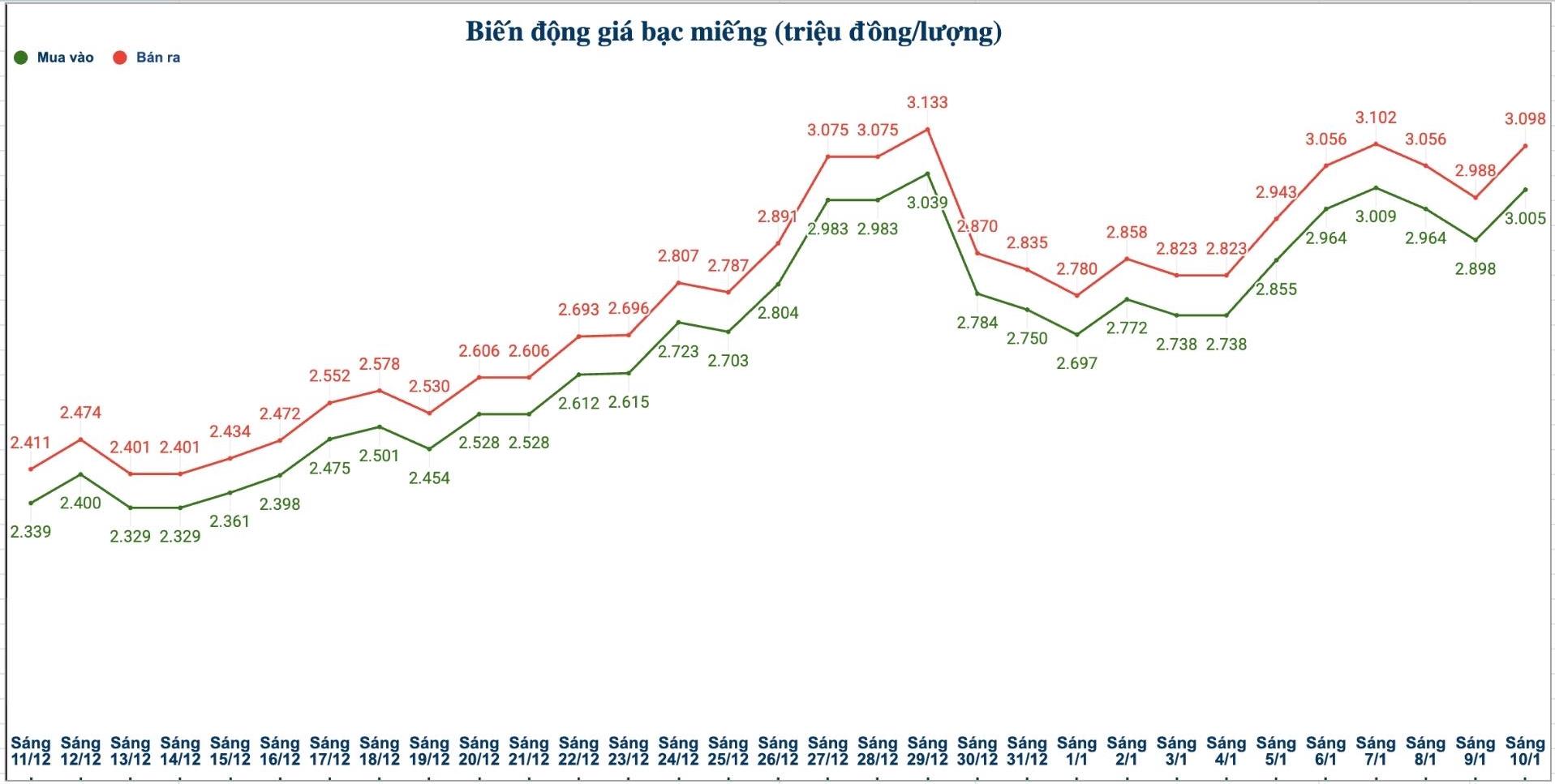

Domestic silver prices

As of 10:30 am on January 10, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) was listed at 3.042 - 3.123 million VND/tael (buying - selling); an increase of 108,000 VND/tael on the buying side and an increase of 111,000 VND/tael on the selling side compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.005 - 3.098 million VND/tael (buying - selling); an increase of 107,000 VND/tael on the buying side and an increase of 110,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 80.133 - 82.613 million VND/kg (buying - selling); an increase of 2.854 million VND/kg on the buying side and an increase of 2.934 million VND/kg on the selling side compared to yesterday morning.

