Domestic silver price

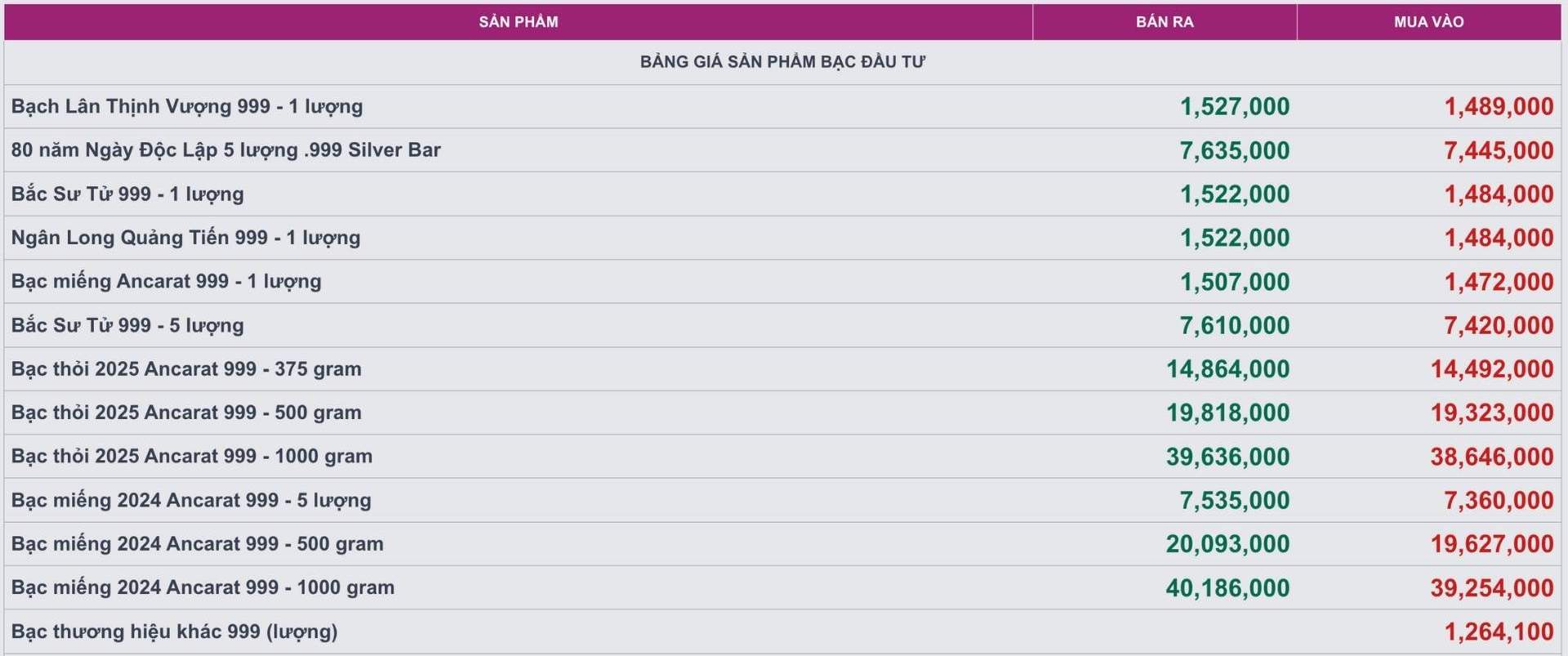

As of 9:40 a.m. on August 14, the price of 999 silver bars at Ancarat Metallurgy Company was listed at VND1.472 - 1.507 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 38,646 - 39.636 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 39.254 - 40.186 million VND/kg (buy - sell).

