Proactively increase the risk "buffer

The most notable highlight in Eximbank's financial picture in 2025 is the strong increase in risk provisioning of 1,526 billion VND, an increase of 57.5% compared to the previous year. This is a proactive and cautious decision to strengthen the financial buffer, helping the bank improve its resilience to unpredictable market fluctuations.

The increase in provisioning costs inevitably leads to a pre-tax profit in 2025 of more than 1,511 billion VND, not reaching the initial plan expected at the beginning of the year. However, this "downturn" is part of strategic calculations. Eximbank accepts sacrificing short-term benefits in exchange for safety, transparency and creating favorable room to improve asset quality in the following stages.

Positive signals from core indicators

Although profits were affected by provisioning and investment costs, Eximbank's core business activities still maintained a stable pace. The consolidated financial statements for the fourth quarter showed that the bank's net interest income increased by 11.4% to 1,690.8 billion VND compared to the same period. In the quarter, Eximbank recorded a slight decrease in service activities, however, foreign exchange business activities still brought in 115.5 billion VND, and profits from other activities reached 151.8 billion VND.

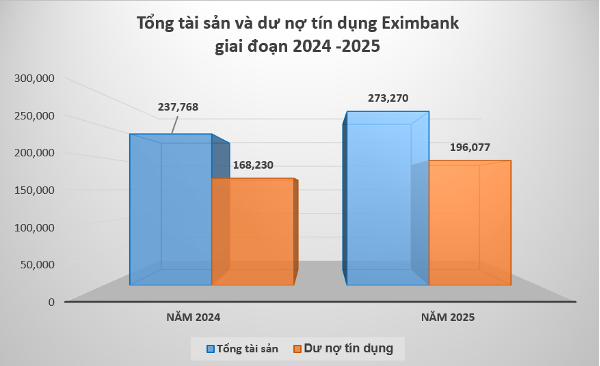

Summarizing 2025, Eximbank's net interest income reached VND 5,979.6 billion, a slight increase of 0.95% compared to the previous year. The bank's total pre-tax profit in 2025 reached VND 1,511.7 billion, only reaching 29.12% of the year plan. However, total assets, capital mobilization and outstanding credit all recorded double-digit growth. In particular, operating safety indicators such as bad debt ratio, capital adequacy ratio (CAR) and liquidity ratio (LDR) are always tightly controlled, within a safer threshold compared to the regulations of the State Bank.

As of December 31, 2025, Eximbank's total assets reached 273,270 billion VND, an increase of 13.97% compared to the beginning of the year. Mobilized capital reached 242,669 billion VND, an increase of 15.52% compared to the beginning of the year. Credit balance reached 196,077 billion VND, an increase of 16.55% compared to the beginning of the year. The bad debt ratio is controlled at below 3%. The simultaneous growth of total assets, mobilized and credit shows Eximbank's increasingly clear role in leading capital for the economy, accompanying businesses and people in the new recovery and growth cycle of the economy.

Restructuring and transformation: Investing for the future

Currently, Eximbank is focusing its efforts on restructuring and comprehensive system transformation. Operating expenses in the year increased sharply mainly because the bank focused on investing in: High-quality human resources; Deploying key projects in technology and operation to improve long-term competitiveness; Strengthening the governance platform according to international standards.

These self-efforts have helped Eximbank to be upgraded by S&P Global Ratings to BB- with a "stable" outlook in 2025. This is the most objective proof of the bank's right direction in recent times.

Closing 2025, Eximbank has completed internal strengthening. The financial and operational foundations built in this period are the launching pad for the bank to enter 2026 with a new mindset. With the goal of achieving a safe balance sheet and a more modern management system, Eximbank expects to make a strong breakthrough, unleashing internal strength to create long-term and sustainable values for shareholders as well as customers.