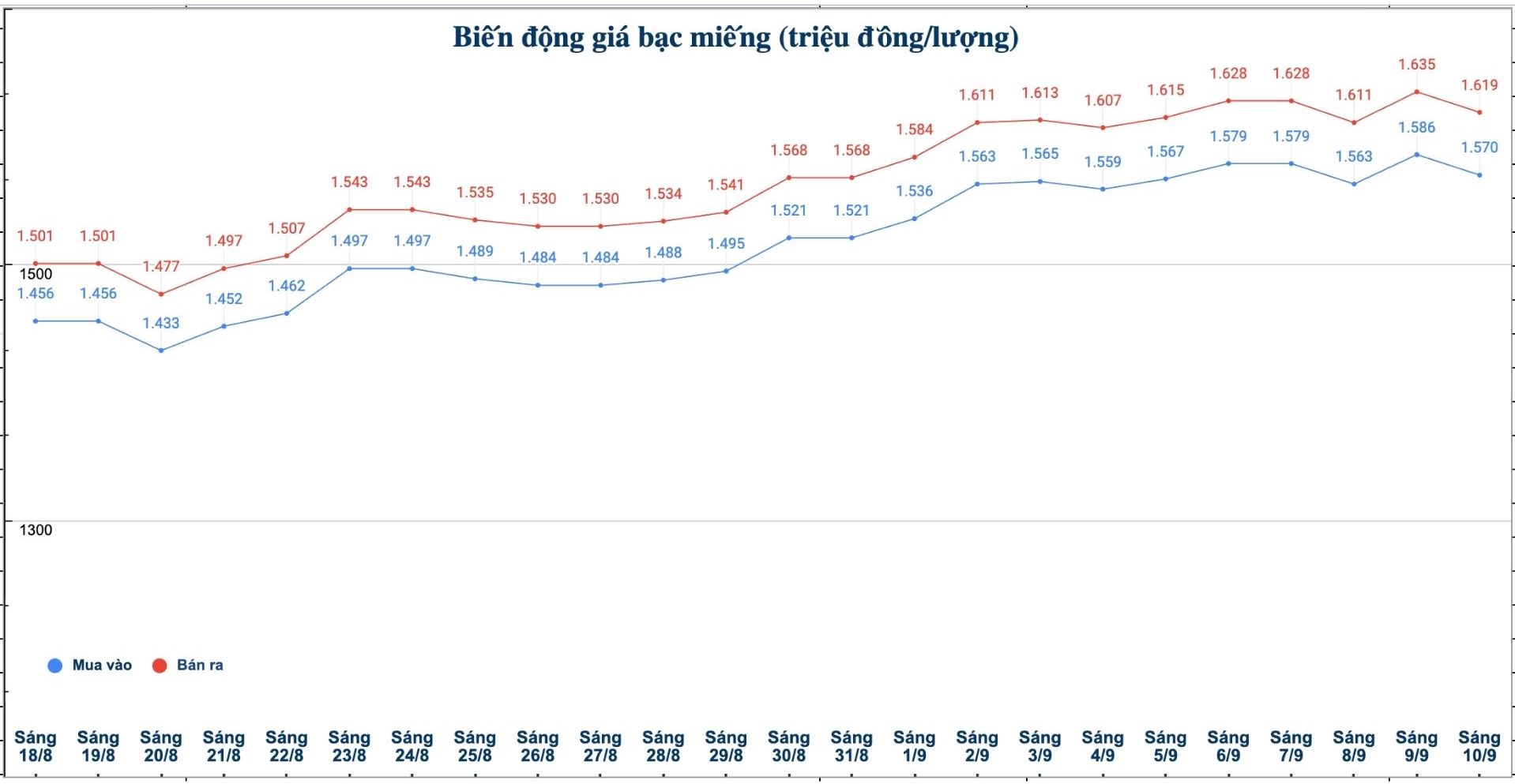

Domestic silver price

As of 9:50 a.m. on September 10, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.570 - 1.619 million VND/tael (buy - sell); down 16,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1,570 - 1.619 million VND/tael (buy - sell); down 16,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 (1kg) gold bars at Phu Quy Jewelry Group was listed at 41.866 - 43.173 million VND/kg (buy - sell); down 427,000 VND/kg for buying and down 426,000 VND/kg for selling compared to yesterday morning.

