Domestic silver price

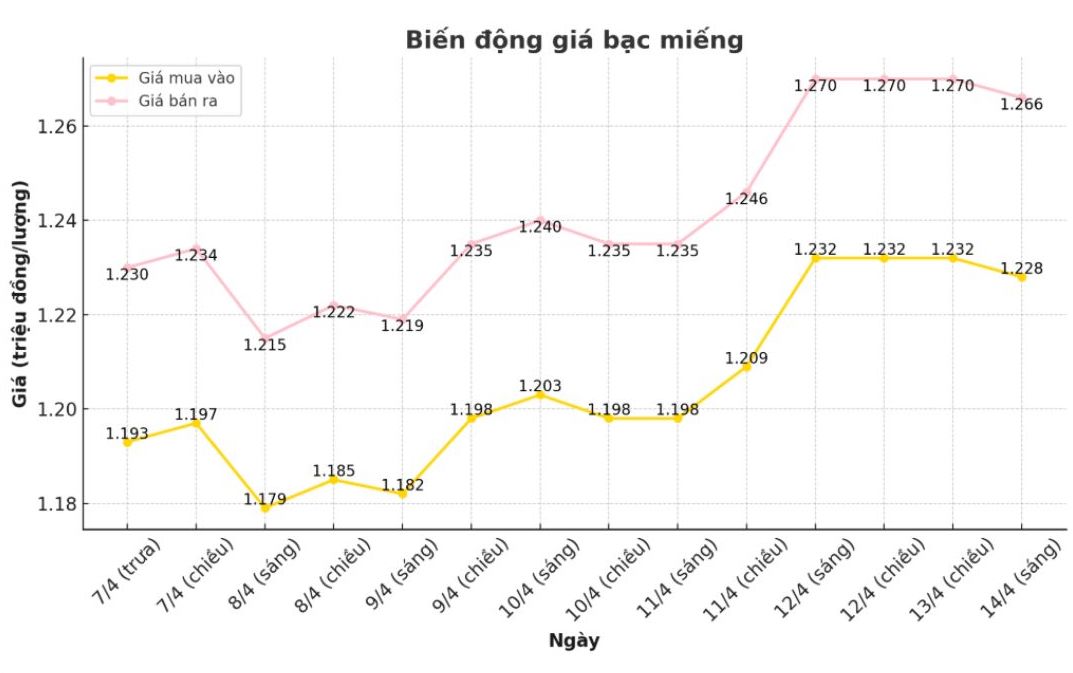

As of 9h05 on 14.4, the price of 999 silver at the Phu Quy Gemstone Gemstone Group listed at the threshold of 1,228 - 1,266 million VND/tael (purchased - sold); Discount 4,000 VND/tael in both buying and selling directions compared to early morning.

At the same time, the price of 999 silver silver at the golden gemstone group listed at the threshold of 1,228 - 1,266 million VND/tael (purchased - sold); Discount 4,000 VND/tael in both buying and selling directions compared to early morning.

Silver price of 999 (1kilo) at Phu Quy Gemstone Gold and Silver Group listed at 32,746 - 33,759 million VND/kg (purchased - sold); Discount 107,000 VND/kg in both buying and selling directions compared to early morning.

