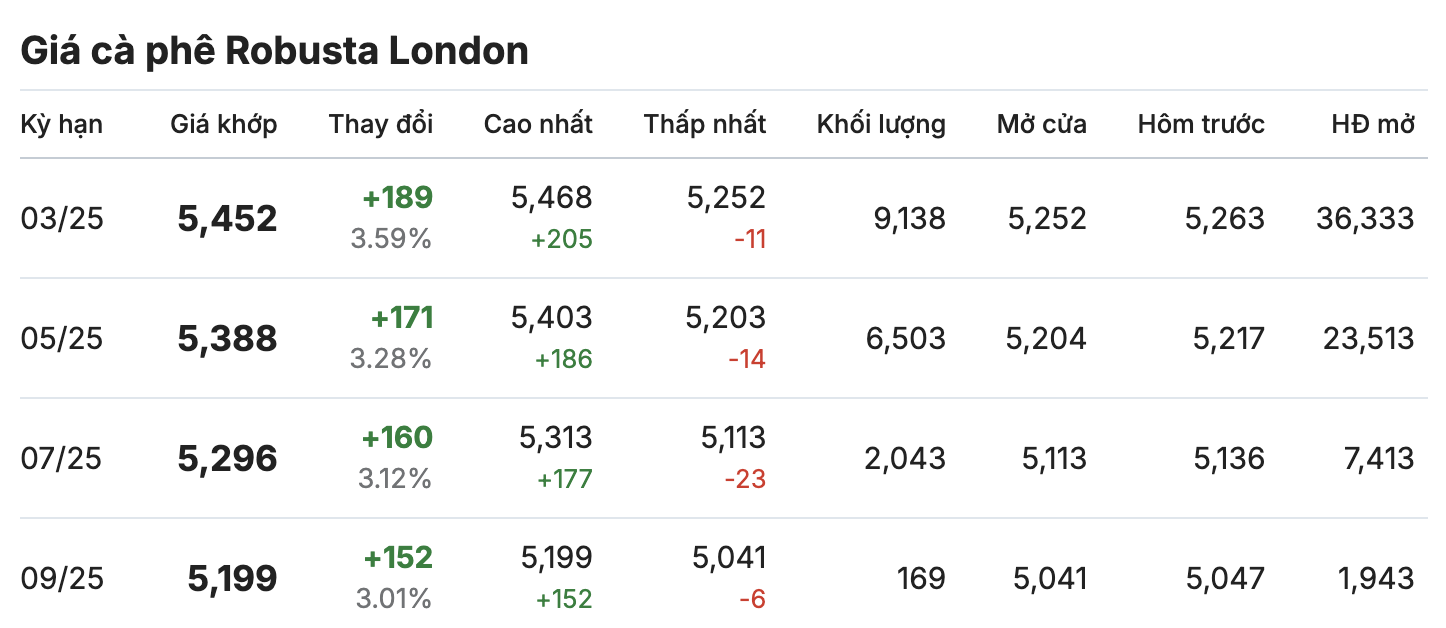

On the London and New York exchanges, the coffee market moved in the same direction across all terms. On the London Robusta Coffee Exchange, coffee prices jumped, surpassing the peak of 5,000 USD/ton. The contract for delivery in March 2025 increased by 3.59% (equivalent to 189 USD/ton), reaching 5,452 USD/ton. In the same direction, the contract for delivery in May 2025 increased by 3.28% (equivalent to 171 USD/ton), anchoring at 5,388 USD/ton.

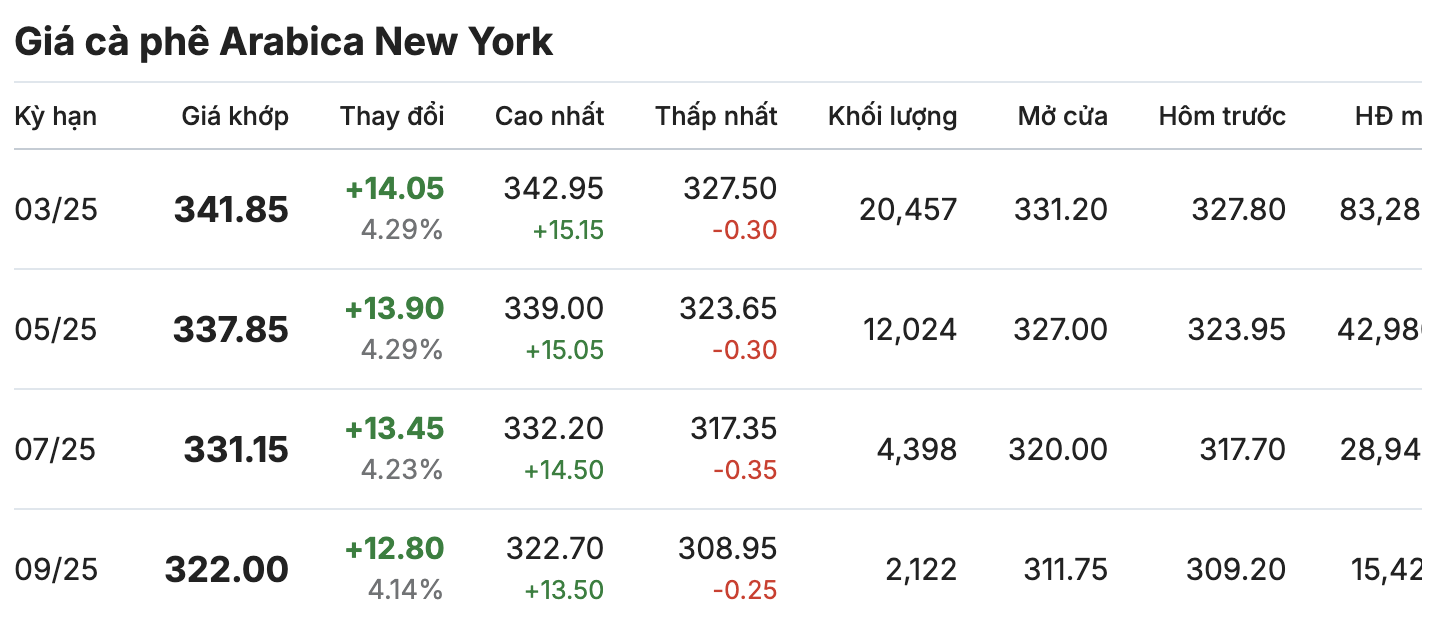

Similarly, the situation in the New York Arabica coffee market reversed sharply. The delivery terms for March 2025 and May 2025 both increased by more than 4%, reaching the market at 341.85 cents/lb and 337.85 cents/lb.

According to the latest report from the Brazilian Institute of Geography and Statistics (IBGE), the country's coffee production is forecast to be at 53.2 million 60-kg bags in 2025, down 6.8% compared to 2024.

Arabica coffee production alone, which accounts for a large proportion of total output, is expected to reach only 35.6 million bags, down 11.2% year-on-year. In addition, cultivation indicators also show a negative trend as planted area, harvested area and yield have dropped by 5.4%, 5.5% and 6.1% year-on-year, respectively.

Poor supply in Brazil and the weakening USD/BRL exchange rate are the reasons pushing the prices of two coffee commodities to consecutive peaks.