Yen plummets

According to Lao Dong, on July 9, the Japanese Yen (JPY) continued to decline as the USD (USD) maintained its upward momentum, causing the USD/JPY pair to remain around 147.00.

The main reason for the weakening of the Yen is concerns about the economic impact when US President Donald Trump announced the imposition of a 25% tax on Japanese goods from August 1.

Mr. Trump also warned that if Japan retaliates, the US will respond similarly. Meanwhile, Japanese Prime Minister Shigeru Ishiba affirmed that he will continue negotiations to seek a mutually beneficial bilateral trade deal, but trade tensions still overshadow Japan's economic prospects. See more..

June derivatives stock trading slows down

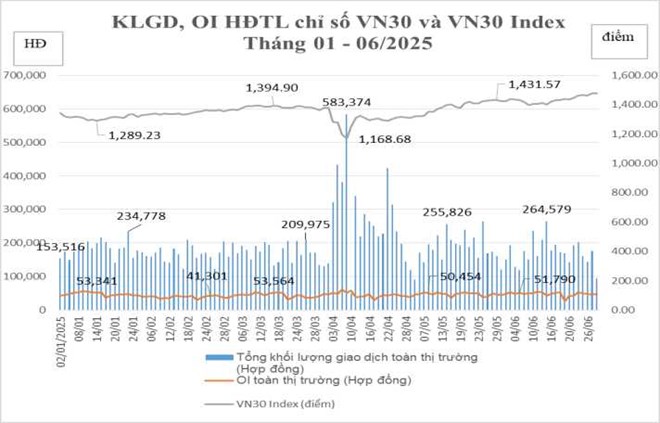

According to statistics from the Ho Chi Minh City Stock Exchange (HOSE), in June 2025, the average trading volume of futures contract products (HDTL) index VN30 reached 172,179 contracts/session, down 6.88% compared to the previous month. The average trading value in the name of the contract reached VND24.516 billion/session, down 4.25%.

Total trading volume for the whole month reached 3,615,759 contracts, down 2.23% compared to May. The session with the largest trading volume fell on June 13, 2025 with 264,579 contracts, showing that there are still sudden trading sessions amidst the slowdown trend. See more...

Hopefully, there will be a plan to support low-income people to replace old vehicles when checking emissions

Gold prices drop, China continues to buy

Although China has slowed down its buying pace this year, it still plays a key role in the global gold market.

Citing data from the People's Bank of China, Mr. Krishan Gopaul - senior analyst for the EMEA region at the World Gold Council said that the People's Bank of China increased 2 tons of gold in June.

"This is the 8th consecutive month that China has added gold. However, this speed has slowed down compared to 10.3 tons in December 2024 and 5 tons in January 2025. Thus, the total amount of gold net purchased since the beginning of the year is 19 tons, bringing the total gold reserve to 2,299 tons" - Mr. Gopaul shared.

Although China's demand for gold has decreased slightly recently, experts believe that the buying trend will not stop. They emphasized that geopolitical instability continues to strengthen the role of gold as a neutral currency asset. See more...