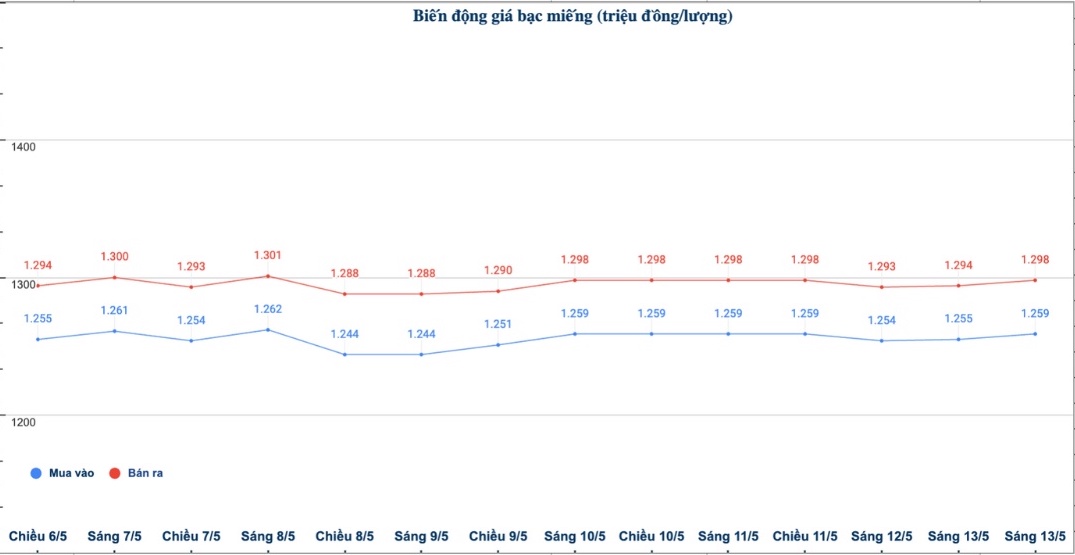

Domestic silver price

As of 9:15 a.m. on May 14, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.259 - 1.298 million VND/tael (buy - sell); an increase of 4,000 VND/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.259 - 1.298 million VND/tael (buy - sell); an increase of 4,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 (1kilo) taels of silver at Phu Quy Jewelry Group was listed at 33.573 - 34.613 million VND/kg (buy - sell); an increase of 107,000 VND/kg in both buying and selling directions compared to early this morning.

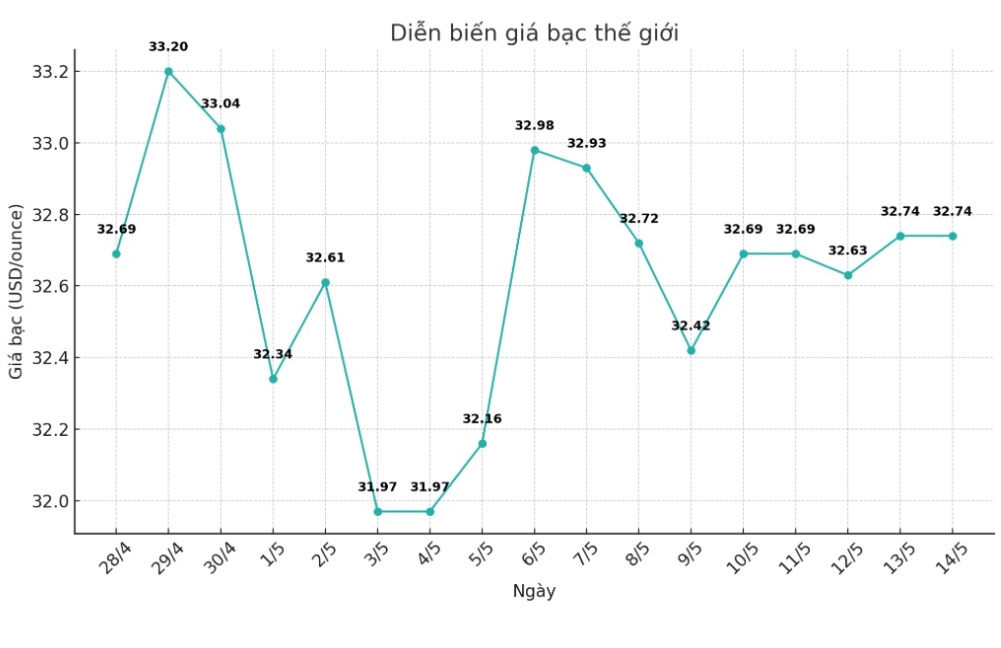

World silver price

On the world market, as of 9:20 a.m. on May 14 (Vietnam time), the world silver price listed on Goldprice.org was at 32.74 USD/ounce.

Causes and predictions

According to FX Empire, silver is gaining short-term strength thanks to a weakening USD and unchanged Treasury yields, along with a slight easing in trading for gold-esiliver prices.

However, James Hyerczyk - market analyst at FX Empire - commented: "With inflation data and signals from central banks, silver prices are still unstable".

James Hyerczyk said that the overall inflation forecast for April will increase by 0.3% compared to the previous month and 2.3% compared to the same period last year, while the CPI is forecast to increase by 0.2% and 2.8%.

"While the tariffs imposed in April could increase CPI, the impact is expected to be temporary and insignificant.

The tax exemption and pre-delivered shipments show that if there is inflationary pressure, it will likely appear at the end of this year," he said.

According to Hyerczyk, that means the April CPI may not cause major market fluctuations, unless the data is released with an unpredictable surprise.

"If the CPI is lower than expected, it could put pressure on the USD and support silver prices thanks to falling real yields. Conversely, if the CPI is higher, it will strengthen the US Federal Reserve's (FED) tough stance, push up yields and put metal prices under pressure," he analyzed.

According to the expert, the short-term outlook for silver will depend heavily on CPI data and market reaction around 32.80 USD/ounce. If prices remain above this threshold, the uptrend will be maintained with clear growth rates.

"However, traders should pay attention to the policy signals following the data - these factors will determine whether silver prices will increase higher or decrease lower" - James Hyerczyk emphasized.

See more news related to silver prices HERE...