After many gloomy years, the silver market is reeling as prices soar above $35/ounce, hitting a 13-year high.

Jim Wyckoff - senior market strategist - commented that this price increase has been awaited by the market for a long time and is completely likely to continue. Since gold hit a new peak of $3,485.60 an ounce in April, I have viewed silver as a valuable investment opportunity. Currently, this metal is likely to enter a strong breakthrough, he said.

According to Wyckoff, silver could well head toward the $40/ounce resistance zone, with a long-term target of a historical peak of $10.36/ounce set in 1980.

Although the recent rally has been impressive, its not surprising as silver has typically fluctuated strongly, said David Morrison, an analyst at Trade Nation. The question now is whether silver will continue to increase to surpass the $50 peak set in April 2011 or not."

Experts at TD Securities also confirmed that although silver is still quite far from the historical peak, the target of 50 USD/ounce is completely feasible, not a given.

According to experts, the metal market is surpassing many important technical milestones, silver continuing to surpass the threshold of 35 USD/ounce will trigger a buying wave according to technical analysis. TD Securities has been optimistic about the outlook for silver since mid-October, as rising industrial demand has continuously exhausted supply of reserves.

TD Securities emphasized that the London silver market is gradually losing liquidity, while the amount of silver stored at the London bullion Market Association (LBMA) is continuously decreasing due to the flow of money into ETF funds and changes in storage activities.

"However, the current rally is largely driven by the futures market, while physical silver-holding ETFs have yet to participate strongly," TD Securities experts noted.

In a recent commentary, Maria Smirnova - Senior Portfolios Manager and Investment Director of Sprott Asset Management - said that the current increase in silver prices is partly due to actual purchases from China. She commented that although demand has not exploded, this breakout is still a notable signal in the market.

As long as investors buy physical silver to participate in the market, silver prices can skyrocket. Because the silver market is quite thin, just a small cash flow is enough to create big fluctuations, said Maria Smirnova.

She emphasized that although prices may fluctuate in the short term, silver is still an attractive investment channel due to increasingly scarce supply. Since 2021, about 800 million ounces of silver have been withdrawn from the market, and this shortage is expected to continue.

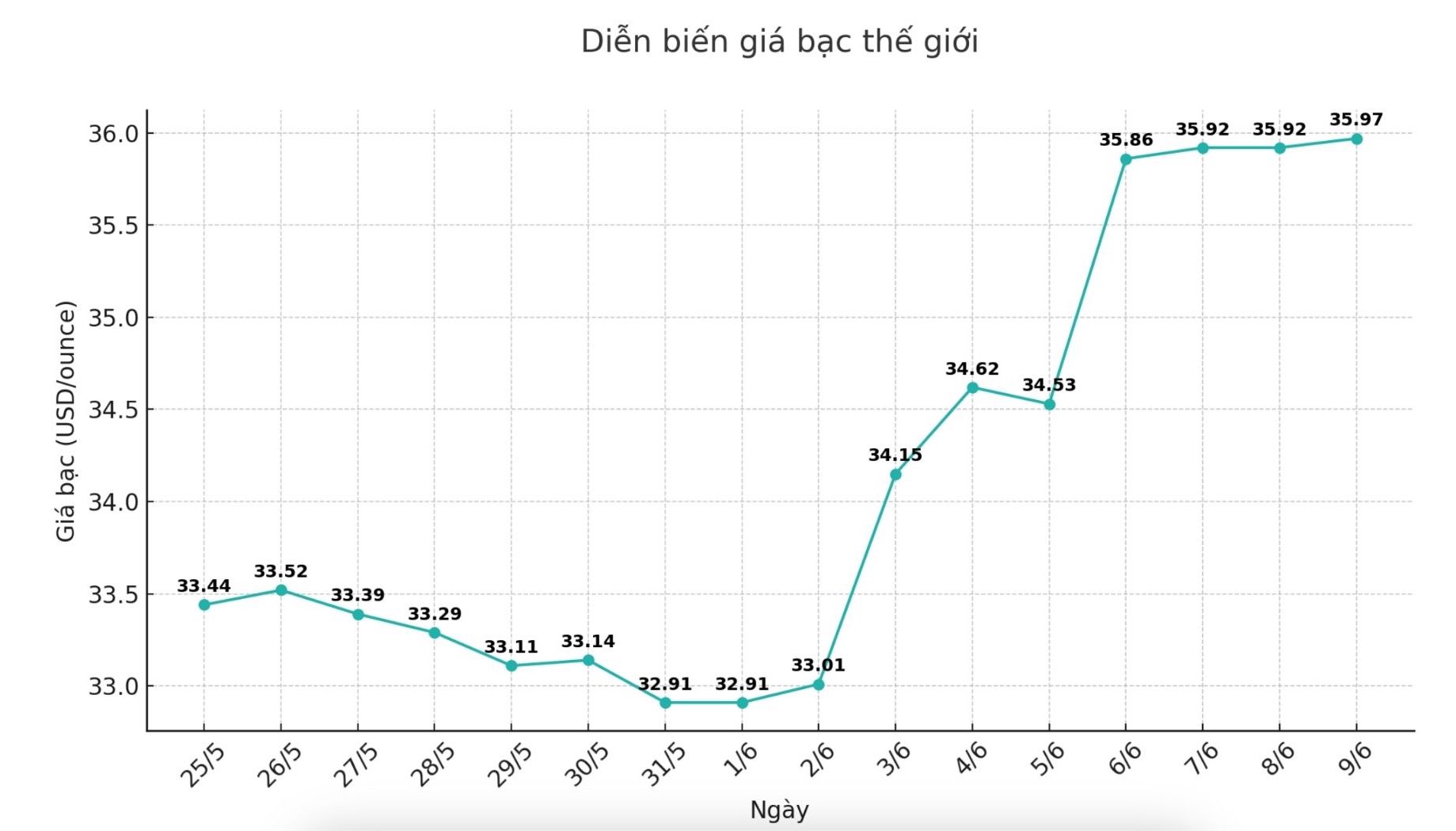

On the world market, as of 10:10 on June 9 (Vietnam time), the world silver price was listed at 35.99 USD/ounce.