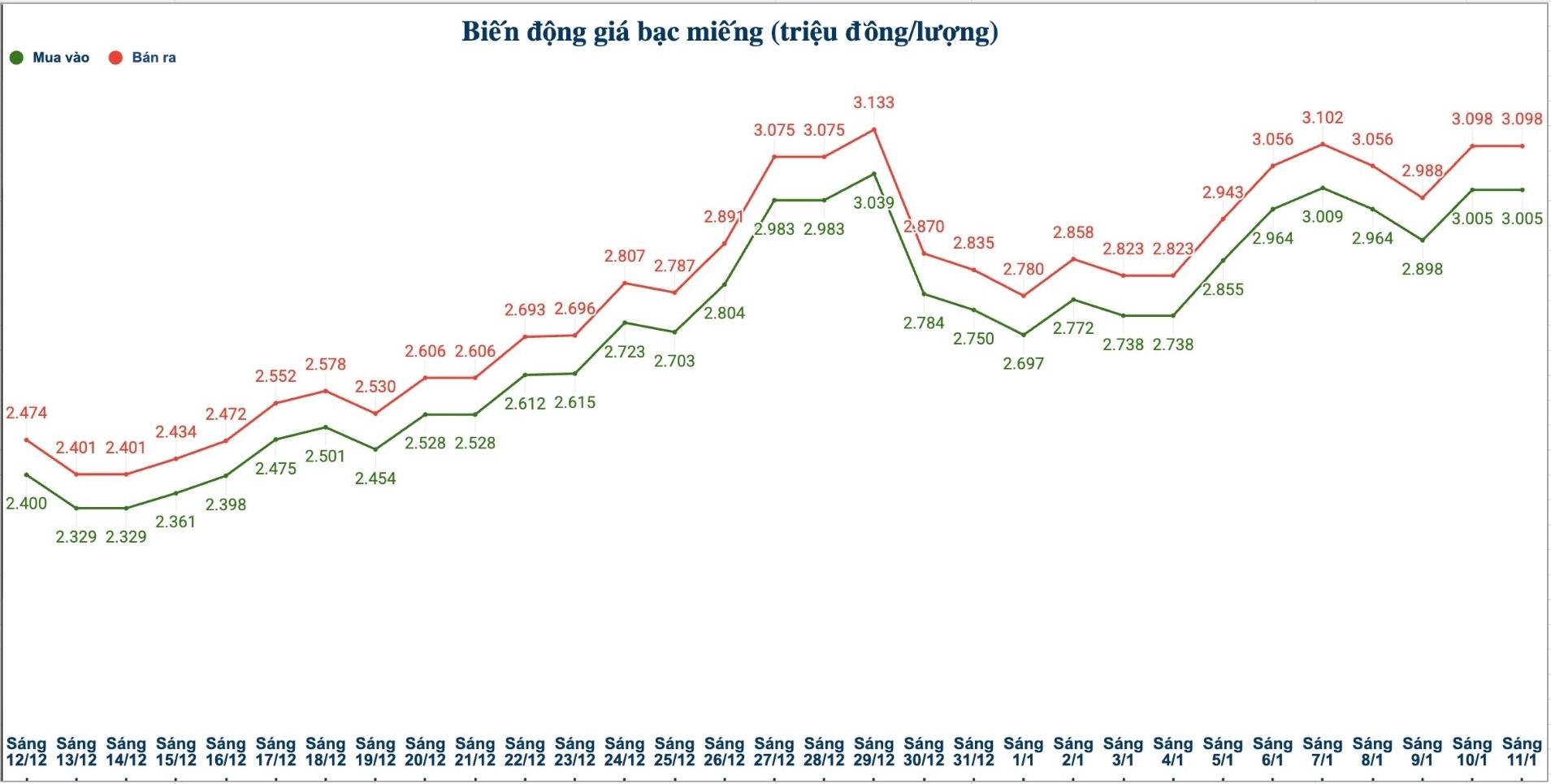

Domestic silver prices

As of 10:00 AM on January 11, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company is listed at the threshold of 3.005 - 3.079 million VND/tael (buying - selling).

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 79.196 - 81.606 million VND/kg (buying - selling).

In the previous week's trading session (morning of January 4, 2026), the price of 2025 Ancarat 999 (1kg) silver bar at Ancarat Jewelry Company was listed at 72.164 - 74.354 million VND/kg (buying - selling).

Thus, if you buy 2025 Ancarat 999 (1kg) silver bars at Ancarat Jewelry Company in the session on January 4, 2026 and sell them in the session this morning (January 11, 2026), the buyer will make a profit of 4.842 million VND/kg.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.005 - 3.098 million VND/tael (buying - selling).

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 80.133 - 82.613 million VND/kg (buying - selling).

In the previous week's trading session (morning of January 4, 2026), the price of 999 silver bars (1kg) at Phu Quy Jewelry Group was listed at 73.013 - 75.279 million VND/kg (buying - selling).

Thus, if you buy 999 silver bars (1kg) at Phu Quy Jewelry Group in the session on January 4, 2026 and sell them in the session this morning (January 11, 2026), the buyer will make a profit of 4.854 million VND/kg.

