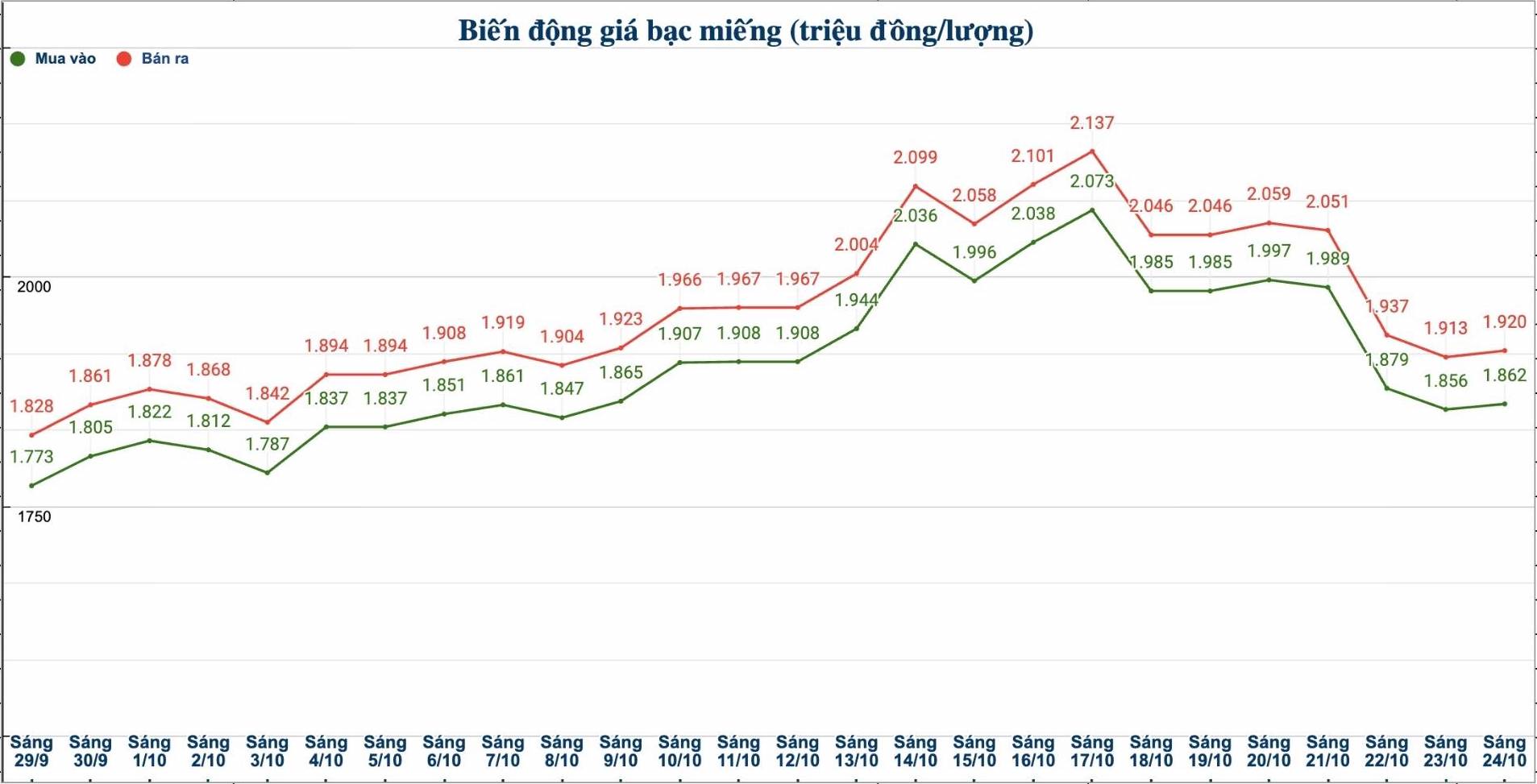

Domestic silver price

As of 9:35 a.m. on October 24, the price of 999 Phuc Loc 999 gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Co., Ltd. (Sacombank-SBJ) was listed at VND1.896 - 1.944 million/tael (buy - sell); an increase of VND3,000/tael for buying and VND30,000/tael for selling compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.862 - 1.920 million VND/tael (buy - sell); an increase of 6,000 VND/tael for buying and an increase of 7,000 VND/tael for selling compared to yesterday morning.

The price of 999 (1kg) gold bars at Phu Quy Jewelry Group was listed at 49,653 - 51,199 million VND/kg (buy - sell); an increase of 157,000 VND/kg for buying and an increase of 186,000 VND/kg for selling compared to yesterday morning.