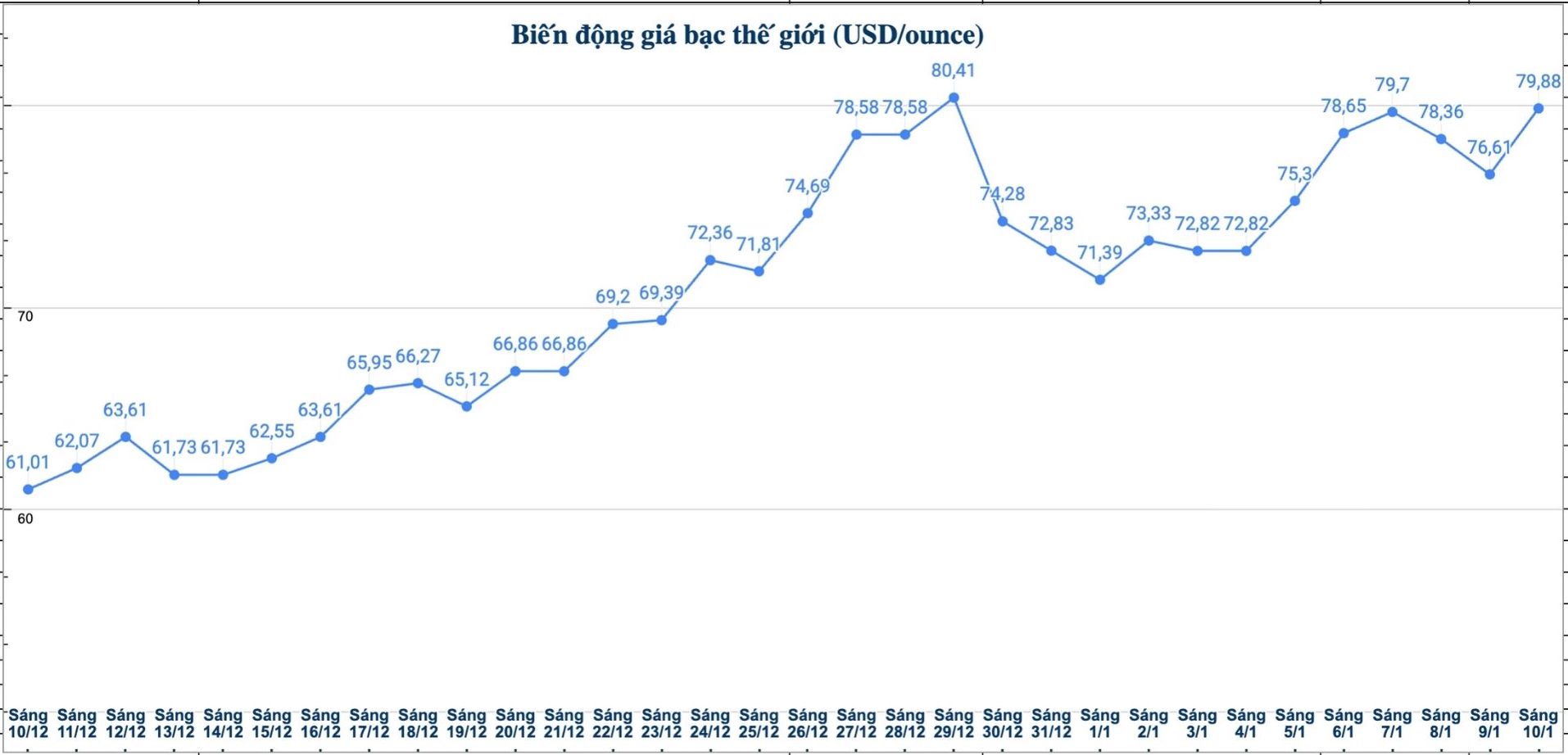

World silver prices

On the world market, as of 10:30 am on January 10 (Vietnam time), the world silver price was listed at 79.88 USD/ounce; up 3.27 USD compared to yesterday morning.

Causes and forecasts

According to precious metal analyst James Hyerczyk at FX Empire, the current increase in silver mainly comes from macroeconomic factors.

He said that newly released job data shows that the US economy only created about 50,000 non-farm jobs in December, significantly lower than market expectations. "This information increases predictions that the US Federal Reserve (Fed) may soon accelerate the interest rate cut roadmap in 2026" - James Hyerczyk said.

James Hyerczyk emphasized that expectations of reduced interest rates often put pressure on the USD, thereby supporting USD-denominated assets such as silver. At the same time, geopolitical instability and tight global supply of precious metals also make silver continue to be seen as a safe haven for cash flow.

Besides macroeconomic factors, James Hyerczyk believes that the silver market is also affected by technical factors. The Chicago Mercantile Exchange (CME)'s two-time raising of the margin for silver in the last days of 2025 has increased short-term fluctuations.

However, in the medium and long term, James Hyerczyk still assesses that the upward trend of silver prices has not been broken.

Demand is maintained at a high level while limited supply continues to be a supporting factor for this precious metal. If prices adjust to lower regions but still maintain the general trend, this may be an opportunity for long-term investors to consider participating in the market" - James Hyerczyk said.

See more news related to silver prices HERE...