Domestic silver prices

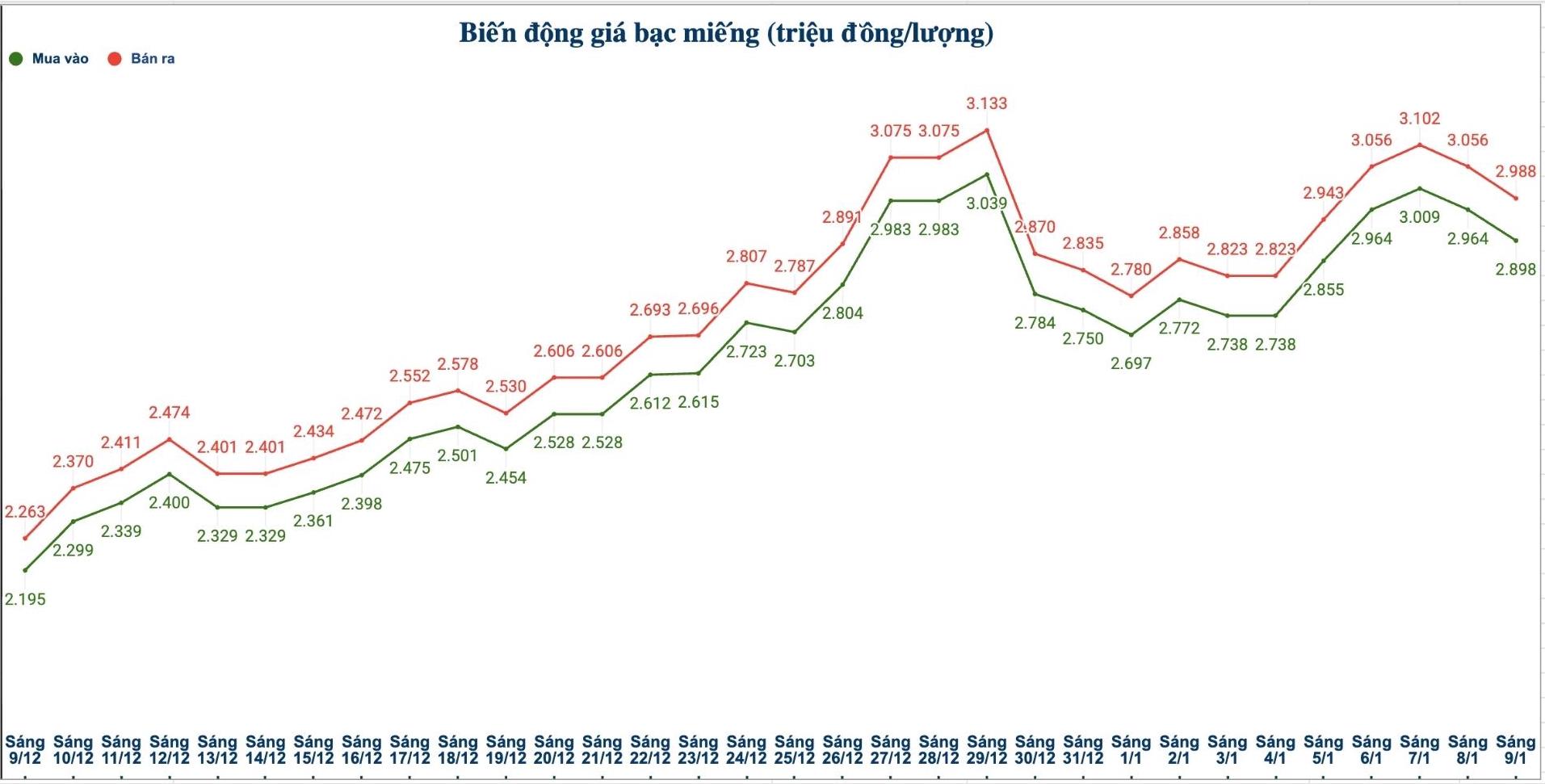

As of 10:00 AM on January 9, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 2.893 - 2.964 million VND/tael (buying - selling); down 64,000 VND/tael on the buying side and down 66,000 VND/tael on the selling side compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 76.220 - 78.540 million VND/kg (buying - selling); down 2.634 million VND/kg on the buying side and down 2.315 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) is listed at the threshold of 2.934 - 3.012 million VND/tael (buying - selling); down 132,000 VND/tael on the buying side and down 130,000 VND/tael on the selling side compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.898 - 2.988 million VND/tael (buying - selling); down 66,000 VND/tael on the buying side and down 68,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 77.279 - 79.679 million VND/kg (buying - selling); down 1.76 million VND/kg on the buying side and down 1.814 million VND/kg on the selling side compared to yesterday morning.

