Domestic silver price

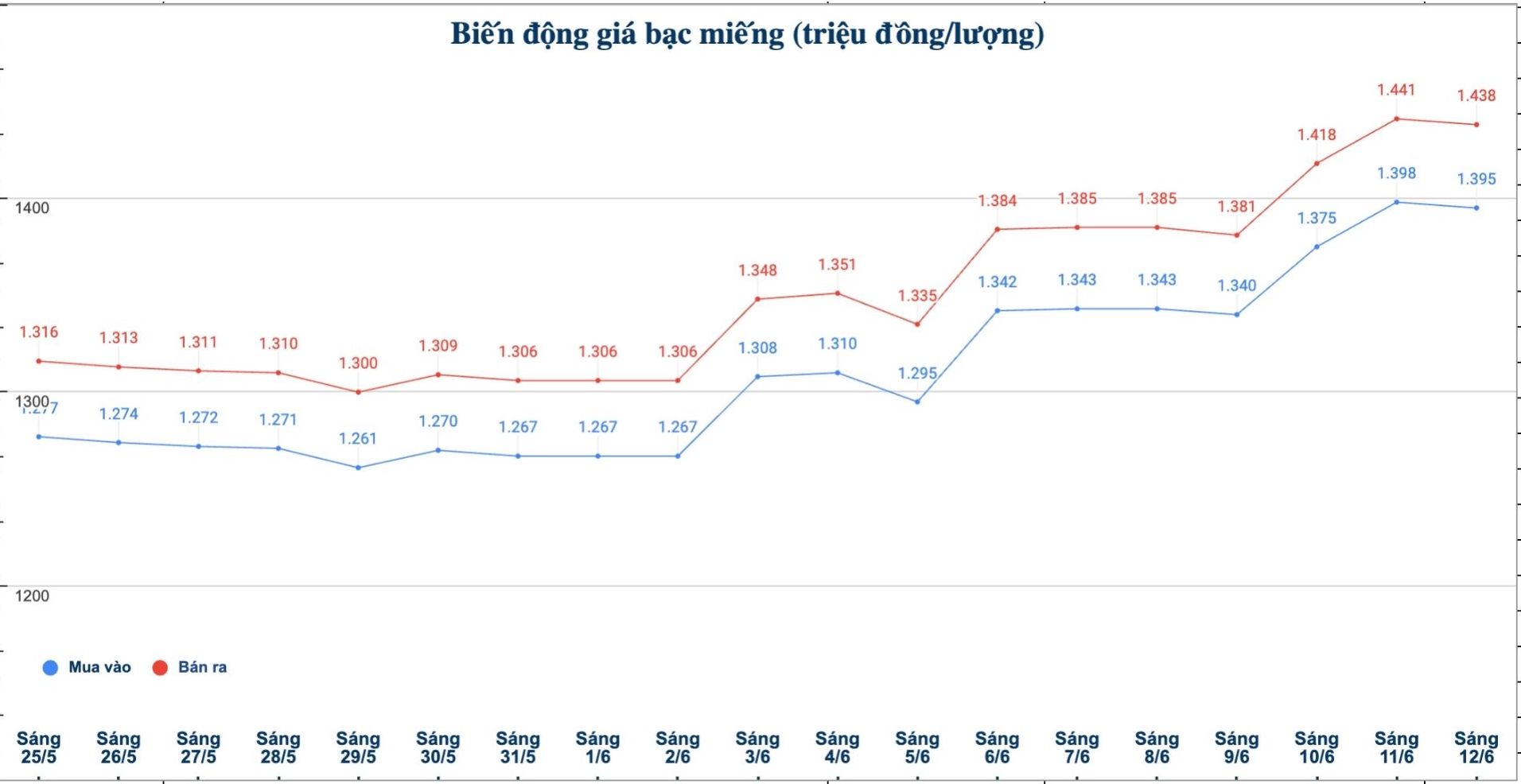

As of 9:15 a.m. on June 12, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.395 - 1.438 million VND/tael (buy - sell); down 3,000 VND/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.395 - 1.438 million VND/tael (buy - sell); down 3,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37,199 - 38.346 million VND/kg (buy - sell); down 80,000 VND/kg in both directions of buying and selling compared to early this morning.

