No special consumption tax on online betting, online games

On the morning of June 14, the National Assembly voted to pass the Law on Special Consumption Tax (amended).

Previously, in the report explaining, accepting and revising the draft Law on Special Consumption Tax (amended) of the National Assembly Standing Committee, it was stated that there were opinions suggesting adding plastic bags, plastic products, and hard-to-decompose plastic packaging to the special consumption tax list. If there are no additional conditions, the upcoming roadmap for collecting special consumption tax on this product should be calculated.

There are also opinions suggesting adding online betting businesses, online games, beauty and beauty services to taxable subjects.

Regarding this opinion, the National Assembly Standing Committee said that according to current regulations, plastic bags are subject to environmental protection tax with the highest absolute tax rate in the Tax framework List, and if necessary, it is possible to study the option of increasing the environmental protection tax framework for plastic bags to be more suitable for environmental protection.

The National Assembly Standing Committee recommends that the Government study a suitable plan to be able to amend the Law on Environmental Protection Tax at an appropriate time. The proposal to add plastic products, plastic packaging, beauty and cosmetic services to the taxable list still has many different viewpoints, the impact assessment is not well-founded to clearly demonstrate the superiority, feasibility and suitability of taxing these services in the current context.

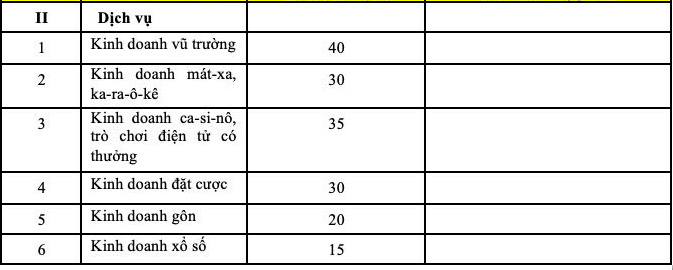

For the field of online betting and online games, these contents were also raised during the drafting of the Law and there are currently many countries regulating the collection of special consumption tax on these products and services.

However, to be able to apply it in Vietnam's conditions, it is necessary to evaluate and calculate a suitable plan. Therefore, the National Assembly Standing Committee requests the National Assembly to allow it to continue to keep it as prescribed in the draft Law, and at the same time recommends that the Government continue to study international experience and carefully assess the impact of adding other goods and services to the list of goods subject to special consumption tax to propose additional additions at an appropriate time to ensure coverage of taxable subjects, contribute to consumer orientation, and be consistent with the shift in consumer trends in society.

