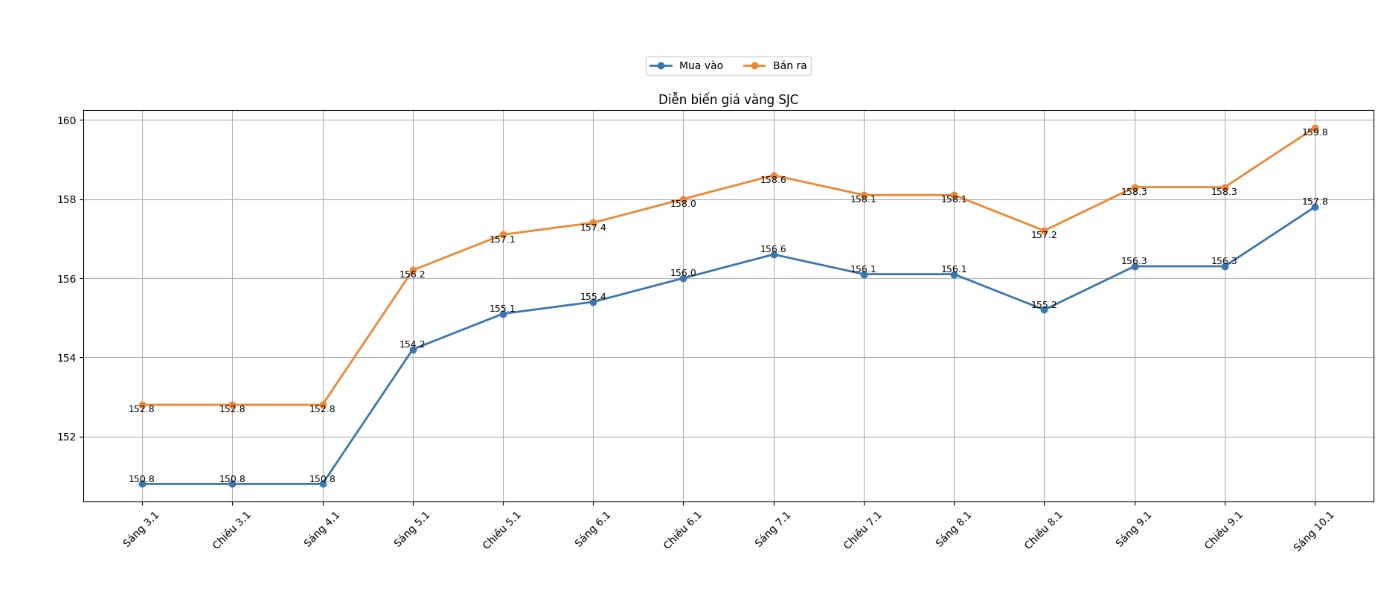

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 157.8-159.8 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 157.8-159.8 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of SJC gold bars at 157.3-159.8 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

