Domestic silver price

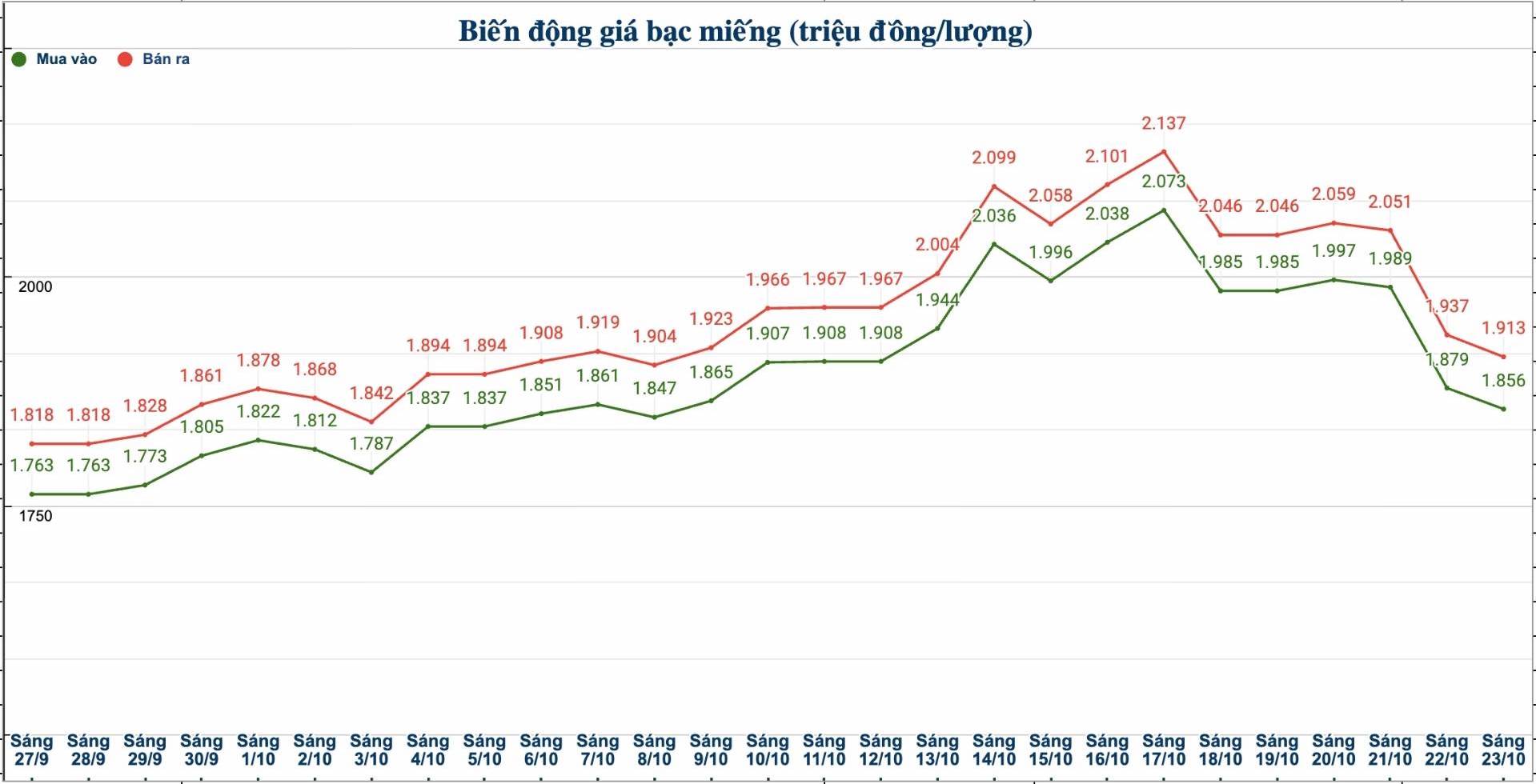

As of 10:05 on October 23, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1.855 - 1.897 million/tael (buy - sell); down VND27,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 48.746 - 50.166 million VND/kg (buy - sell); down 640,000 VND/kg for buying and down 720,000 VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at VND1.893 - 1.914 million/tael (buy - sell); down VND21,000/tael for buying and down VND48,000/tael for selling compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.856 - 1.913 million VND/tael (buy - sell); down 23,000 VND/tael for buying and down 24,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 49.493 - 51.013 million VND/kg (buy - sell); down 613,000 VND/kg for buying and down 640,000 VND/kg for selling compared to yesterday morning.