A series of items are subject to special consumption tax

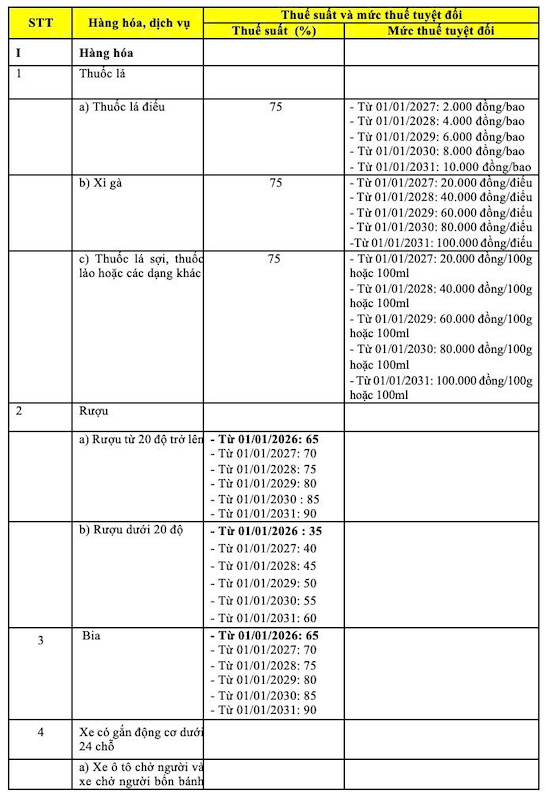

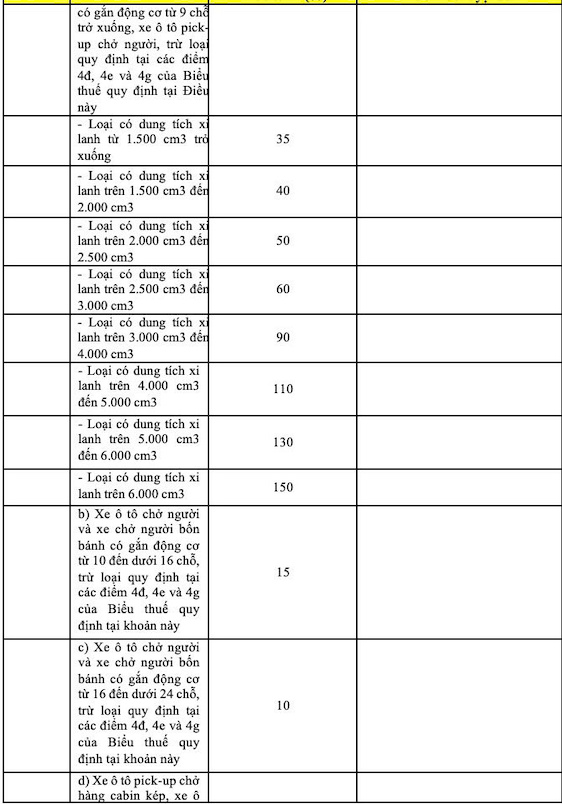

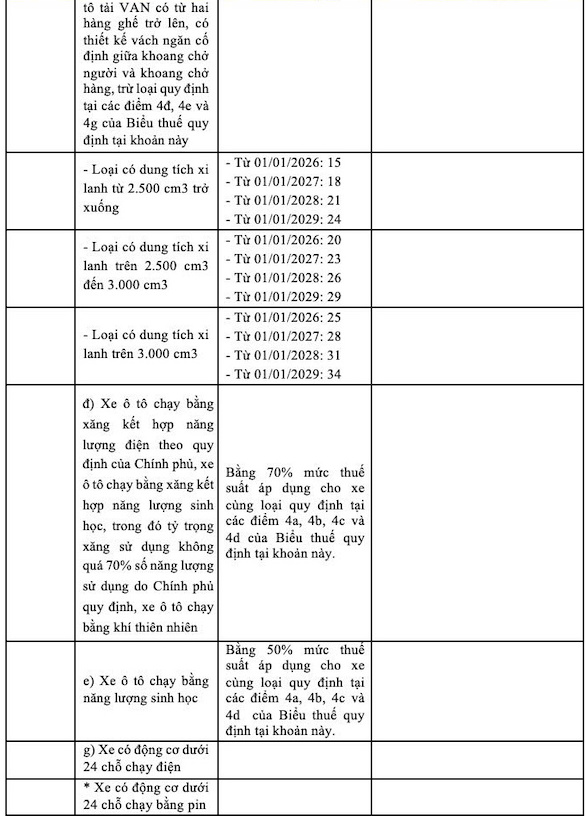

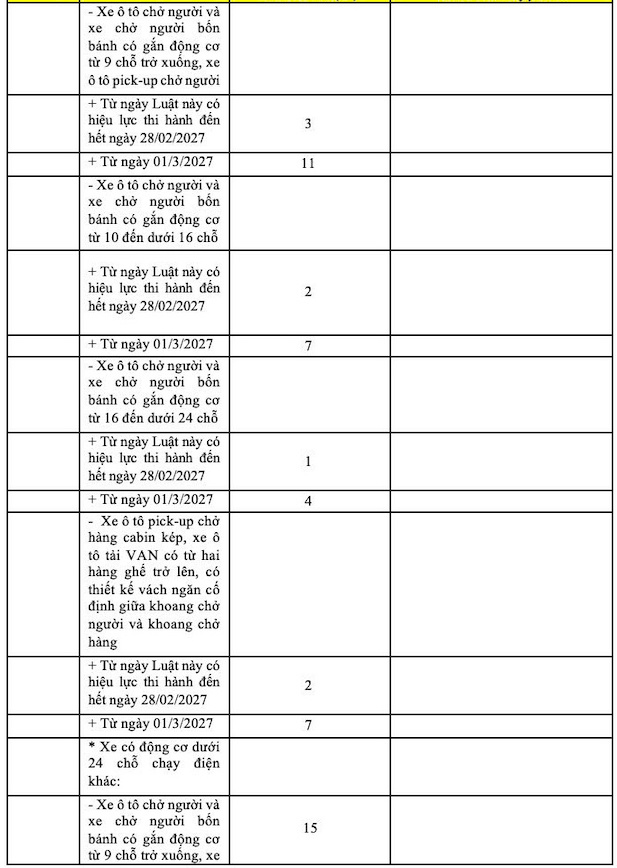

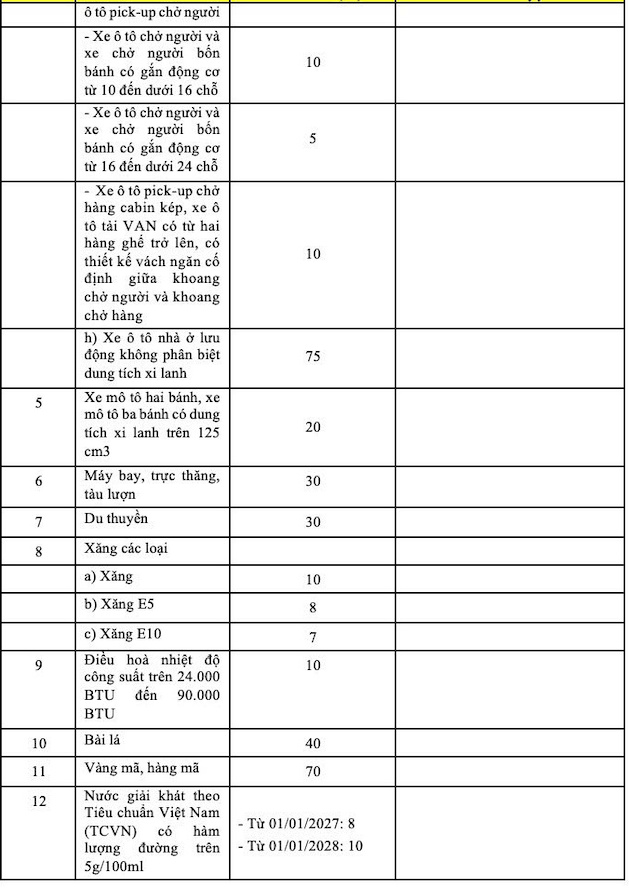

The tax rate and absolute tax rate on special consumption tax on goods and services are specified in the following Special Consumption Tax Schedule:

According to the approved Law, soft drinks with 5 grams of sugar in 100 ml (sweet water) are subject to special consumption tax for the first time.

soft drinks will be taxed at 8% from January 1, 2027, and increase to 10% from the beginning of 2028.

Products not subject to this tax include milk, dairy products; natural mineral water, bottled water; vegetable and whole fruit juice and nectar (seed) of vegetables, fruits and cocoa products. Fruit juice, coconut water, and liquid foods used for nutritional purposes are also not subject to this tax.

Chairman of the Economic and Financial Committee Phan Van Mai said that adding soft drinks to the taxable list is necessary, in accordance with international practices to orient production, consumption, and expand tax facilities.

Also in the beverage group, special consumption tax on alcohol and beer will increase according to the roadmap. Specifically, alcohol with 20 degrees or more is subject to a tax rate of 65% from January 1, 2026, an increase of 5% per year in the period of 2027-2030 and reaching a tax rate of 90% from the beginning of 2031.

Alcohol under 20 degrees is subject to a special consumption tax of 35% from the beginning of 2026, an increase of 5% per year for the next 4 years and up to 60% from 2031.

As for beer, the tax rate is 65% from January 1, 2026 and will gradually increase to 90% in early 2031.

Similarly, fiber cigarettes, tobacco products or other forms have a tax rate of 20,000 VND per 100 grams or 100 ml and will increase to 100,000 VND in 2031...

The National Assembly also "finalized" the application of special consumption tax with air conditioners with a capacity of over 24,000 to 90,000 BTU, at a rate of 10% from January 1, 2026. Air conditioners with a capacity of 24,000 BTU or less and types over 90,000 BTU are not subject to special consumption tax.

Mineral petroleum products are still subject to 10% special consumption tax, while E5 and E10 biofuels have preferential tax rates of 8% and 7%, respectively.