Silver will soon experience price tightenings

After a long period of consecutive gold prices increasing to record levels over the past two years, silver prices have begun to break out in the past two weeks. According to Daniel Ghali - senior commodity strategist at TD Securities, market instability between New York and London could soon push silver prices to new highs.

The silver market is currently very vibrant as prices have surpassed $35/ounce. This level has been difficult to overcome in recent years. The last time silver surpassed this level, prices have soared to $50/ounce in just six weeks. So the excitement is increasing, said Ghali.

We believe this has been going on for a long time and the current market structure supports small price cuts in the future, he added.

Ghali explained that the recent sharp increase in silver prices is partly due to the imbalance between the two major trading centers of London and New York.

Silver surpassing $35 an ounce is a major turning point, but it is driven largely by trading in the futures market, rather than actual demand.

This is quite unusual, because for the past 5 years the physical silver market has always been in a state of shortage - should have increased silver prices from the real market. But that doesnt happen, showing that there is a lot of speculative activity right now, making it more difficult to predict price trends, he said.

However, Daniel Ghali believes that this breakthrough could mark a change in the psychology of the physical silver market.

In fact, the last time silver broke above this threshold was a huge increase after that, which could attract more capital from ETFs. These ETFs are withdrawing silver from the world's largest reserve system in London. This imbalance is partly due to concerns about tariffs earlier this year, causing silver to shift from London to New York due to price differences between the two regions, said Ghali.

According to Ghali, the London market is currently facing a serious shortage of silver: The amount of silver that can be bought and sold right in London is less than the average amount of silver traded per day. Meanwhile, New York has an excess supply. However, prices in London do not accurately reflect this shortage.

He said that the current market structure will continue to create small-scale tightenings, thereby supporting the upward trend.

Silver still has potential to break out

Regarding the outlook for the silver market in the coming time, Ghali said that there are three possible scenarios.

"The first scenario is the current imbalance. Since physical silver is mainly traded outside London and is in short supply, the market will be increasingly unlivable, causing any demand for physical silver here to increase sharply, said Ghali.

He warned that this would increase the focus of available silver in London on a small number of investors, making the market even less liquid, thereby reinforcing his view on small price cuts in the future.

The remaining two scenarios are options to help the silver flow return from New York to London.

The second scenario is to increase the supply of silver in the futures market. This will create a clear price difference between the two regions, especially when silver prices in London are higher than in New York. However, despite a major sell-off from speculative funds, the additional supply is still not enough to change the situation.

The final scenario is that physical silver prices in London must increase more strongly than those on the US futures market. This is also the reason why we believe that consecutive small price cuts may be necessary to address this imbalance, he added.

Regardless of the scenario, Ghali believes that silver prices will continue to increase by about 10% in 2025: "We predict that prices will continue to increase. We expect silver to reach $40/ounce before the end of this year.

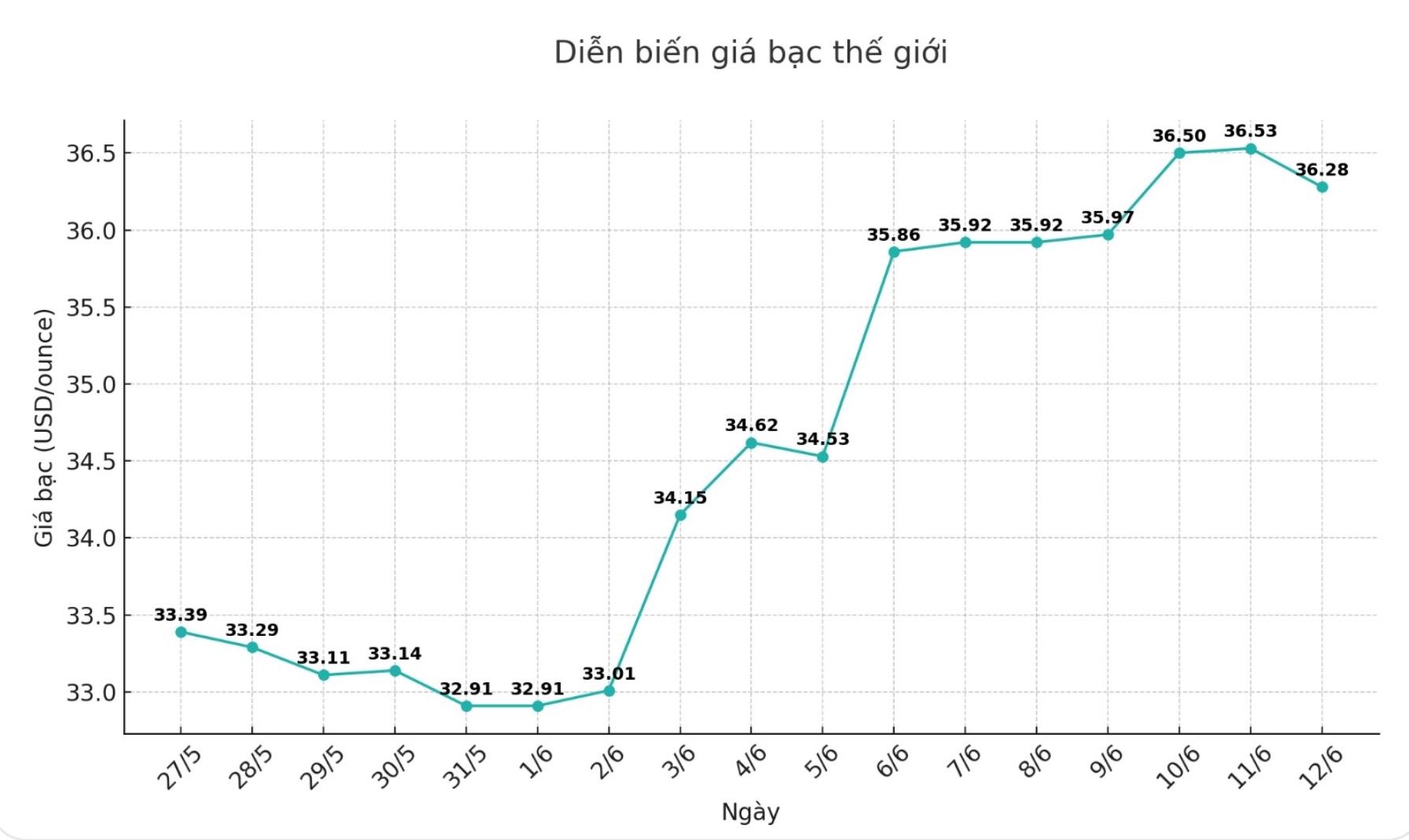

Currently, silver is fluctuating within a fairly wide range. Despite many strong sell-offs, each time the price returns to the support level of nearly 36 USD/ounce, it remains stable.

As of 10:56 a.m. on June 12 (Vietnam time), the world silver price was listed at 36.37 USD/ounce; up 0.09 USD compared to early this morning.

See more news related to silver prices HERE...