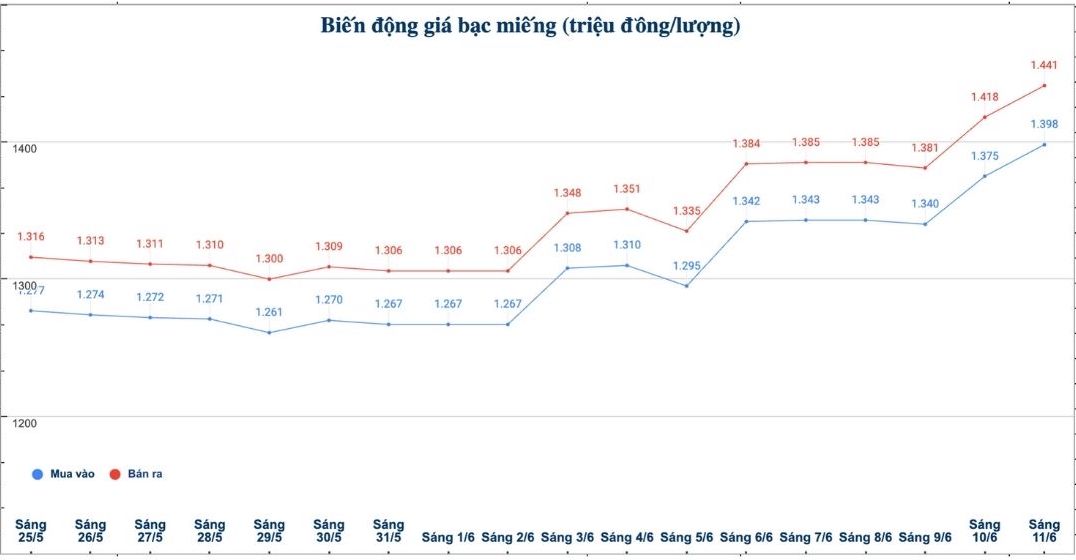

Domestic silver price

As of 9:15 a.m. on June 11, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.398 - 1.441 million VND/tael (buy - sell); an increase of 23,000 VND/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.398 - 1.441 million VND/tael (buy - sell); an increase of 23,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.279 - 38.426 million VND/kg (buy - sell); an increase of 613,000 VND/kg in both buying and selling directions compared to early this morning.

World silver price

On the world market, as of 9:15 a.m. on June 11 (Vietnam time), the world silver price was listed at 36.53 USD/ounce; up 0.03 USD compared to early this morning.

Causes and predictions

Silver prices are being supported by many factors, from industrial demand to macroeconomic instability. One of the most important factors this week is the US Consumer Price Index (CPI) report scheduled to be released today (Wednesday). The market is now expecting the US Federal Reserve (FED) to cut interest rates by about 50 basis points by the end of the year.

James Hyerczyk - market analyst - commented that if inflation is higher than expected, this could put pressure on both gold and silver. Conversely, if data is weaker, the attractiveness of the precious metal as an inflation hedge will increase.

"Currently, gold is holding technical support around $3,310/ounce, while the USD index remains stable below 99. These are positive signals that silver traders can refer to, as silver often fluctuates correlated with gold, especially during the risk period," he said.

James Hyerczyk shared that another factor that could affect the precious metals market is the ongoing trade talks between the US and China in London.

"Unlike previous rounds that only focused on tariffs, this time the two sides discussed controlling chip exports and accessing rare earths. If an important step forward is made, safe-haven demand for gold and silver could ease," he said.

James Hyerczyk added that US government bond yields are falling slightly, showing that the market expects the Fed to loosen monetary policy, thereby supporting the precious metal.

See more news related to silver prices HERE...