The silver has just undergone a strong adjustment. New York spot silver prices fell 7.2% to $11.88/ounce. In the same direction, gold decreased, while platinum and palladium also decreased, showing that the precious metal market is cooling down widely.

According to The Economic Times, this correction has caused the historic increase streak of silver to slow down, raising concerns that the increase may be weakening. Previously, on the Indian Commodity Exchange (MCX), silver also recorded a record day's decrease of 16.715 points.

The silver retracement was largely due to concerns about financial risks and US-China trade tensions temporarily easing after President Donald Trump's reassuring statements. In addition, positive business results from US banks have helped the stock market recover and bond yields increase, reducing the attractiveness of safe-haven assets such as gold and silver.

In addition to psychological factors, silver prices are also affected by the gradual stabilization of material supply in London - a shortage that had pushed prices to a record high that was previously being eased.

According to The Economic Times, technical indicators also show that silver is in a state of "overbought" after a long series of increases, signaling the possibility of a short-term correction. Along with that, investors taking profits after a period of global instability has contributed to a wave of selling, causing silver prices to fall sharply in recent sessions.

However, according to The Economic Times, since the beginning of the year, silver has increased sharply thanks to large industrial demand, limited supply and capital flow to safe-haven assets. Solar panel and green energy industries continue to boost demand for silver, while global inventories fall to low levels.

The physical silver market in London is still particularly tense, with warehouse rental prices skyrocketing to 39%. Some traders even have to hire silver transport aircraft from New York to London to meet demand. This unusual situation partly comes from concerns that the US may impose silver import tariffs after the metal is classified as an important mineral.

The US government's proposal to add silver as an essential mineral marks a strategic shift, recognizing the dual role of silver - both an investment asset and an important industrial resource. This classification could pave the way for policies to increase national reserves, provide financial support for mining and recycling activities, and trade protection measures, thereby boosting investment and demand for silver in the future.

Meanwhile, many traders also maintain a positive outlook for silver in the medium and long term, especially if the US Federal Reserve (FED) conducts stronger interest rate cuts - a factor that often supports precious metal prices.

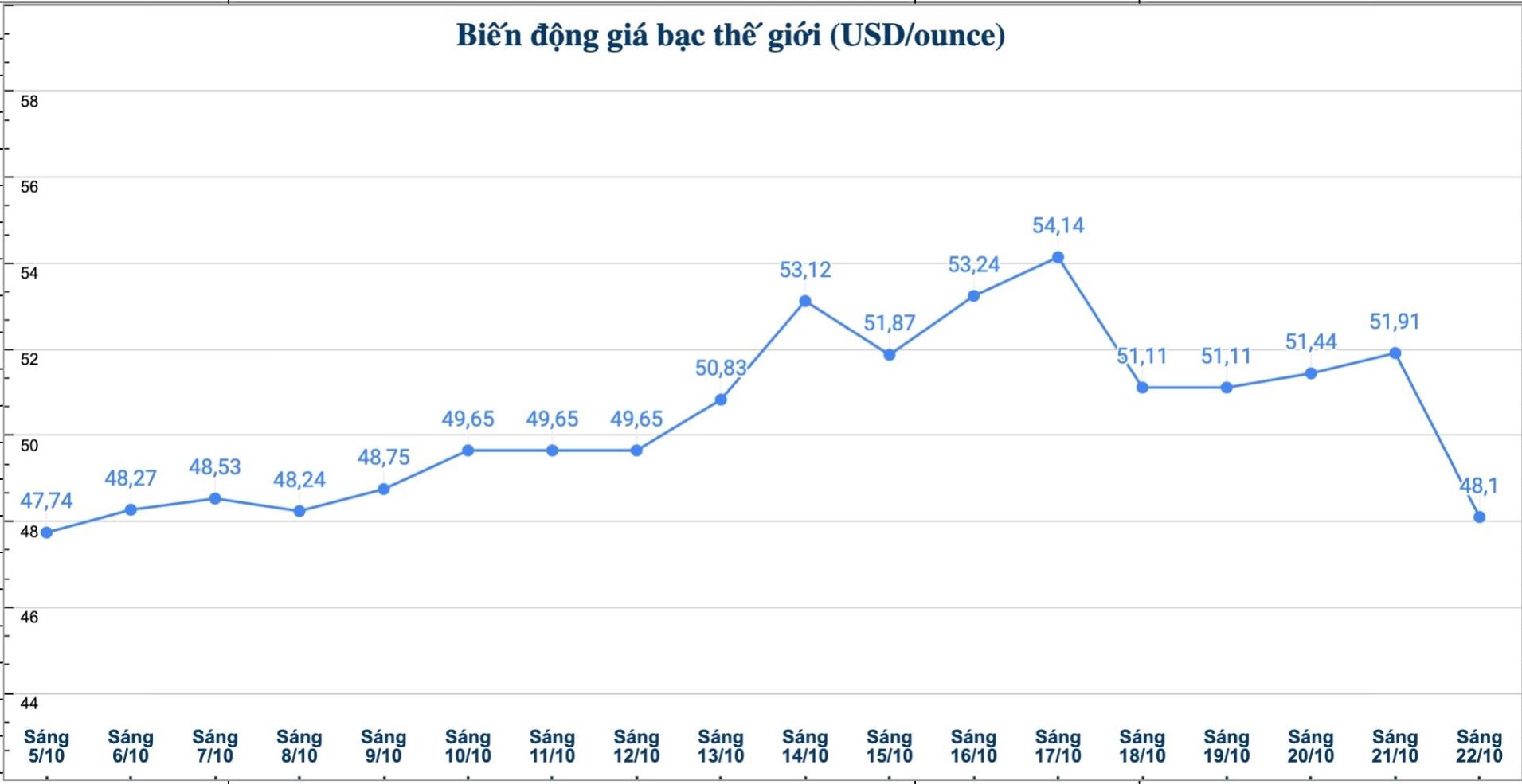

As of 8:00 a.m. on October 22, the world silver price was listed at 48.12 USD/ounce, down 1.63 USD compared to yesterday morning.

Update on domestic silver prices

As of 8:15 a.m. on October 22, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1.897 - 1.939 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 49.856 - 51.356 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.852 - 1.909 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49.386 - 50.906 million VND/kg (buy - sell).