Experts make surprising predictions about gold prices this week

Gold has remained stuck in a wide range of trading for the past four months, but dovish comments from Federal Reserve Chairman Jerome Powell are creating a strong optimistic sentiment in the market, as both Wall Street and Main Street expect prices to increase next week.

On Friday, in his highly anticipated speech at the Fed's annual meeting, Mr. Powell paved the way for the possibility of a rate cut as early as next month. He highlighted the risks of rising inflation and slowing economic growth. However, he also said that while risks are balanced, US monetary policy may need to be adjusted.

... While policies remain limiting, the fundamentals and changes in risk balance may require us to adjust policy stance, he said in a prepared speech...

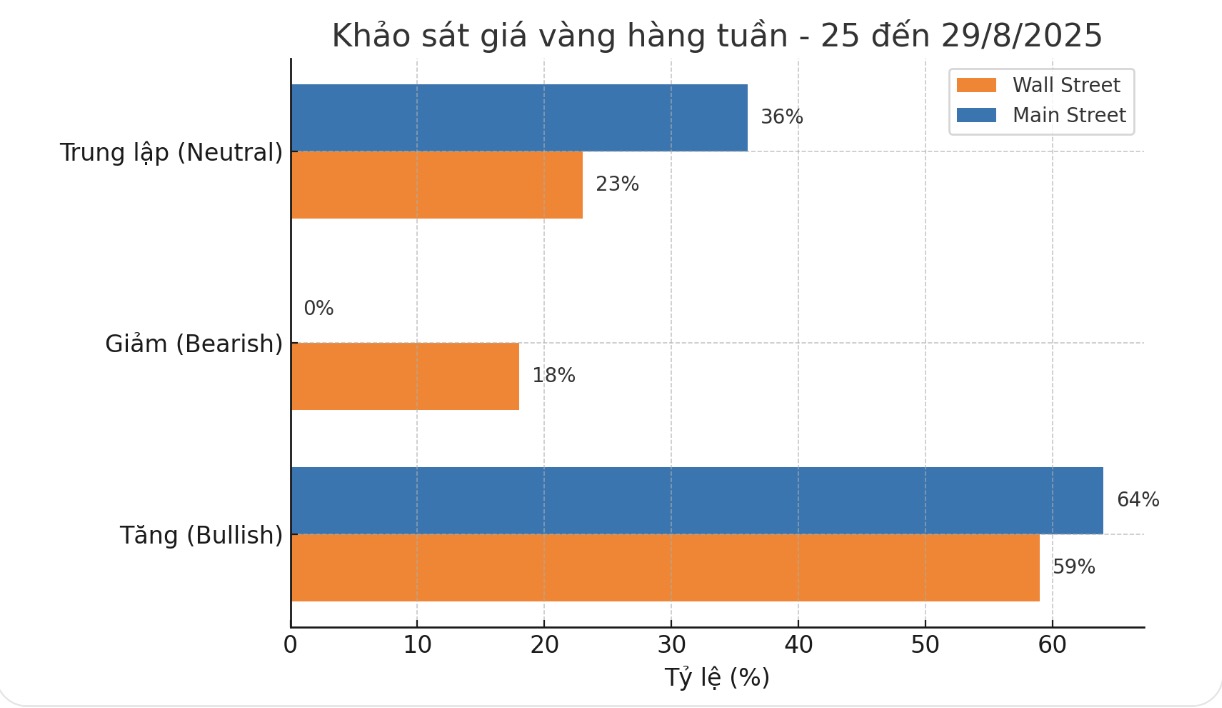

Last week, 13 market analysts participated in a gold survey, and none predicted a decrease in prices. Eight analysts (62%) see gold rising this week. Meanwhile, five analysts (38%) are neutral on the precious metal.

Meanwhile, Kitco's online poll recorded 194 votes, showing that retail investors on Main Street are also less optimistic than before, but still maintain confidence in gold's prospects. See more...

Securities will not reverse after a strong correction

The stock market last week also had many impressive acceleration sessions before high selling pressure pushed the index down sharply in the weekend session on August 22. VN-Index decreased by 42.53 points (-2.52%) to 1,645.47 points at the end of the week, but still increased by 15 points compared to the previous week. Trading liquidity last week continued to be raised to a new level with an average value of about VND45,400 billion/session.

Experts still consider this market correction as necessary when it has been "hot" for a long time. The concentrated cash flow to hold the index has caused investors holding small and medium-sized stocks to have almost no profits, reflecting that cash flow is showing signs of withdrawing from the market after a series of hot increases. See more...

Experts analyze Cadimi treatment solutions, ensuring the quality of durian for export

Gasoline price forecast to continue to increase this week

According to the Ministry of Industry and Trade, the world petroleum market from August 14, 2025 to August 20, 2025 is affected by main factors such as: US crude oil inventories decreased more strongly than forecast; the military conflict between Russia and Ukraine continues... The above factors have caused world petroleum prices in recent days to fluctuate up and down depending on each commodity.

According to a representative of a petroleum business, domestic petroleum prices will fluctuate according to the world petroleum situation. According to current market developments, it is forecasted that in the next price adjustment period, retail prices of gasoline may increase. See more...