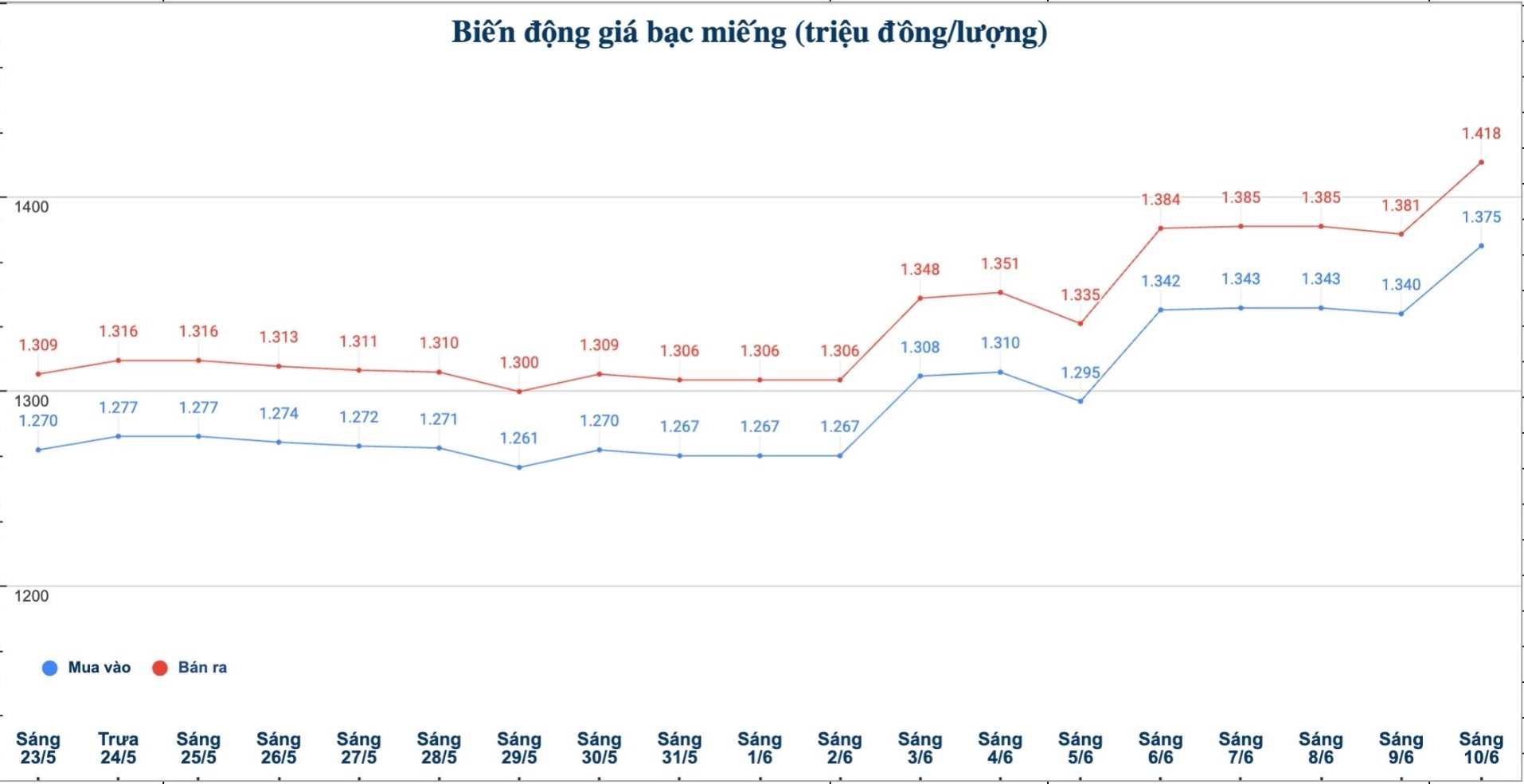

Domestic silver price

As of 10:25 a.m. on June 10, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.375 - 1.418 million VND/tael (buy - sell); an increase of 35,000 VND/tael for buying and an increase of 37,000 VND/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.375 - 1.418 million VND/tael (buy - sell); an increase of 35,000 VND/tael for buying and an increase of 37,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 36,666 - 37.813 million VND/kg (buy - sell); an increase of 933,000 VND/kg for buying and an increase of 987,000 VND/kg for selling compared to early this morning.

