Domestic silver price

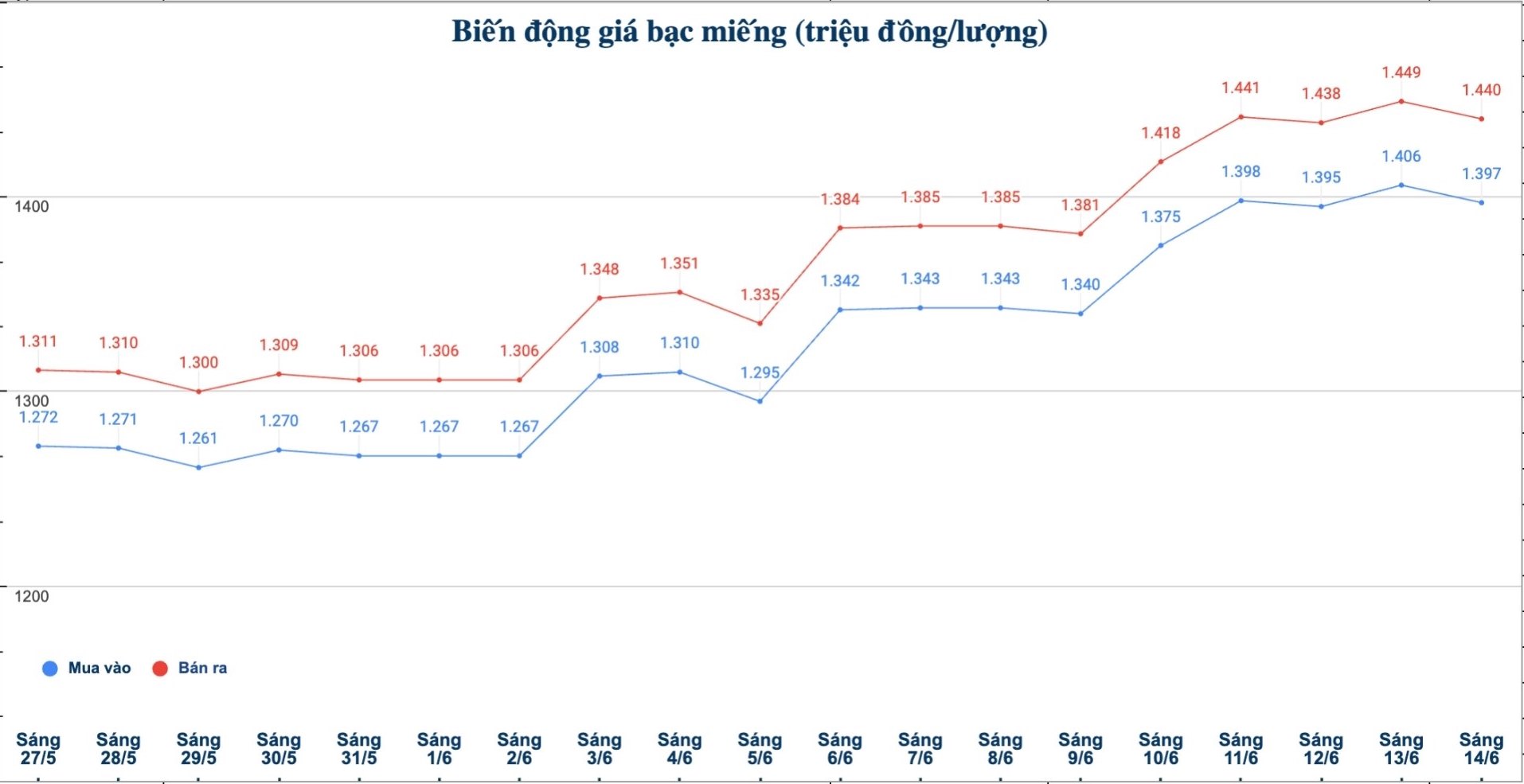

As of 9:12 a.m. on June 14, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.397 - 1.440 million/tael (buy - sell); down VND9,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.397 - 1.440 million VND/tael (buy - sell); down 9,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.253 - 38.399 million VND/kg (buy - sell); down 240,000 VND/kg in both directions of buying and selling compared to early this morning.

