Last weekend, US President Donald Trump issued an executive decree clarifying the exemption of tariffs on some important metals such as gold, graphite, tungsten and uranium.

However, analysts note that silver is not on this official list. This uncertainty has caused silver rental interest rates to skyrocket.

Bernard Dahdah - Precious metals analyst at Natixis, said that silver loan interest rates are currently at unusual levels, in the negative range of about 1.2%.

"Simply put, the silver borrower is willing to pay instead of receiving interest when exchanging USD for silver. Meanwhile, silver lenders are enjoying a profit of about 5.5% for a 3-month term, he said.

Dahdah said silver rental interest rates have begun to rise again, reflecting market scarcity, after the precious metal was added to the US government's list of strategic minerals last month.

He also said that with this new position, silver could be in the spotlight of President Trump, who ordered an investigation into strategic minerals in April.

Since the announcement, the Exchange for Physical (EFP, COMEX and London spot prices) gap has increased from the historical average of 25 cents to $1.1 an ounce, showing strong demand for materials from the US. This demand reduces the amount of silver that can be rented in London, thereby pushing up silver rental interest rates, he added.

According to reports, this is the fifth time this year that silver rental rates have skyrocketed. Some analysts said that this scarcity is not surprising as physical inventories at the London Gold Market Association (LBMA) are at an extremely low level.

In a recent report, commodity analysts at TD Securities predicted that cash inventories could run out within 7 months. If the demand for silver ETFs increases sharply, this reserve could even run out in 4 months.

The scarcity is also reflected in the price difference between New York silver futures contracts and London spot prices. Currently, December silver futures are trading 55 cents higher than spot prices.

Although the shortage could continue, Dahdah expects silver rental rates to cool down over the next month. The risk of silver being taxed is there, but many experts say this is unlikely to happen.

Domestic silver production only meets three-quarters of demand, and the US imports about 1,000 tons of silver per year.

The Section 232 investigation into strategic minerals is expected to be published around mid-October, and is likely to include silver (which may or may not be subject to a proposed tax) - Dahdah said. This could be the time for silver rental rates to drop sharply. An earlier public reassurance statement would have a similar effect.

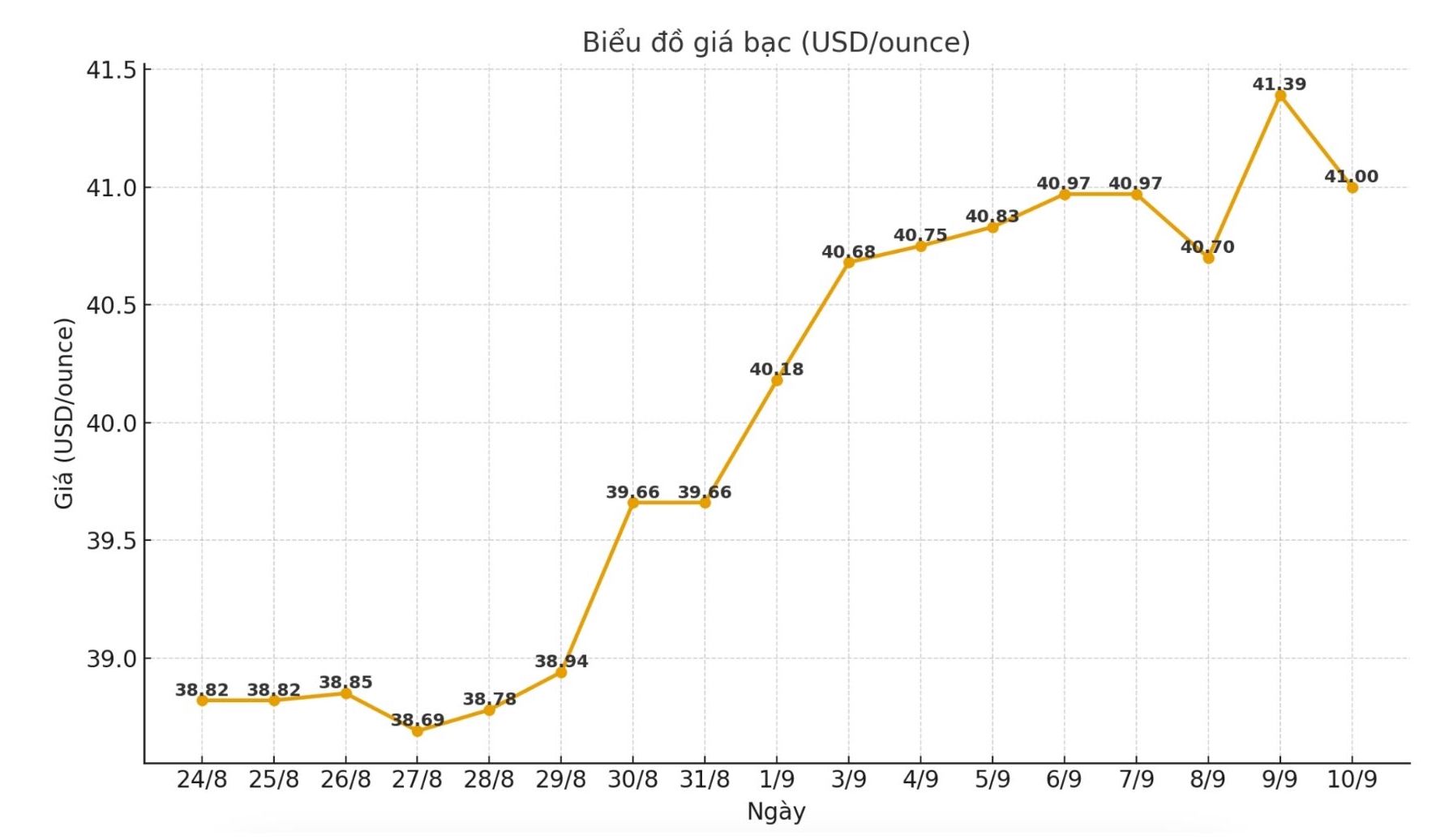

Update on domestic silver prices

As of 9:55 a.m. on September 10, the price of 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at 1.563 - 1.599 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 41.080 - 42.060 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 41.680 - 42.640 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.570 - 1.619 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 41.866 - 43.173 million VND/kg (buy - sell).