World silver prices

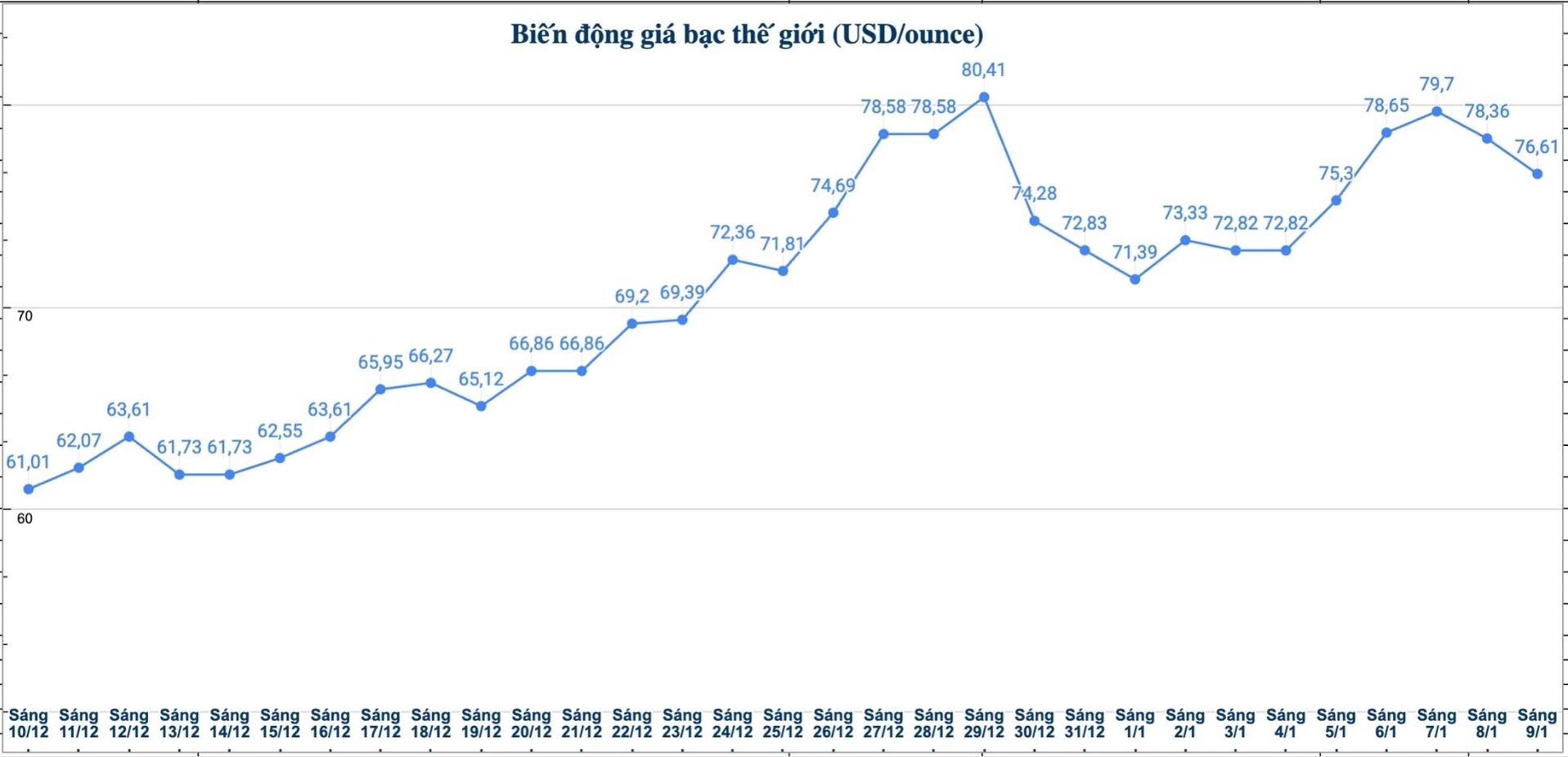

On the world market, as of 10:20 am on January 9 (Vietnam time), the world silver price was listed at 76.61 USD/ounce; down 1.74 USD compared to yesterday morning.

Causes and forecasts

Silver prices fell sharply as the market entered a more cautious phase before the US released its non-farm payroll report today (Saturday).

According to precious metals analyst Christopher Lewis at FX Empire, the fluctuation range of silver prices tends to be stable but continues to expand, reflecting investor caution when limiting strong disbursement in the face of important economic information.

Despite the downward adjustment, the silver market still attracts great interest from both institutional and individual investors. However, in the short term, many traders choose to stand aside or reduce their holdings, waiting for further clear signals from US economic data" - Christopher Lewis said.

Meanwhile, precious metal analyst James Hyerczyk at FX Empire said that in the long term, the basic factors supporting silver prices have not changed, including supply shortages and demand maintained at a high level.

However, some external factors are weakening expectations of silver prices soon conquering the 100 USD/ounce mark" - James Hyerczyk emphasized.

The expert said that the Chicago Commodity Exchange (CME)'s two-time raise in margin has contributed to pushing silver prices to a previous record high of 84.03 USD/ounce. In addition, expectations of a large-scale portfolio rebalancing of key commodity indices also supported silver prices to increase sharply, with the nearest peak being 82.77 USD/ounce in Wednesday's trading session.

James Hyerczyk added that the silver futures market is facing the risk of experiencing great selling pressure, which may create additional adjustment pressure on silver prices in the short term.

See more news related to silver prices HERE...