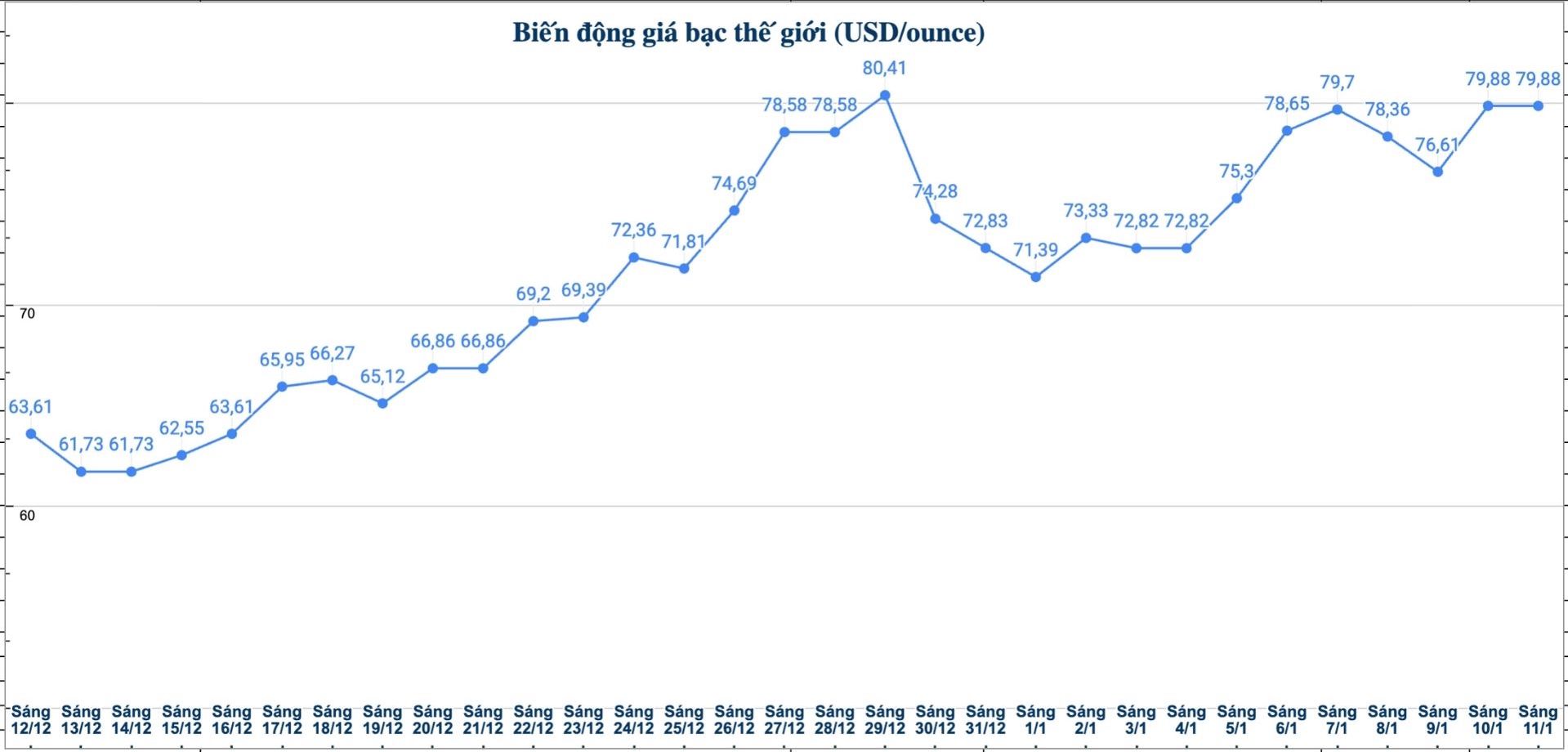

World silver prices

On the world market, as of 10:00 AM on January 11 (Vietnam time), the world silver price is listed at 79.88 USD/ounce.

Causes and forecasts

The silver market in the past week recorded positive developments, in which macroeconomic factors played a leading role in the trend. New signals from the US economy are causing investors to increase expectations for the possibility of monetary policy easing in the near future.

According to precious metal analyst James Hyerczyk at FX Empire, the latest job report shows that the number of non-farm jobs in the US in December only increased modestly, much lower than previously forecast. This development raises the notion that the US Federal Reserve (Fed) may soon adjust the rate of interest rate cuts in 2026.

The prospect of falling interest rates often puts pressure on the USD, thereby creating favorable conditions for assets valued in this currency, including silver. In addition, prolonged geopolitical instability and limited global supply of precious metals continue to strengthen the silver's shelter role in the investment portfolio" - James Hyerczyk emphasized.

From a medium and long-term perspective, this expert believes that the upward trend of silver is still maintained. "High demand while limited supply expansion is creating a supporting foundation for prices" - James Hyerczyk said.

Meanwhile, Jen Bawden - founder and CEO of Bawden Capital - said that another important factor creating a "perfect storm" for silver is the prospect of the Fed cutting interest rates next year.

According to her, when interest rates fall and the USD index falls below the 100 mark, the opportunity cost of holding silver is almost gone; in the context of the weakening USD, this metal not only increases in price but can also break through strongly.

See more news related to silver prices HERE...