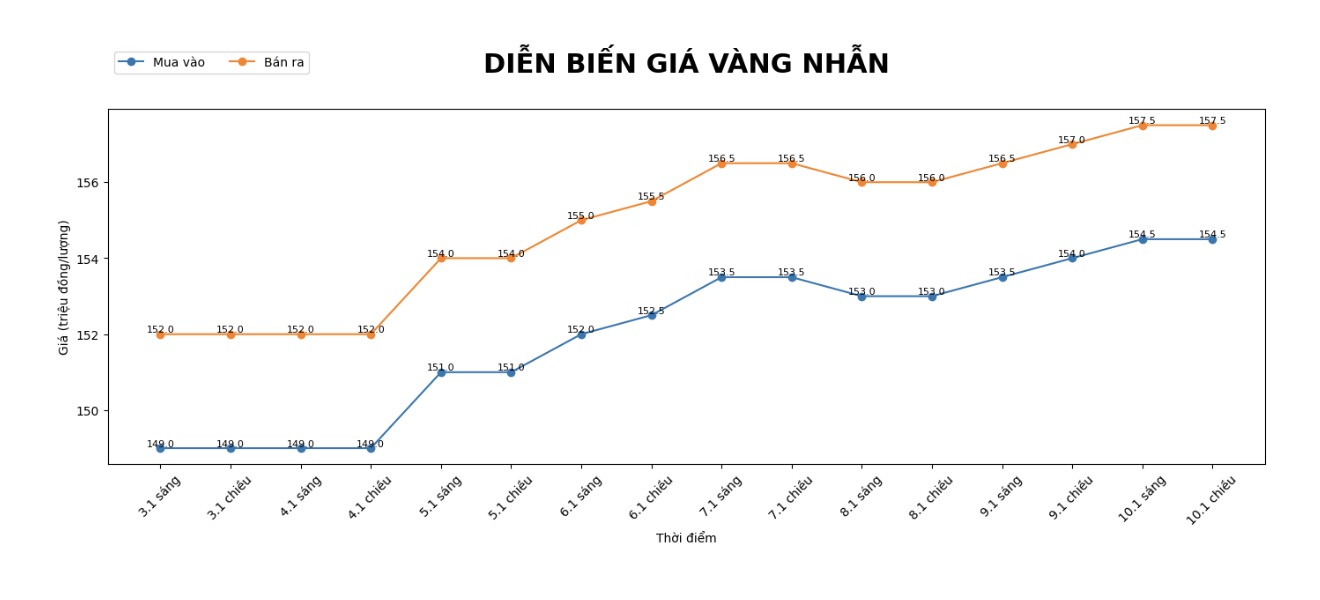

9999 gold ring price

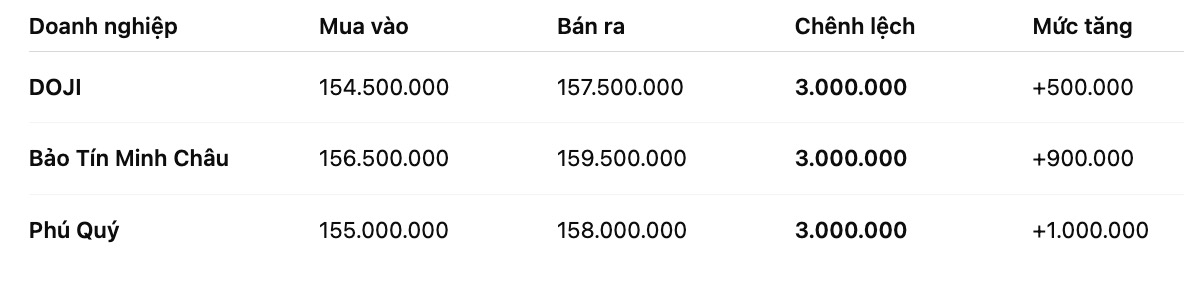

As of 6:00 AM, DOJI Group listed the price of plain gold rings at 154.5-157.5 million VND/tael (buying - selling), an increase of 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.5-159.5 million VND/tael (buying - selling), an increase of 900,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 155-158 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

