The Policy Department (General Department of Politics, Ministry of National Defense) is organizing a consultation on the draft Circular of the Minister of National Defense guiding the implementation of policies and regimes for officers, professional soldiers, defense workers and civil servants, and those working in secret service who receive salaries as for soldiers (collectively referred to as subjects in the army) in implementing the arrangement and streamlining of the organizational apparatus in the Army according to Decree No. 178/2024/ND-CP dated December 31, 2024 of the Government.

Article 7 of the draft circular states the calculation of the severance pay policy for defense workers and civil servants, and those working in secret service who receive salaries as for soldiers.

Accordingly, in case of aging 2 years or more compared to the highest age limit as instructed in Clause 5, Article 4 of this Circular and not eligible for early retirement benefits as prescribed in Article 7 of Decree No. 178/2024/ND-CP and instructions in Article 5 of this Circular; if the competent authority decides to retire, they will enjoy the policy prescribed in Article 10 of Decree No. 178/2024/ND-CP;

In particular, the severance allowance regime for the number of months of work with compulsory social insurance (SI) contributions and the one-time allowance regime for the number of years of work with compulsory social insurance contributions are guided for implementation, as follows:

Regarding how to calculate allowances:

a) severance allowance for the number of months of work with compulsory social insurance contributions shall be implemented according to the instructions in Point a, Clause 1, Article 6 of this Circular.

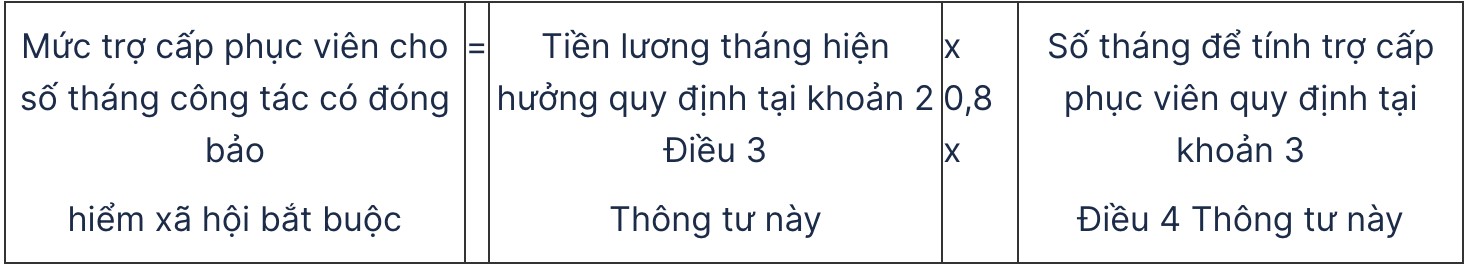

How to calculate benefits if you quit your job in the first 12 months:

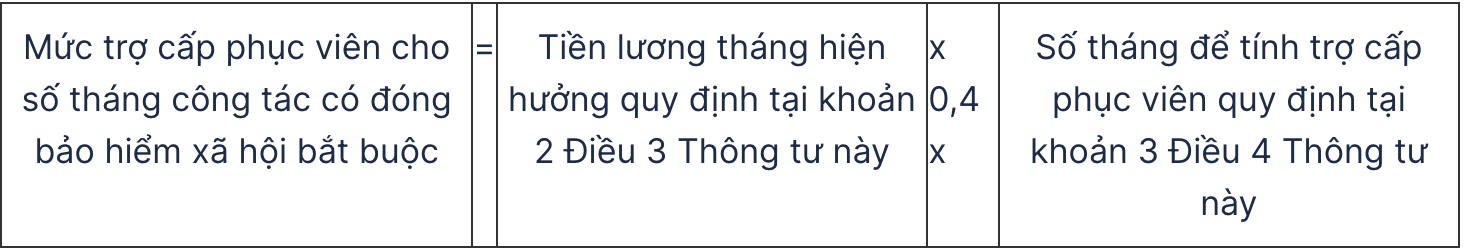

How to calculate the allowance if you quit your job from 13 months onwards:

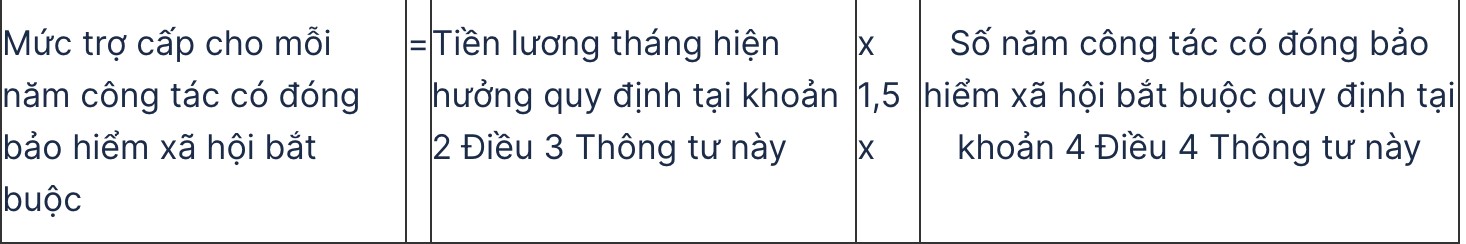

b) One-time allowance for the number of years of work with compulsory social insurance contributions shall be implemented according to the instructions in Point b, Clause 1, Article 6 of this Circular:

The draft circular gives a hypothetical example, Ms. Ngo Thi Thu Tra; born in September 1996; was recruited as a defense official in September 2016; working at the Provincial Military Command.

In June 2025, Ms. Tra's unit merged with another unit. According to regulations, Ms. Tra is not eligible for early retirement benefits as prescribed in Article 7 of Decree No. 178/2024/ND-CP and instructed in Article 5 of this Circular.

In December 2025, Ms. Tra was decided to resign by the competent authority (as of the time of resignation in December 2025, Ms. Tra has served in the Army for 9 years and 4 months, and has paid compulsory social insurance) and is eligible for resignation within the first 12 months from the effective date of the merger decision of the competent authority.

Suppose the current month's salary before the date of resignation (November 2025) of Ms. Tra is 12,000,000 VND; in addition to being able to reserve the time of social insurance payment or receiving one-time social insurance according to the provisions of law, Ms. Tra is entitled to the following regimes:

The severance allowance for the number of months of work with compulsory social insurance contributions is: VND 12,000,000 x 0.8 months x 60 months = VND 576,000,000.

One-time allowance for the number of years of work with compulsory social insurance contributions is: VND 12,000,000 x 1.5 months x 9.5 years = VND 171,000,000.

Thus, the total amount of severance pay that Ms. Tra received was: 747,000,000 VND.

Clause 2, Article 7 of the draft circular states that cases that have received severance pay as prescribed in Article 10 of Decree No. 178/2024/ND-CP and instructions in Clause 1 of this Article will not be entitled to the severance pay regime prescribed in Decree No. 19/2022/ND-CP dated February 22, 2022 and Decree No. 32/2013/ND-CP dated April 16, 2013 of the Government.