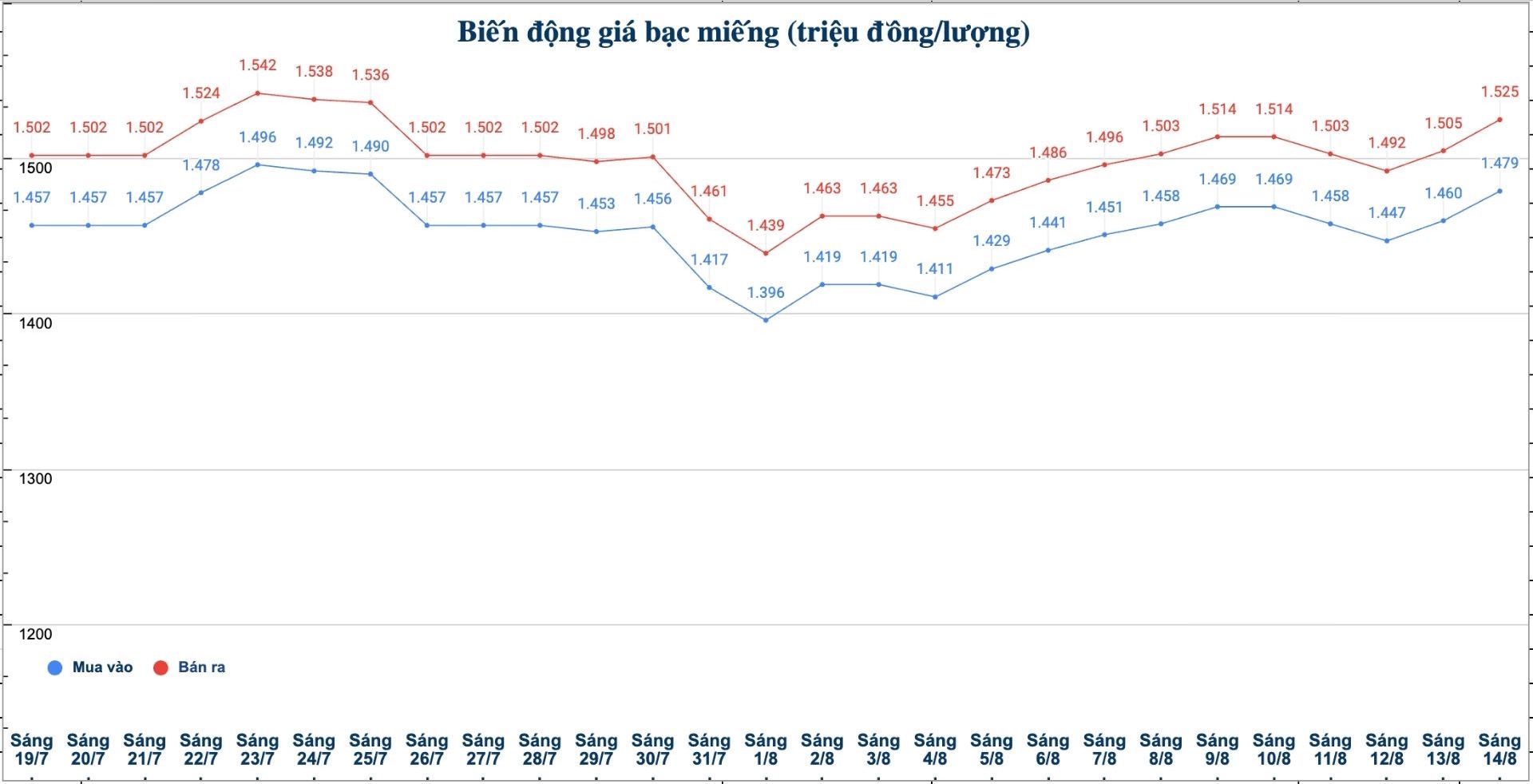

At the same time, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.479 - 1.525 million VND/tael (buy - sell); an increase of 19,000 VND/tael for buying and an increase of 20,000 VND/tael for selling compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.479 - 1.525 million VND/tael (buy - sell); an increase of 19,000 VND/tael for buying and an increase of 20,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 39.439 - 40.666 million VND/kg (buy - sell); an increase of 506,000 VND/kg for buying and an increase of 533,000 VND/kg for selling compared to yesterday morning.

