Investor demand has pushed gold prices to a record high of over $3,600/ounce, but gold is not the only precious metal that attracts market attention. Silver prices are on the rise and receive very positive forecasts.

In a report on Friday, Daniel Ghali - senior commodity strategist at TD Securities said that silver may be entering the final stage of the current cycle. The reason is that demand, especially from the strong return of investors, is causing the amount of silver reserves in the market to gradually dry up.

Ghali said the free silver in the London Gold Market Association's (LBMA) warehouse could sell out within seven months.

If investment demand increases, as we have seen in previous easing cycles, reserves could run out within four months. The global Treasury withdrawal that has lasted for many years with a restructuring deficit, combined with super trends, will continue to attract capital flows into precious metals ETFs, he said.

The Canadian bank has been bullish on silver since April 2024, noting for the first time that silver reserves at the LBMA have been tight due to strong industrial demand.

According to the silver Institute's 2025 forecast, the global silver market is expected to continue to have a supply deficit for the fifth consecutive year, with a shortage of 117.6 million ounces.

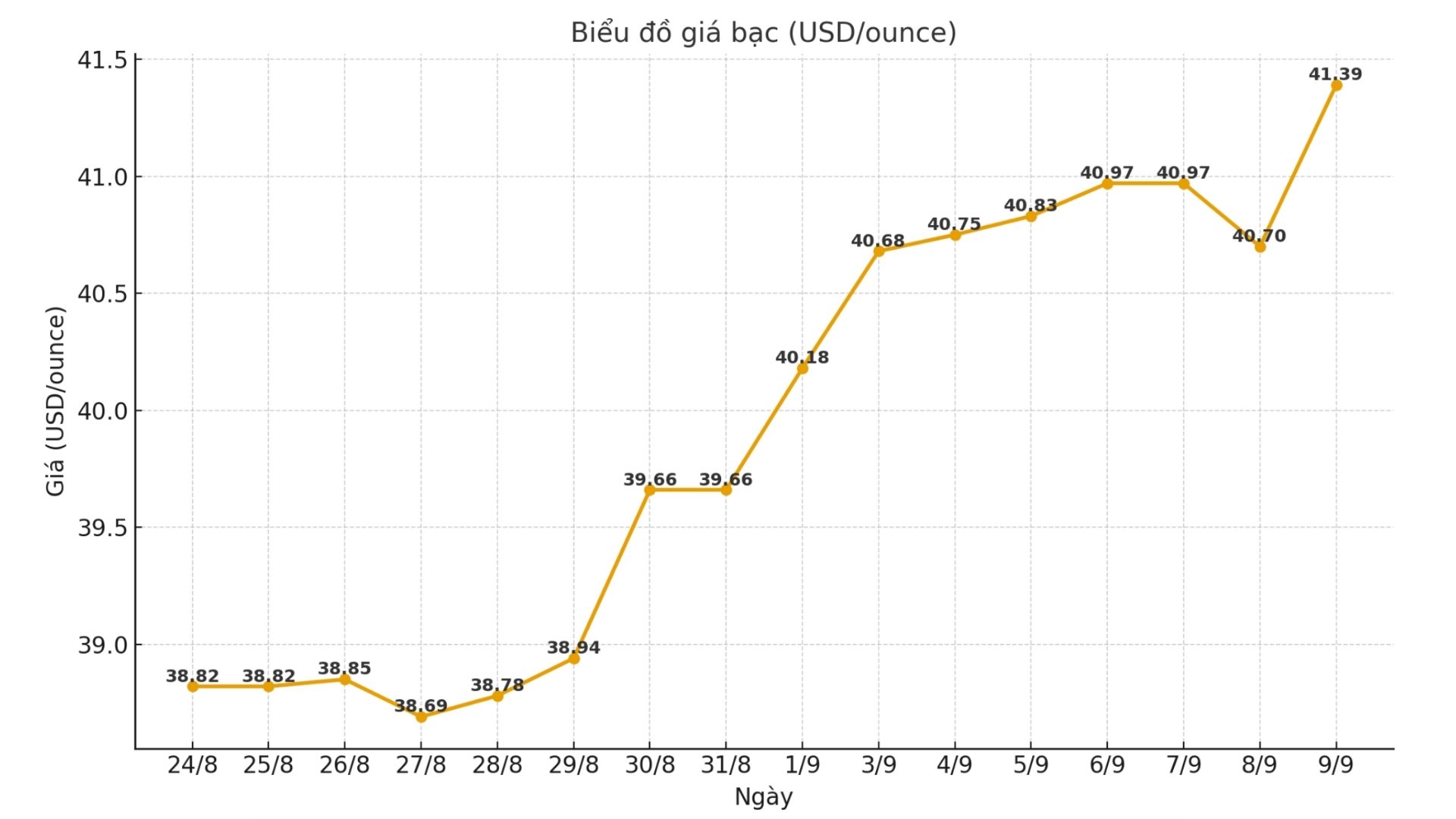

In its official forecast, TD Securities expects gold prices to average around $17.50 an ounce in the fourth quarter. However, the price is currently far exceeding the forecast. The most recent spot silver price was recorded at 41.24 USD/ounce, up 0.76% on the day, and this is also the highest level in the past 14 years. Analysts said the only remaining major resistance level was a record $50 USD.

From a historical perspective, when a hot rally like this occurs, it is difficult to predict how prices will develop. I think prices could well hit $50 an ounce in the next few months. With the current momentum, that is the direction prices are moving forward, said Ghali.

Investors' interest in silver has increased in recent weeks as the market has begun to strongly predict the possibility of the Fed loosening policy.

According to CME's FedWatch tool, the market is currently pricing in a nearly 10% chance of a 50 basis point rate cut this month - a scenario that had not been considered a week ago.

Regarding factors that can cool down silver prices, Ghali said that the market needs to re-balance supply and demand. He noted that a potential economic downturn, accompanied by higher silver prices, would be a condition for a market rebalancement.

However, he admitted that he is uncertain how that scenario will play out and that it could be a serious recession that could curb industrial demand, due to the essential role of silver in key sectors of the global economy, especially the green energy transition.

At the same time, he said that silver prices may have to be much higher to attract new supply.

Histically, if the expectation of market rebalancing comes from price factors, that price is often much higher than expected, he said.

Although TD Securities maintains a very optimistic view on silver, Ghali said that silver may find it difficult to outperform gold in the current context. He explained that gold could continue to lead as central bank demand remains the main support pillar for the precious metal.

Although silver prices have increased by 43% since the beginning of the year, gold is not far behind. The gold/ silwer ratio is still much higher than the historical average, currently trading below 88 points.

Update on domestic silver prices

As of 10:15 on September 9, the price of 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at 1.579 - 1.615 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 41.506 - 42.486 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 42.106 - 43.066 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.586 - 1.635 million VND/tael (buy - sell).

The price of 999 taels of silver (1 tael) at Phu Quy Jewelry Group was listed at 1.586 - 1.635 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 42.293 - 43.599 million VND/kg (buy - sell).