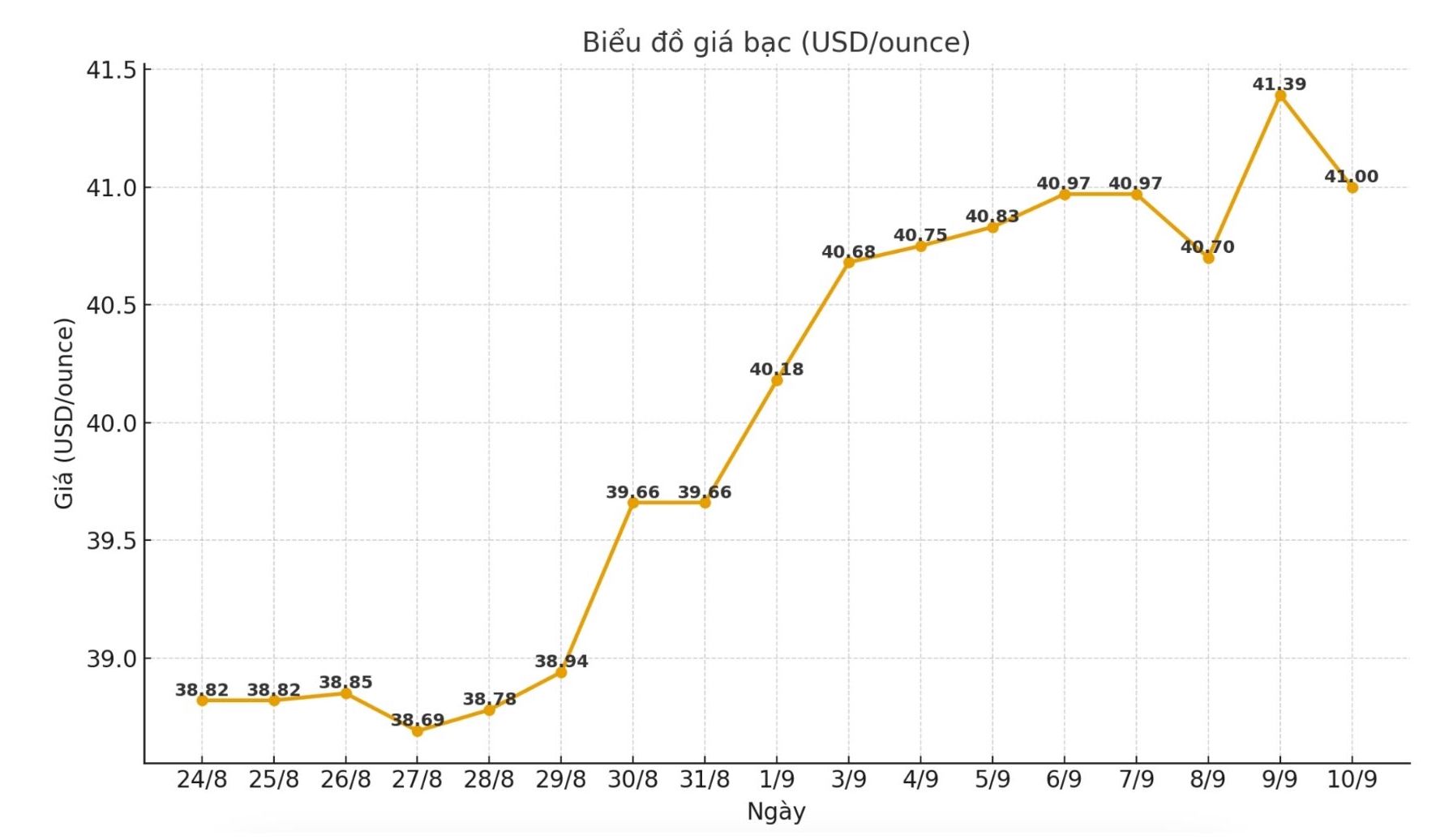

World silver price

On the world market, as of 9:50 a.m. on September 10 (Vietnam time), the world silver price was listed at 40 USD/ounce; down 1.39 USD compared to yesterday morning.

Causes and predictions

Silver prices are stagnant around the support level of 40.40 USD/ounce, while gold continues to set a new record of over 3,650 USD/ounce, pushing the gold - silver ratio above 88.2. According to analyst James Hyerczyk, this contrast reflects investor sentiment: gold broke out thanks to expectations of the US Federal Reserve (FED) cutting interest rates, while silver was held back by its dual role as both a safe-haven metal and an industrial demand.

"The strong increase in gold was driven by the US dollar and deeply declining US bond yields, along with large buying from central banks and international investors. On the contrary, silver is under pressure due to concerns about a global recession and slowing production, causing industrial demand to decrease," he said.

Technically, James Hyerczyk believes that silver is facing resistance at $41.67/ounce with a long-term target of $44.22/ounce, while the support level is close to $40.40/ounce and deeper at $29.88/ounce. If they do not break out soon, silver may continue to weaken, especially when the gold - silver ratio is heading towards around 91.7.

"The outlook for silver is still quite narrow and vulnerable. Only when we can surpass the 41.67 USD/ounce mark can we change the situation, otherwise the downtrend is still dominant" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...