World silver price

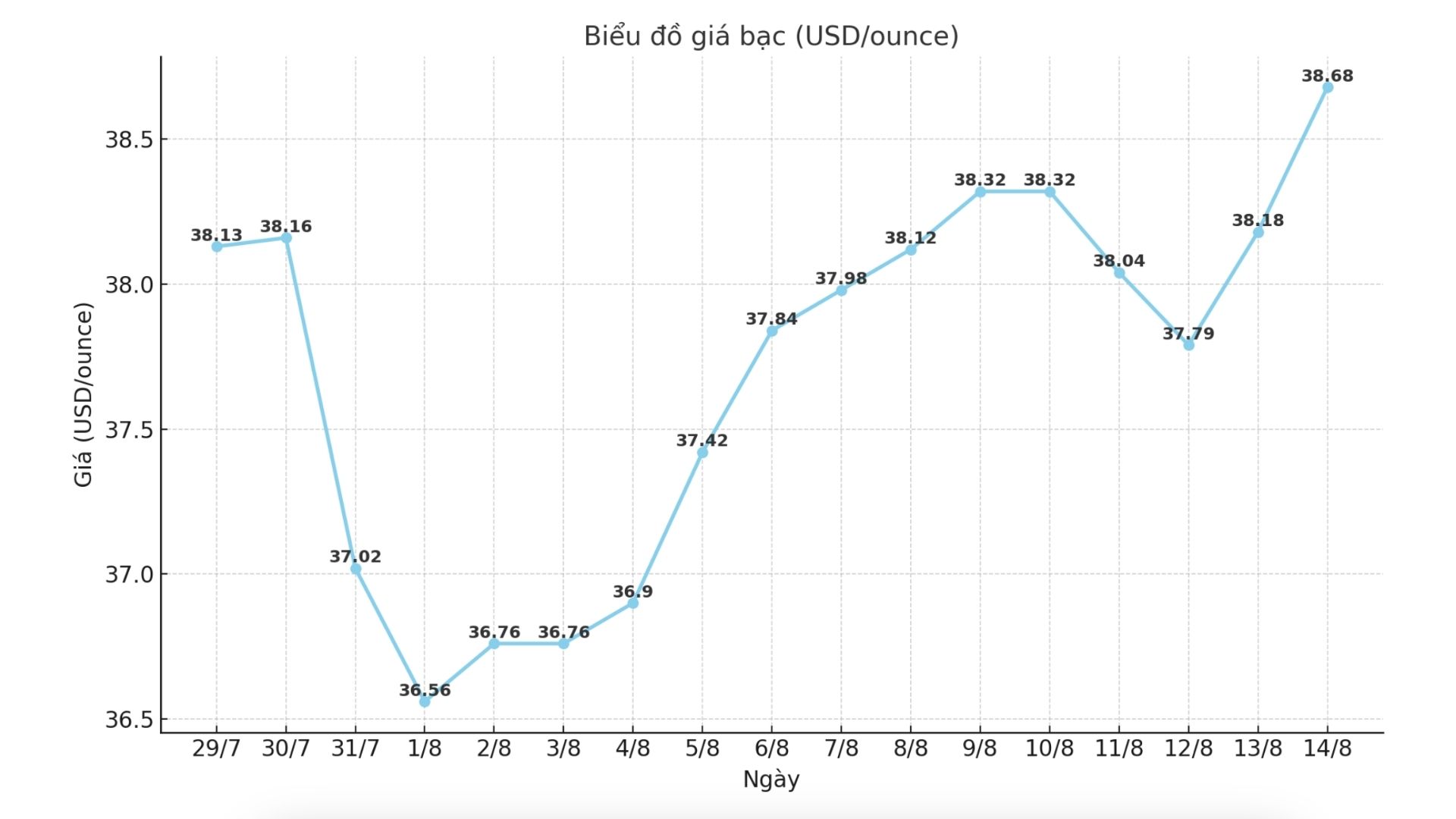

On the world market, as of 9:43 a.m. on August 14 (Vietnam time), the world silver price was listed at 38.68 USD/ounce; up 0.5 USD compared to yesterday morning.

Causes and predictions

Silver prices continued to increase strongly, reaching the peak of last week on Wednesday morning.

Senior analyst Christopher Lewis said that the current concern is whether the market has enough strength to continue to break out.

"Cold is a highly volatile market, so in the long term, prices will have to clearly determine the trend, as well as see if investors are able to withstand these fluctuations or not" - he said.

Christopher Lewis said that if silver prices continue to increase, the next target will be $40/ounce. When this milestone is surpassed, the market may enter a period of strong acceleration.

Conversely, $37.50 an ounce is a key support zone as prices fall below this threshold.

"The long-term outlook for silver is still positive, but the market has recently seen many fluctuations. An important factor to note is that the USD - which has a large correlation with silver - is currently fluctuating quite strongly," he said.

In addition, Christopher Lewis emphasized that silver is both a precious metal and an industrial metal, and should be affected by both safe-haven investment factors and production demand.

See more news related to silver prices HERE...