Domestic silver price

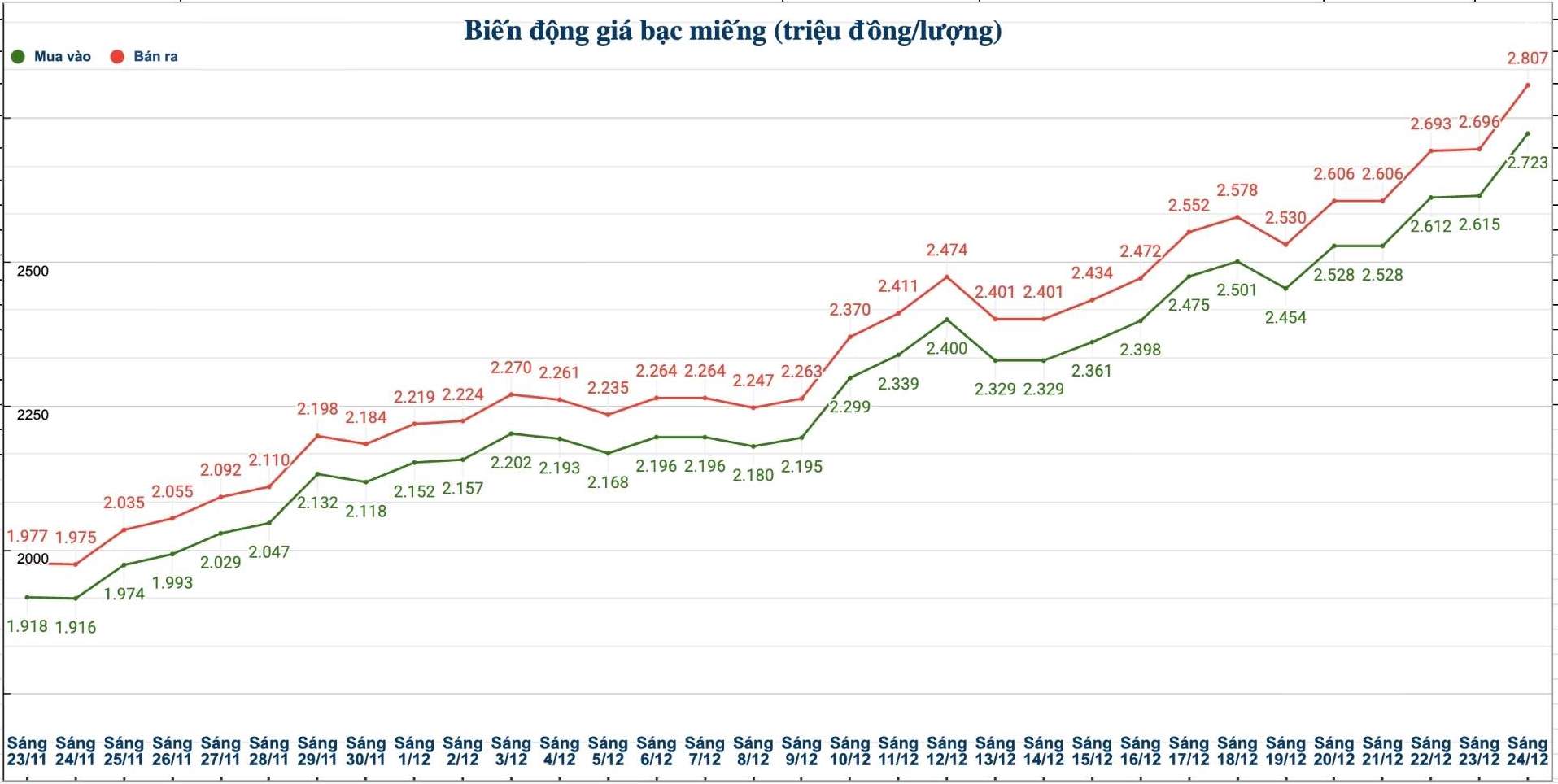

As of 11:35 a.m. on December 24, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Petrochemical Company was listed at 2.721 - 2.788 million VND/tael (buy - sell); an increase of 115,000 VND/tael for buying and an increase of 112,000 VND/tael for selling compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 71.666 - 73.846 million VND/kg (buy - sell); an increase of 2.896 million VND/kg for buying and an increase of 2.986 million VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at 2.715 - 2.784 million VND/tael (buy - sell); an increase of 102,000 VND/tael for buying and an increase of 105,000 VND/tael for selling compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.723 - 2.807 million VND/tael (buy - sell); an increase of 108,000 VND/tael for buying and an increase of 111,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 72.613 - 74.853 million VND/kg (buy - sell); an increase of 2.88 million VND/kg for buying and an increase of 2.96 million VND/kg for selling compared to yesterday morning.