World silver price

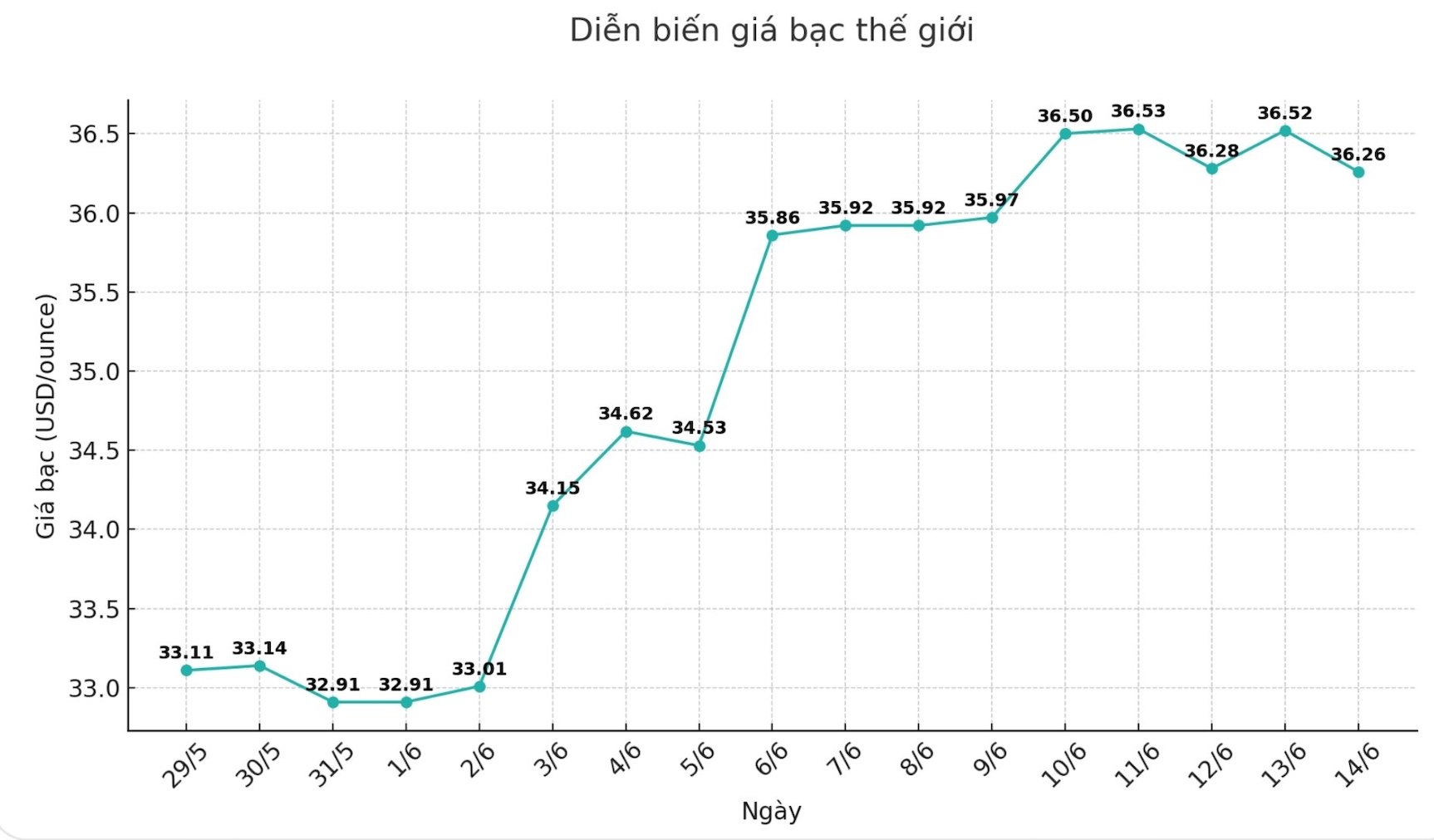

On the world market, as of 9:10 a.m. on June 14 (Vietnam time), the world silver price was listed at 36.26 USD/ounce; down 0.26 USD compared to early this morning.

Causes and predictions

Silver prices continue to decrease, completely different from gold - a metal that is still increasing thanks to safe-haven demand. While gold hit a multi-week high due to geopolitical tensions, silver prices cooled down after peaking at 36.89 USD/ounce at the beginning of the week.

This difference reflects the dual nature of silver as both a precious metal and an industrial metal, said James Hyerczyk, a market analyst. Unlike gold, silver prices are closely linked to global production demand and clean energy, two factors less affected by short-term geopolitical tensions.

The conflict in the Middle East has caused cash flow into gold and the USD, while silver has fallen due to the impact of general economic sentiment and industrial demand. Despite maintaining a weekly increase, silver prices are still on a weak foundation without a strong catalyst."

He added that the macro context also affects silver prices. US Treasury yields rose and the US dollar strengthened, supporting gold but creating difficulties for silver. The story of silver's industrial demand is still facing challenges in the context of tight finances.

"However, long-term factors such as demand for solar panels, electric vehicles and battery technology continue to support silver prices. With limited global silver supply and the development of green energy, any strong decline in silver prices could attract intervention from strategic buyers" - James Hyerczyk assessed.

In the short term, James Hyerczyk believes that silver could fall below 34.87 USD/ounce, causing sell-off and could continue to fall to 33.10 USD/ounce. However, if prices recover and surpass 36.89 USD/ounce, the uptrend may continue.

"Traders need to pay attention to signals from the US dollar, gold and industrial demand factors," James Hyerczyk emphasized.

See more news related to silver prices HERE...