According to actual records, preferential home loan interest rates at many banks have increased by 1-2%/year compared to previous months. Specifically, ACB Bank 8%/year; ABBank 9.65%/year; Sacombank 7.49%/year; VIB from 7.8%/year; BVBank 8.49%/year...

On the other hand, floating interest rates for home loans have increased to 12-15%/year, creating pressure on buyers. Monthly repayment costs increase, affecting personal financial payment and balance.

Ms. Thanh Huyen (HCMC) said she has a loan of about 2 billion VND to buy an apartment. Recently, she has received a preferential loan with an interest rate of 6%/year. However, by May 2026, the bank will apply floating interest rates, which makes her worried.

In response to the actual needs of customers, many investors have proactively deployed financial accompanying packages to solve the worry of high home loan interest rates.

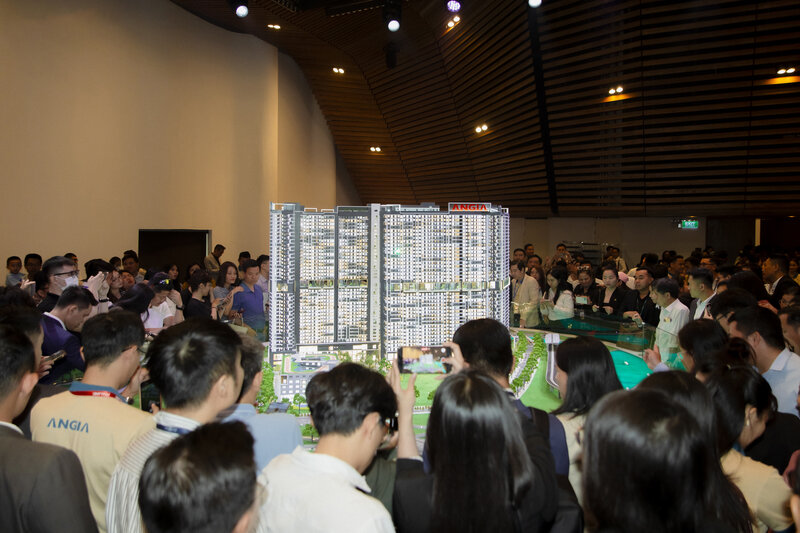

Recently, investor An Gia (AGG) announced a policy to support 100% interest rates for buyers of apartments at The Gio Riverside (HCMC).

Accordingly, customers only need to pay 21% of the apartment value according to progress, equivalent to about 600 million VND for a 65m2 apartment. For the remaining amount, the bank supports loans, the investor supports the entire interest rate for 36 months, including 24 months before handover and 12 months after receiving the house.

In addition to the 36-month interest support package, An Gia also applies a principal grace period of up to 60 months for buyers of The Gio Riverside apartments.

The policy allows customers to not have to pay the principal for 5 years and maintain flexibility in financial planning. In the first 2 years of project construction, customers were almost not under financial pressure. Entering the third year of the apartment being handed over and put into operation, the revenue from the rental can become a source of income to cover interest expenses for the following years. This helps balance cash flow, reducing the financial burden often seen in the early stages of home ownership.

By the end of the 5th year, when the grace period policy ends, customers have had enough time to stabilize their income, accumulate finances and benefit from increased real estate prices.

In particular, for many young families who want to own a luxury apartment but have not accumulated enough capital, policies create conditions for them to settle down soon, while still ensuring the quality of life, instead of having to wait many more years to accumulate enough.

According to analysts, the combination of a policy to support 100% interest rates for 36 months and a 60-month principal grace period creates a "golden time period" for both home buyers and investors to optimize capital efficiency. Real buyers can settle down soon without financial pressure, while investors have more time to take advantage of rental cash flow and anticipate the growth cycle.

Readers visit https://www.thegio.vn/ to find out project information.