World silver price

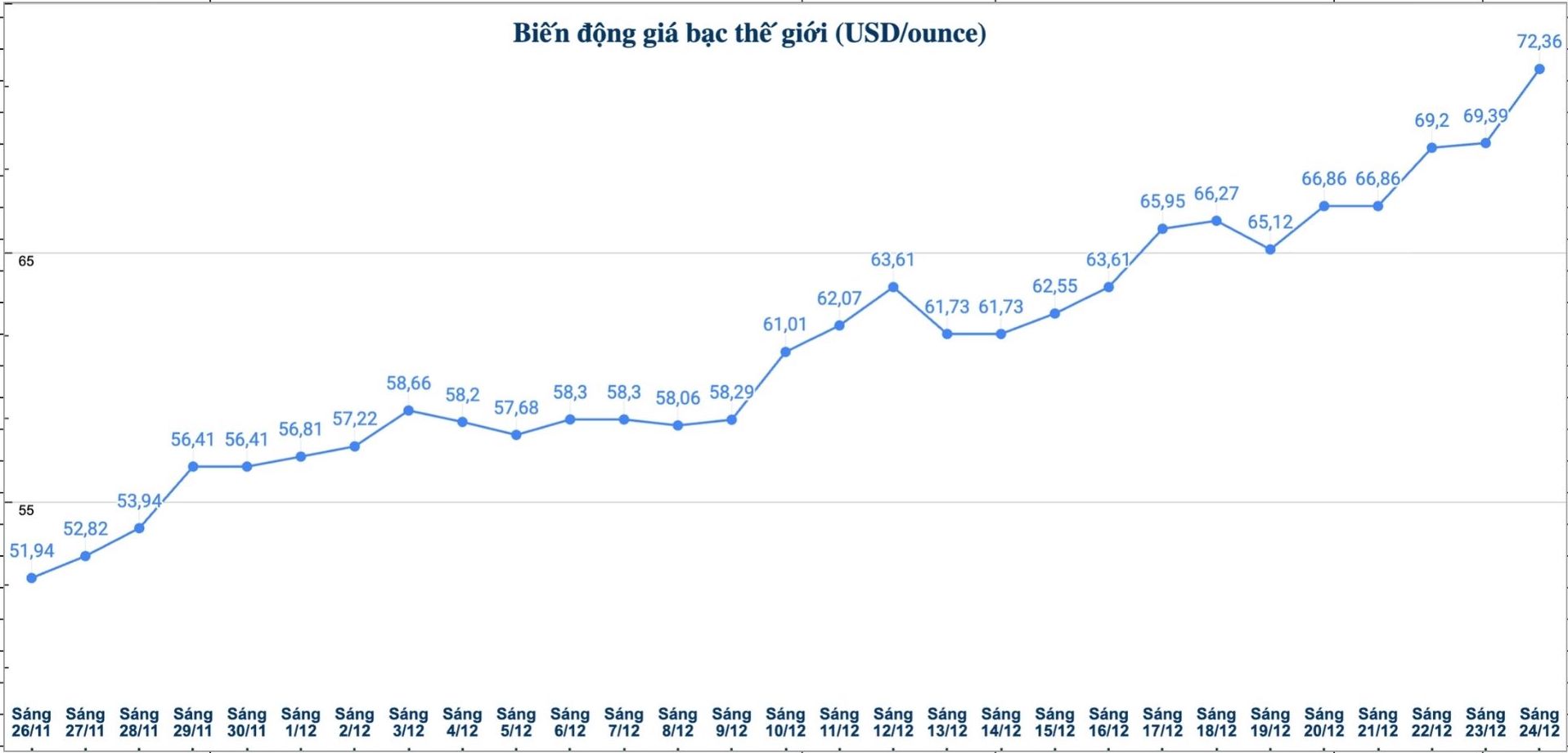

On the world market, as of 11:35 a.m. on December 24 (Vietnam time), the world silver price was listed at 72.36 USD/ounce; an increase of 2.97 USD compared to yesterday morning.

Causes and predictions

According to FX Empire precious metals analyst James Hyerczyk, strong demand from the industrial and investment sectors, along with limited supply, geopolitical tensions and expectations of the US continuing to cut interest rates have pushed silver prices above the $70/ounce mark.

He said that this week, the market continues to closely monitor important bond auctions of the US Treasury Department.

"With the bond market closing early on Wednesday evening and a full holiday on Christmas Day, liquidity is expected to decline, making investors more cautious in both the precious metals and interest rates markets," said James Hyerczyk.

In the short term, James Hyerczyk said, the outlook for silver prices is still leaning towards a positive trend, thanks to high actual demand and limited supply. "Crossing the 70.68 USD/ounce mark could open a new price increase. However, the risk of strong fluctuations still exists" - the expert said.

If selling pressure increases, James Hyerczyk believes that silver prices could retreat to the support zone around 65.74 USD/ounce.

"In the next few sessions, the slight upward trend will continue, but market momentum depends largely on US bond yield movements. Stable or declining yields could reignite buying momentum, while continued rising yields are likely to extend profit-taking activities into early next week," said James Hyerczyk.

See more news related to silver prices HERE...