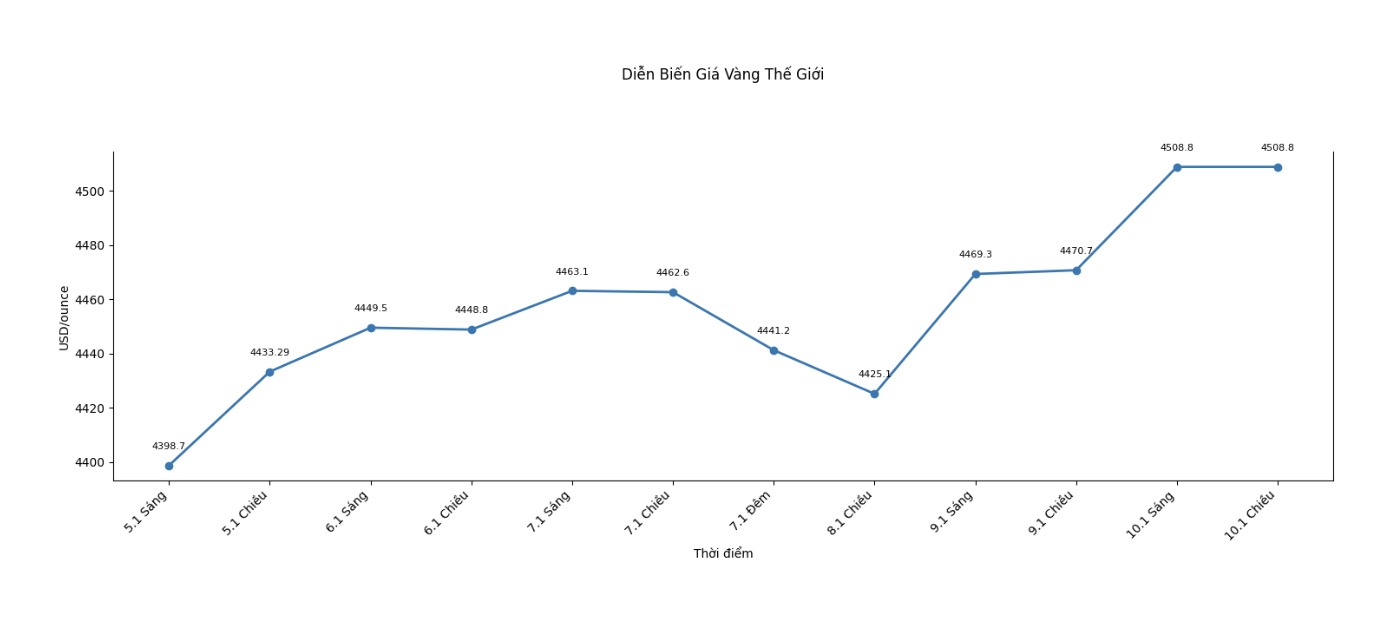

World gold price

World gold price listed at 6:00 am at 4,508.8 USD/ounce, up 19.7 USD.

Gold price forecast

The strong increase in world gold prices in recent sessions is creating a positive foundation for the short-term trend of precious metals. The fact that spot gold prices have broken through and maintained stability above the 4,500 USD/ounce range shows that safe-haven cash flow has not shown signs of retreating, especially in the context of geopolitics and global monetary policy still having many fluctuations.

According to the latest survey by Kitco, Wall Street analysts are almost in agreement on the possibility of gold prices continuing to rise next week. Up to 88% of experts surveyed predict that this precious metal will increase in price, while a small number believe that the market may adjust or go sideways. Optimistic sentiment also spread among individual investors as nearly 70% of survey participants believe that gold still has room to increase in the short term.

Mr. Adrian Day - Chairman of Adrian Day Asset Management, said that the current upward momentum of gold is not only technical but also reflects changes in monetary policy expectations. “The market is increasingly believing that the US Federal Reserve (Fed) will be forced to cut interest rates as growth and the labor market show signs of cooling down. Every time this expectation increases, gold benefits significantly,” Mr. Day said.

Sharing the same view, expert Marc Chandler from Bannockburn Global Forex believes that the price range above 4,500 USD/ounce is becoming a new level of the market. According to him, the fact that gold has not been pushed down deep after profit-taking sessions shows that buying power is still dominant. "As long as the price remains firm above the 4,450 USD/ounce mark, the short-term upward trend has not been broken," Mr. Chandler assessed.

In the overall context, fundamental factors such as geopolitical tensions, the trend of diversifying foreign exchange reserves and the possibility of the Fed soon easing policies are still supporting the scenario of gold prices remaining in the highs.

With the domestic market, the dien bien of world gold prices continues to be the dominant variable, while the large buying-selling difference requires individual investors to be more cautious when participating in the market in the short term.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...