World silver price

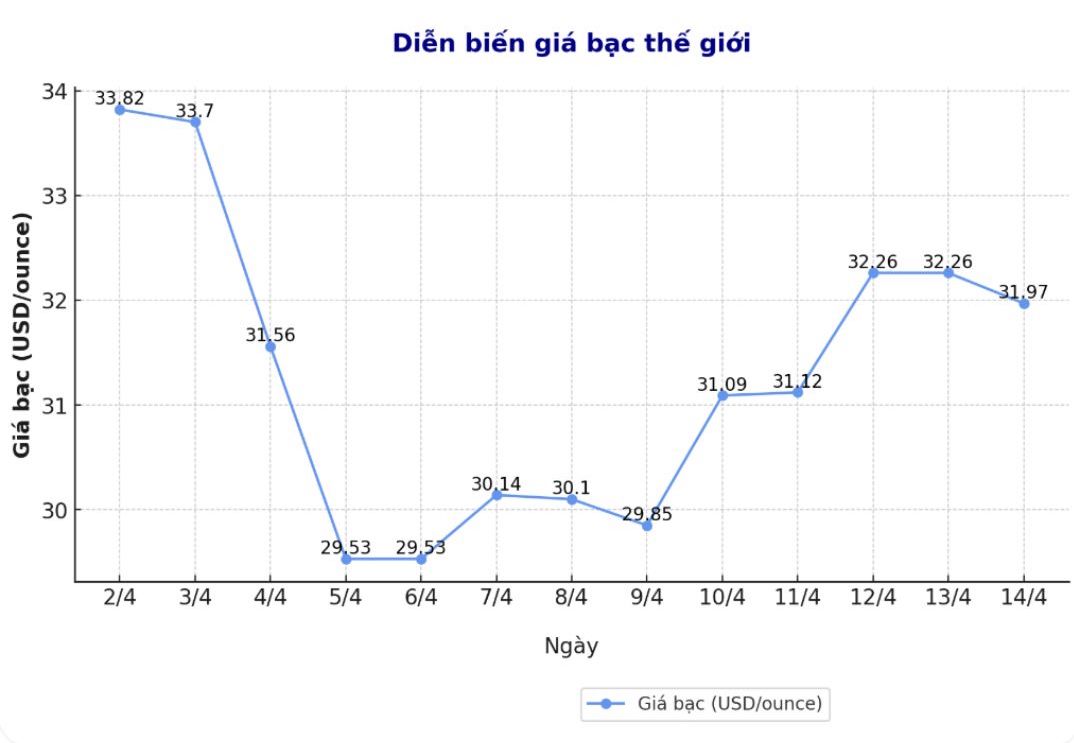

On the world market, as of 9:10 am on April 14 (Vietnam time), the world silver price listed on GoldPrice.org at the threshold of 31.97 USD/ounce.

Causes and forecasts

Despite slightly decreased in the last session, the silver price has recorded a strong increase in the past week. According to FX Empire, the increase in the price of silver price is largely from the need for safe shelter when the global market is increasingly unstable, the dollar weakens and is concerned about the global trade.

Despite the historic gold price that helps to increase the silver, many investors are still cautious due to concerns that industrial demand weakened, especially from China.

Analyst James Hyerczyk at FX Empire said that gold price exceeded the $ 3,200/ounce milestone is an important catalyst that helps silver price increase, thanks to the psychology to avoid global risks and cash flow into physical assets.

"The investor withdrawing from bonds and the dollar helps silver become more attractive in the role of a replacement value storage. The cash flow into the precious metal group and the weak dollar have created a favorable environment for silver prices, although there is still risk from the actual needs," he said.

However, according to James Hyerczyk, Bac still faces great obstacles due to the majority of demand from the industry.

Trade tensions between the United States and China continue to increase with new tax rates, making the psychology of the manufacturing industry more negative. "China is a large silver consumption country for industries such as electronics, solar energy ... But the demand is slowed down. If produced in China, it is not recovered soon, the demand for silver will also be difficult to maintain" - James Hyerczyk said.

James Hyerczyk added, the current macro context is still beneficial for precious metals. The dollar fell down for many years compared to the Swiss franc and the lowest 6 months compared to Yen Nhat. Meanwhile, the US bond market has been with a strong capital withdrawal, the 10 -year bond yield has the strongest week in decades - a sign that investors no longer trust traditional shelter channels. This promotes cash flow to tangible assets like silver.

"As long as the macro pressure continues and gold still holds high prices, silver can continue to go up. But to increase sustainably, it is necessary to support the actual and cautious needs with the current price area" - the expert emphasized.

Technically, James Hyerczyk said that despite the strong fluctuations in the past week, the price of silver was still closed above an average of 52 weeks of 30.60 USD/ounce. This will be a new support area in the near future.

See more news related to silver prices here ...