World silver price

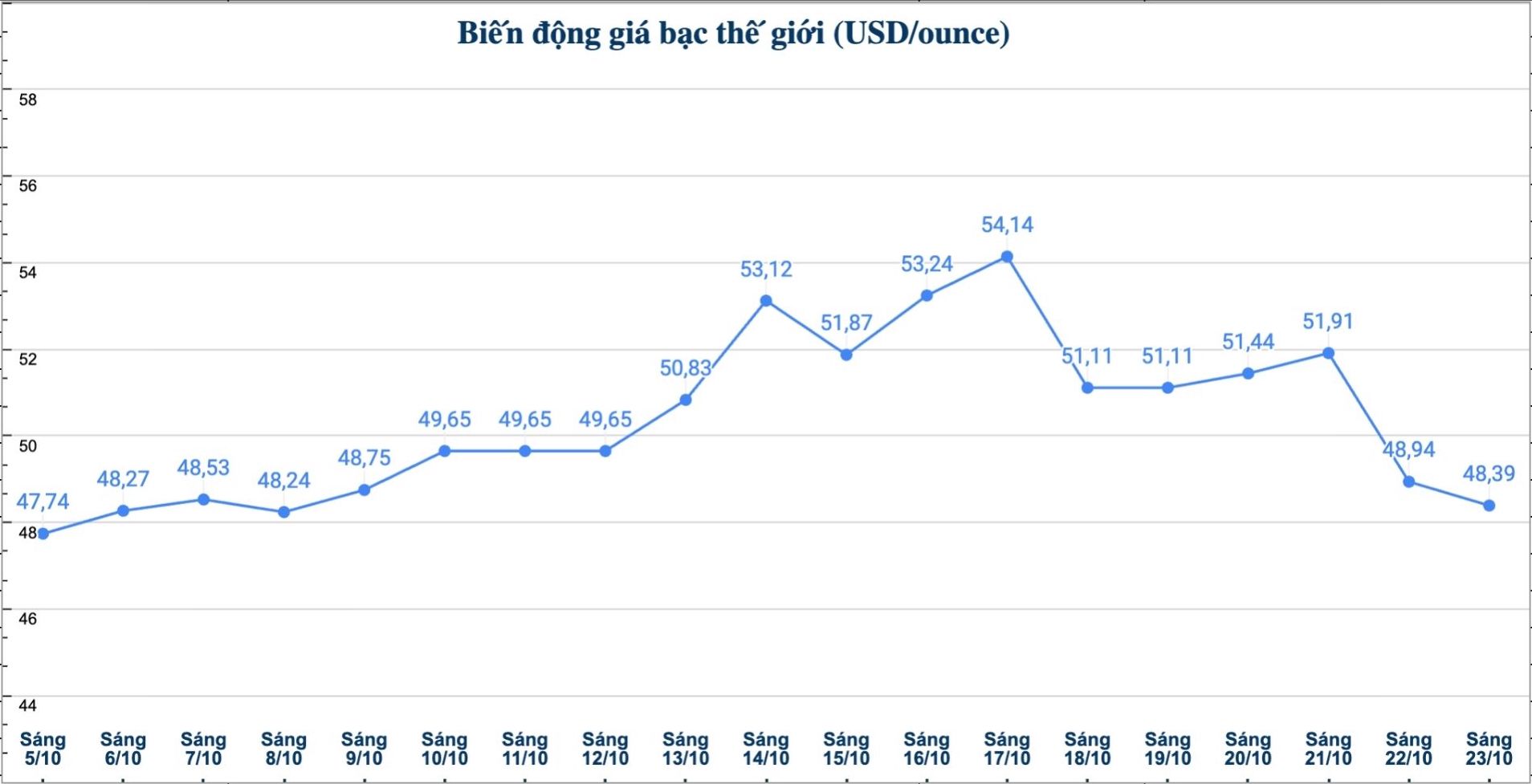

On the world market, as of 10:00 a.m. on October 23 (Vietnam time), the world silver price was listed at 48.39 USD/ounce; down 0.55 USD compared to yesterday morning.

Causes and predictions

Silver prices have fallen to around $47 an ounce. According to precious metals analyst Christopher Lewis, this price zone needs to be kept firm to maintain the current uptrend.

"After a few sessions of sharp decline, the silver market is showing signs of being quite fragile. If prices fall below $47/ounce, it is likely that silver will continue to fall, and if it breaks through this mark, a deeper correction to $40/ounce could occur," he said.

Christopher Lewis said that although there may still be short-term recoveries, the $50/ounce threshold will be a notable barrier.

However, the expert said that the market is currently fluctuating strongly, so investors' worries are understandable. In that context, many people may take profits from silver to cover losses in other markets.

"The current situation is somewhat similar to the bubble peak period, when the public rushed to buy silver - often a sign that the market has reached the end of the uptrend" - he added.

Christopher Lewis said it is important to see how the market responds to the upcoming correction. "A little caution and patience is probably the most reasonable strategy at the moment," Christopher Lewis said.

See more news related to silver prices HERE...