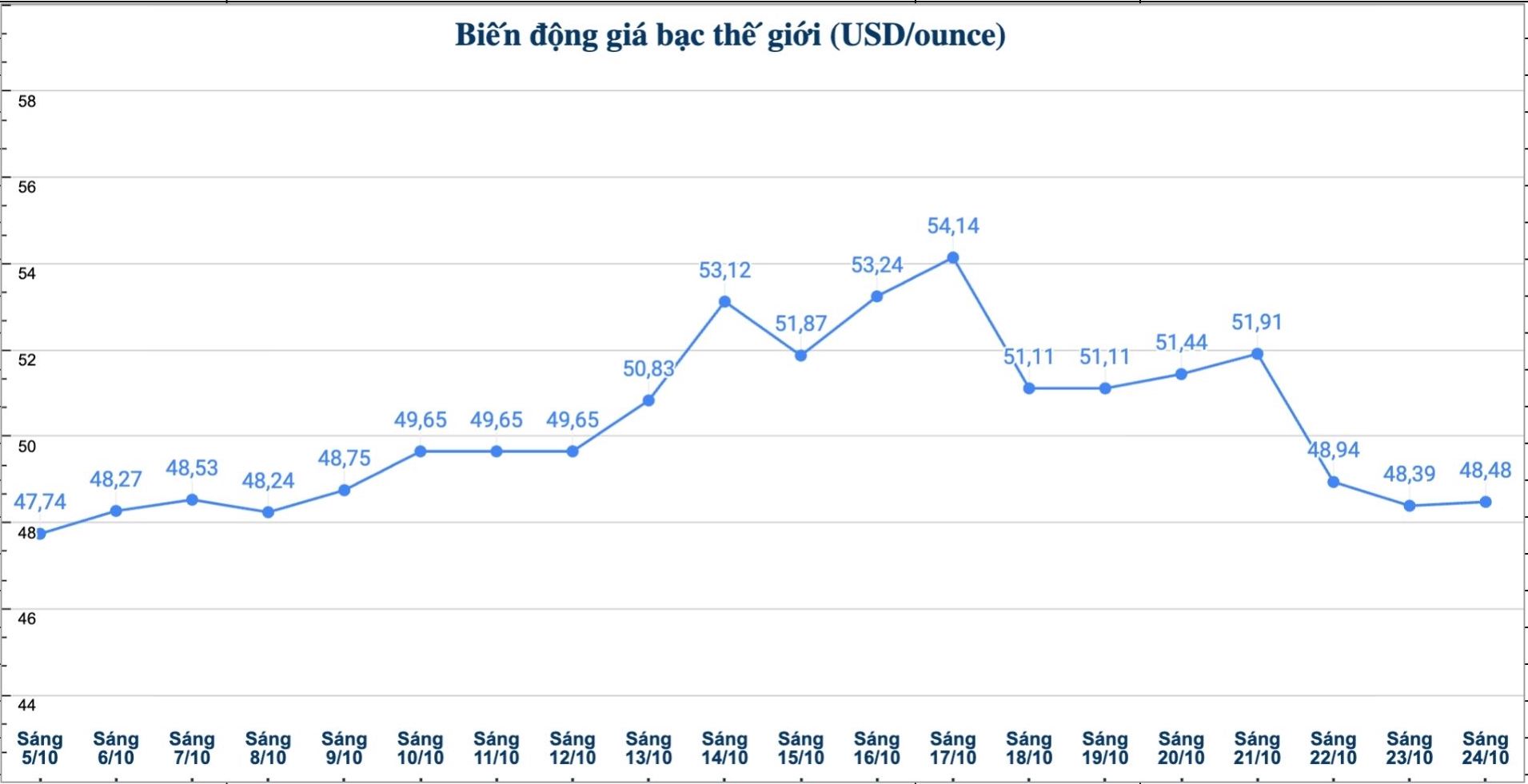

World silver price

On the world market, as of 9:40 a.m. on October 24 (Vietnam time), the world silver price was listed at 48.48 USD/ounce; up 0.9 USD compared to yesterday morning.

Causes and predictions

The silver market attracted cash flow again in yesterday's session (Thursday), despite having just experienced a strong sell-off. According to precious metals analyst Christopher Lewis, this recovery is bringing some expectations, but also comes with many risks.

"Cilber prices have decreased slightly and then rebounded. However, investors need to be cautious before considering this a reversal signal. The market has just suffered a deep decline in many days and strong fluctuations have caused the stabilization factor to almost disappear" - he said.

According to Christopher Lewis, the current threshold of $47/ounce is playing an important role in the resistance level. If prices cannot stay in this area, the trend may soon return to the negative.

"On the contrary, the $50/ounce mark will be a major barrier that silver prices must overcome if they want to increase again," he said.

The expert noted that recent sharp declines have rarely occurred randomly. Therefore, the current recovery is likely to be short-term. In the most positive scenario, silver prices may need more time to stabilize before establishing a new trend.

"In fact, if it does not surpass $50/ounce, it could be a sign that the upward trend of silver has ended and the market is preparing to enter a deeper correction phase," Christopher Lewis commented.

See more news related to silver prices HERE...