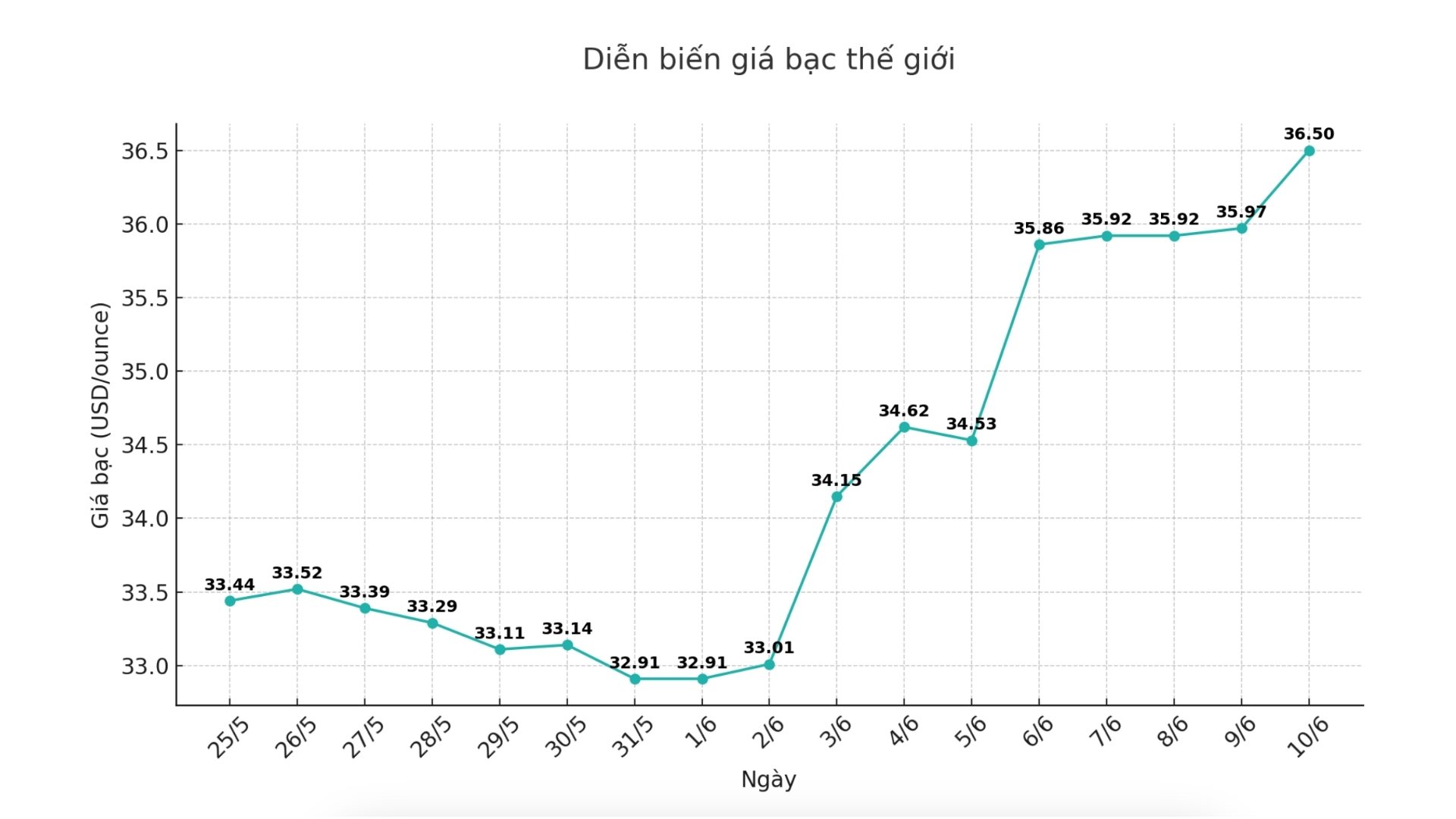

World silver price

On the world market, as of 10:30 a.m. on June 10 (Vietnam time), the world silver price was listed at 36.5 USD/ounce; up 0.53 USD compared to early this morning.

Causes and predictions

Silver prices have just surpassed $36/ounce - their highest level since 2011. According to experts at GSC Commodity Intelligence, this is considered the most explosive investment opportunity and profit difference in 2025. Prices have risen more than 30% since the start of the year, but analysts believe the rally is just getting started.

Unlike gold, which is attracting the attention of investors, silver has quietly become one of the most efficient assets in the commodity market.

Phil Carr - Head of Trading Department at GSC Commodity Intelligence - said that silver has officially entered the breakthrough phase.

The $50/ounce level may come much earlier than expected. This time, money may go far beyond that mark" - he commented.

A large part of this increase comes from the technological revolution. Artificial Intelligence (AI), clean energy and global data infrastructure are boosting demand for silver - the world's best electricity-led metal, irreplaceable in AI chips, data centers and high-tech sensors.

However, the silver supply cannot expand accordingly. In 2024, the silver market had a shortfall of 184 million ounces - the fifth consecutive year of a shortfall. More than 70% of silver is now a by-product of copper and lead mining, making it difficult to increase output. Reserves have declined and recycling has not kept up, causing increasing supply pressure.

Its becoming increasingly clear that silver supply cannot meet the current technological thirst, the report from GSC Commodity Intelligence emphasized.

Phil Carr commented that silver at $36/ounce is being seen as a notable investment time. According to him, silver is not only an asset to store value but also plays a role in the new technology ecosystem, especially AI infrastructure.

Economic data to watch this week

Wednesday: US Consumer Price Index (CPI)

Thursday: US Producer Price Index (PPI), weekly jobless claims

Friday: University of Michigan Consumer Psychology Index

See more news related to silver prices HERE...