World silver price

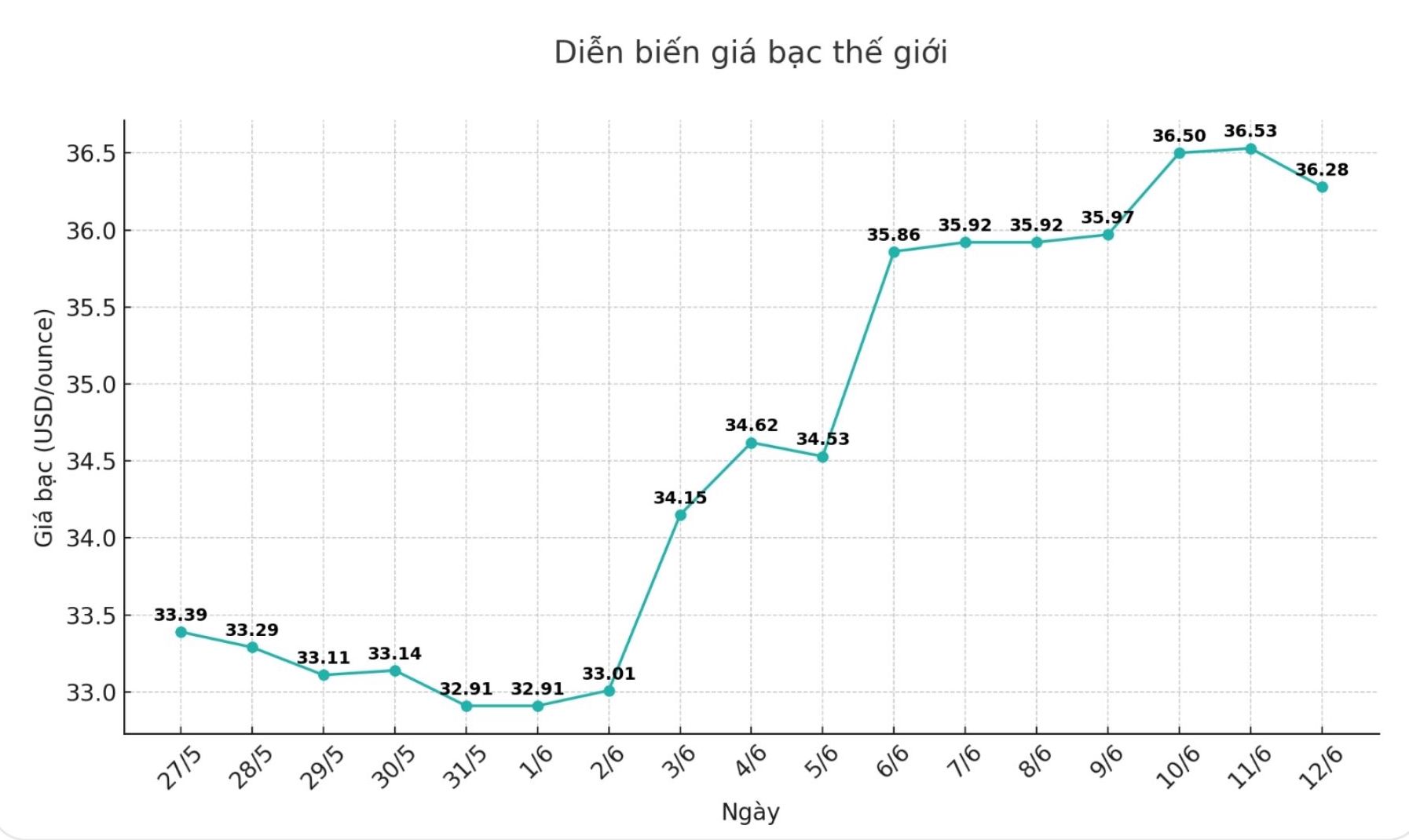

On the world market, as of 9:15 a.m. on June 12 (Vietnam time), the world silver price was listed at 36.28 USD/ounce; down 0.25 USD compared to early this morning.

Causes and predictions

Silver prices fell slightly after US inflation data was lower than forecast, causing Treasury bond yields to decline and putting pressure on the USD. Although gold responded positively to this information, silver fell behind and could not maintain its recent upward momentum.

The consumer price index (CPI) increased by only 0.1% in May, lower than the forecast of 0.2%. Compared to the same period last year, the CPI remained at 2.4%. More important for the market, the core CPI - excluding food and energy - also increased by only 0.1% compared to the previous month, compared to an estimated 0.3%. The data has fueled risk-offs in the US dollar and Treasury markets.

Psychology has also been affected by new developments in US-China trade relations. Officials from the two countries said they have agreed on a framework to relieve trade tensions and lift restrictions on rare earth exports.

Developing trade has added a lenient leniency to the US dollar and added momentum to the metal, said James Hyerczyk, a market analyst. Gold has not yet reaten silver.

James Hyerczyk added that the pullback of silver appears to be more adjusted than breaking the trend. With real yields falling, the US dollar under pressure and risk appetite being controlled, silver could still increase further if it can surpass the price of 36.89 USD/ounce.

"Up to that point, traders should closely monitor silver's support level at 35.40 USD/ounce. Unsatisfactory inflation and falling yields reinforce the short-term uptrend" - James Hyerczyk assessed.

See more news related to silver prices HERE...