Also on the occasion of its 32nd birthday, the bank launched thousands of attractive incentive programs to thank customers.

VPBank and its emotional marketing strategy

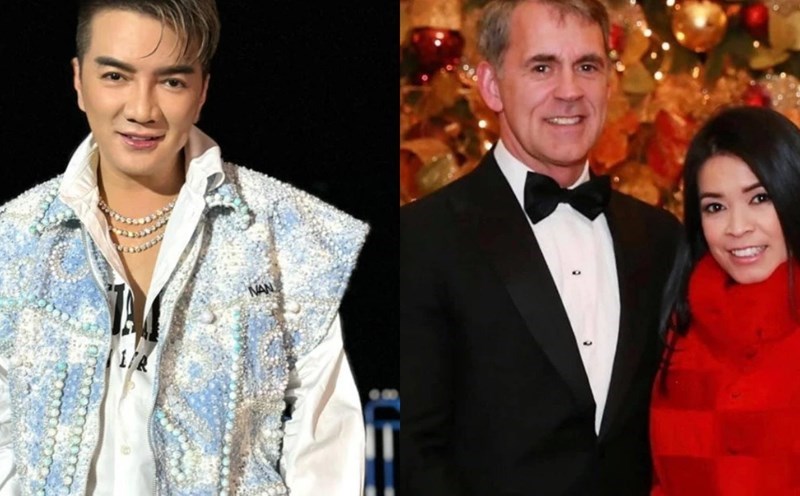

Welcoming the 32nd anniversary of its founding (August 12, 1993 - August 12, 2025), Vietnam Prosperity Joint Stock Commercial Bank (VPBank) created an "earthquake" in the financial market with a large-scale music festival gathering a group of famous K-pop superstars, including G-Dragon - the king of K-pop, which many fans in Vietnam are waiting for.

The moment more than 40,000 enthusiastic audiences in the rain at My Dinh were strongly spread became a statement for the VPBank brand. This is a comprehensive communication strategy, effectively using the power of digital platforms, fandom culture and community emotions to reach target customers especially Millennials and Gen Z.

The music festival gives existing customers more experience, further strengthens their affection, trust and attachment to VPBank. Meanwhile, a group of young customers approaching VPBank as a bridge connecting with their idols, realizing similarities in style and lifestyle, gradually transformed from initial acquaintances to feelings of trust, deciding to stay with VPBank for a long time.

VPBank's choice of G-Dragon is not simply a promotional campaign, but a strategic step to reposition the image of a young, modern and globalized bank. G-Dragon represents creativity, breakthrough and personality - the values VPBank is pursuing in the digital transformation journey and expanding the young customer segment. It is the diversity in the forms of approach that has helped VPBank create a vibrant, connected and sustainable brand ecosystem.

Sector-covered strategy - personalization to make a difference

VPBank has long chosen to develop according to the "sector coverage" strategy with the orientation of personalization, difference and sustainability. For the young customer group, VPBank has Prime; for the mid-range - upper-end group, VPBank has Diamond and Diamond Elite and the super VIP group, VPBank has Private. This is not only an effective approach but also an affirmation of the brand vision: Taking customers as the center, creating long-term value.

In addition to building its own tailored finance products, VPBank also focuses on improving service quality and bringing maximum satisfaction to customers. On the occasion of its 32nd birthday, VPBank opened another Flagship branch in Hanoi, marking a new step forward in the journey of comprehensive digital transformation and improving customer experience.

In particular, VPBank also officially expanded and developed the business household customer segment under the name CommCredit after more than 10 years of taking care of this group of customers through a separate channel.

The brand development strategy for each segment helps VPBank not only expand market share but also build deep, long-term relationships with each customer group. Each segment is a separate journey and VPBank chooses to accompany, understand and create value.

Happy 32nd birthday, thousands of deals in hand

celebrating birthdays is also an occasion for VPBank to thank millions of customers who have been accompanying it for the past 32 years. Known as one of the leading banks in credit card issuance in Vietnam in both the number of issuing cards and spending sales, in 2025, VPBank will build a card ecosystem revolving around 3 main spending pillars including Shopping (Smart Shopping) - Travel (Experimental Tourism) - Wellbeing (Self Care and Development).

The bank designs card lines as tailored versions, suitable for each need, each lifestyle, gradually completing a comprehensive promotion map, helping customers not only make convenient payments but also fully enjoy a modern, dynamic and valuable life.

Celebrating her 32nd birthday, VPBank has launched countless attractive incentives exclusively for card products. VPBank immediately gave iPhone 16 to the first 10 customers with a total VPBank Mastercard credit card expenditure on August 15, reaching 50 million VND.

From now until December 31, 2025, customers will receive a discount of up to 50% or a refund of up to VND 1,500,000 when using VPBank's credit card to pay for culinary services, e-commerce, electronics, travel... a refund of up to 50% at Shopeefood, Be, Grab...

Customers who open a new credit card and spend 3 million VND in the first 30 days of opening the card will receive Evoucher Urbox up to 700,000 VND. Customers who open a new VPBank YoJo Visa platinum credit card and spend 2 million VND in the first 30 days of opening the card will be given 5,500 Skypoint points.

In addition, VPBank also built a special program, lowering the maintenance threshold to only 0 VND for customers participating in Super Profit on VPBank NEO. For all new customers, the system will automatically set the minimum threshold to 0. Customers who want to apply a new maintenance threshold, customized according to their needs, need to proactively activate and install it right on the VPBank Neo app. The program will be implemented in August, divided into 3 phases, each phase of 3 days from Tuesday to Friday every week from August 12 to August 28, 2025.

Not only that, VPBank offers an attractive savings interest rate incentive program for customers from now until August 21: plus an interest rate of 0.5%/year compared to the listed interest rate when depositing from 32 million VND for a flexible term of 1 month or more for customers named: Vietnam, Nam, Thinh, Vuong or born on August 12 or born in 1993; plus 0.32%/year compared to the listed interest rate with a minimum balance of 100 million VND, term of 1 month or more.

Entering the age of 32, VPBank not only marked a milestone of maturity but was ready to go further. With the spirit of continuous innovation, VPBank is committed to continuing to create outstanding financial experiences, accompanying customers on every journey of life, work and development.